CUB has been around for about a year.

If memory serves we launched in March...

https://peakd.com/hive-167922/@leofinance/introducing-cub-finance-or-leofinance-expands-into-defi-on-the-binance-smart-chain

March 8th Confirmed

Within that time it's been a wild ride. Token all time high quickly spiked to $13, and today we sit at all time lows at 24 cents. Such is the life of a hyperinflationary token.

A much better technical analysis metric for CUB is the market cap.

CUB has had an extremely consistent market cap range, with $5M MC sparking heavy resistance and $2M MC marking massive support. Basically anyone that's been buying at $2M MC and then selling at $5M MC has made a mint at this point. Currently with 10.3M tokens in circulation, the MC sits at $2.47M, so we can basically assume that the ultimate floor for CUB is around 20 cents per token at this point, assuming no growth has occurred since our last bottom.

The DEGENS

Leofinance has a very zealous userbase. Even though CUB has bled this entire time, there are still degenerates in the Kingdom's Den longing the price of CUB without putting their tokens for sale in the liquidity pools. In fact, with $1,493,725 in the Den right now, that means slightly over 60% of all CUB in circulation is going long at the moment. Even after a 98% loss in token valuation over the last year, them CUB degens are still hodling strong. Quite impressive really.

Not Khal's fault degens are degens.

Seriously though, think about it. It's not good that 60% of all the CUB is in the Den. If that value had been providing liquidity this entire time, CUB would probably have a higher price right now. Cramping the DEN and competing with everyone else for such low yields is akin to going extremely long. The only way to make money in the DEN when comparing the yields offered if for the price of CUB to go up significantly over time.

Essentially what has happened here is that 60% of the network went long, and then the shorts won and token price crashed hard. Had the diehard members of this community been supporting the liquidity pools instead of getting wrecked in the Den they'd have a bigger stake in the network today, and the network would be stronger because of that fact.

Instead what we see is LP providers doing what LP providers do best, which is compound yield or exit the platform entirely with their farm. Because there are so many degens in the DEN and yields on the LP are so high with liquidity being lower, that makes the slow bleed of hyperinflation even worse over time. Or maybe it doesn't... like I said our market cap has bounced between a very consistent range. Value has not been exiting the system on the average.

Idealistically, the yield on the Den should be very close to the liquidity pools themselves. Rather than 60% of all CUB being in the DEN, it should be more like 30%, which, in turn, would drop the yields on the CUB/BUSD and CUB/BNB LPs a bit, and everything would be around a 70% APR. Instead, everyone is piled into the DEN, expecting exponential growth, constantly asking Khal 'wen'.

WEN!?!

So we've been waiting for the pCUB launch and the next IDO to drop for quite some time. In fact I recall being promised like three IDOs in October, and we have gotten... zero in three months... and no updates on any of them except for one, which ended up being very vague. Such is the life of a developer. The unknown unknowns will always get you.

Khal wants to play the hero.

Everyone wants to be a superhero these days, most of all token builders. We're all looking to create economic systems that will fix the broken garbage of an economy we see today. Imagine building a token and having the price drop from $13 to 24 cents with the community complaining the entire time. Yikes, not fun!

So pCUB is going to be deflationary...

Which makes a lot of sense in the context of what just happened with CUB. Nobody likes these slow bleeds and massive hyperinflationary diluted pools... except me of course. I think they're awesome, but that's beside the point. pCUB will be deflationary, which is fine. Should be a nice experiment, but I get the feeling it will be even more volatile than CUB was. After all, it's a new project, and it has a halving event every month. Obviously most assume this will lead to a higher token price and more network growth. I guess we'll find out, eh?

I still have a lot of faith in CUB.

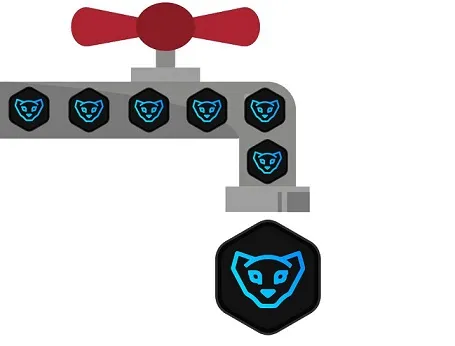

Even after reaching a new all time low during the current correction, reaching this 10M token point is quite the milestone. Think about it: we went from 0 CUB in circulation to 10M, that's an increase of infinity percent. Talk about hyperinflation.

However, now that CUB has been up and running for a while, the inflation is still linear. The next year going forward is only going to mint another 10M tokens. Going from 10M to 20M is a lot easier than going from 0 to 10M. At worst, the token price of CUB loses 50% over the next year from token dilution instead of 98%. Big upgrade, and that would assume zero growth over the next year, which is highly unlikely. I think at worst token price would be 25 cents in a year's time, but obviously the degens are targeting much crazier numbers than this. All I can say is that you can't go wrong in the LPs, even if it stings when the price goes up and all your CUB in the LP is getting automatically sold off at a loss.

CUB and pCUB are mutually exclusive.

Many people ask why we would create two different tokens on two different platforms that do the same thing. Ah well... they don't do the same thing at all so, don't worry about that. pCUB is doing all kinds of new up-and-coming DEFI stuff and is deflationary. It's not like we are going to launch IDOs on pCUB to reduce the supply; the supply of pCUB doesn't need to be reduced. The tokens might have similar names and branding but they perform completely different functions within the ecosystem.

Some of these functions, like bonding, will be applied to both platforms because there is no reason not to. That's the beauty of EVM chains: build something once and it can be easily forked to any other EVM network. The work done on pCUB helps CUB, and the work done on CUB helps pCUB. No need to get hung up on the naming being similar. They could have been completely different brands, but this is the path that has been chosen.

Conclusion

Soon™

Posted Using LeoFinance Beta

Return from 10M CUB Supplied to edicted's Web3 Blog