What even is "legal tender"?

Does anyone remember when it used to mean this?

I member

Used to be legal tender meant that type of payment had to be accepted by law. When I was a kid cash was accepted everywhere. Not accepting cash was unheard of, now it's almost the standard or at least not unsurprising to see a vendor that refuses to do business in cash.

At the same time this rule has always had its limits. In the olden days it would have been unthinkable to walk into a Taco Bell, for example, and try to pay with a $100 bill. Even $50 bills were not accepted for a long time. Then again it makes sense. Why you trying to buy a 29 cent hamburger at McDonalds with a $100 bill anyway? Remember dollar menus? Hilarious.

Limit 10 per customer gets me every time.

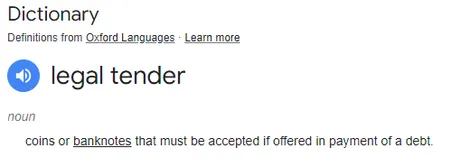

Notice anything else?

The above definition of legal tender also assumes physical cash. Coins and Banknotes are physical. Funny how this definition just sits online undisturbed while so many others seem to change on a whim (like the definition of what a "recession" or a "vaccine" is). Kinda like how they let schoolkids believe that the dollar is still backed by gold reserves. What weird oversights! That!

On the other side of this coin, so to speak, we are also seeing somewhat of a revival of cash in niche areas. Struggling small businesses often like to deal in cash because credit card fees are imposed on the producer rather than the consumer, in order to hide the entire business model. This is how credit cards were able to bootstrap themselves and proliferate in the first place all those decades ago.

Now it is possible for a business to save somewhere between 2%-5% on a transaction if they get payment in cash, which doesn't sound like a ton but makes all the difference in the world for vendors that operate on razor thin profit margins. Will crypto be the next means of payment for small businesses to stay afloat? That is yet to be seen, but last I checked HBD can be moved for $0, and even a large BTC fee is imposed on the sender not the receiver.

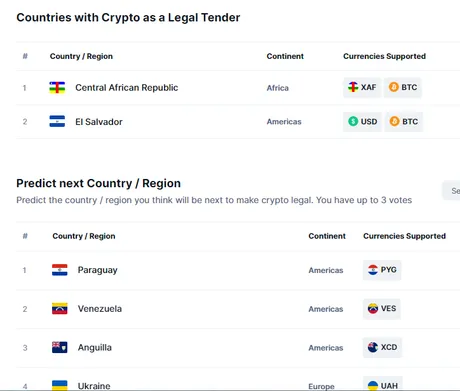

https://coinmarketcap.com/legal-tender-countries/

Ha look at this...

I forgot that another country besides El Salvador made Bitcoin legal tender. This is a disturbing trend for the central bankers for a variety of reasons, and it threatens most sovereign currencies as well. Also, who forgot there is a country literally called Chad? Crypto needs you, friend. We need more Chads.

I didn't buy an investment I acquired a Foreign Currency.

So the thing about the definition of currency on a legal level is that in terms of tax purposes it cannot be taxed when someone spends it. This can be confusing because there are things like sales tax which can be applied to spending currency, but the value of the currency itself is never measured. 1 USD = 1 USD. 1 BTC = 1 BTC. A currency is a unit-of-account by definition, which means it's value can't be measured against any other asset besides itself on a legal level.

This rule works fine for debt currencies which are guaranteed to lose value over time, but what of Bitcoin? Bitcoin is an asset gaining exponential value, and now countries are running around saying that it can't be taxed at the capital gains level. Why is this significant?

There's a reason why the BIS (Bank for International Settlements) has threatened and bribed El Salvador multiple times now with regard to the decision to declare Bitcoin legal tender. As an official currency, Bitcoin can get grandfathered into all the laws that protect foreign currency. How long before BTC gets listed on FOREX? Think about how crazy that would be.

While it's easy enough to ignore a country like El Salvador's laws it's going to be a lot trickier if dozens of other nations adopt this trend and make claim that Bitcoin is in fact a currency and a unit-of-account that measures value.

At this point it's only a matter of time before this situation escalates in a big way. With the whole Blackrock adoption of it all it's hard to stand in the way of a freight train like this that just continues to gain more and more momentum. The political intrigue of Bitcoin has largely just begun, and the battles being won are nothing short of impressive and absolutely definitive. The regulators will continue to spin their wheels on this one and lose ground, especially as number goes up and the financial incentive to obstruct regulations becomes even more prominent.

Conclusion

Still early. The current four-year cycle that we are in right now will likely go down in the history books as one of the most prominent transitions for crypto. The writing is on the wall. The regulators are baffled and losing ground. The institutions have been disrupted, capitulated, and pivoted accordingly. The fight isn't anywhere near from over but the money shows us it's only a matter of time before the transition is made. Crypto is legal tender.

Personally I hope we transcend into an epoch where that doesn't even mean anything and lacks any type of substance. After all, the entire foundation of the term is rooted in regulations and taxes, which are arguably outdated within systems that regulate themselves and print their own currency. In it for the long game.

Return from Legal Tender to edicted's Web3 Blog