Bitcoin had Mega-Bubbles in 2013 & 2017.

During these times at the end of the year BTC spiked up x10-x20 in under 12 months, followed by a brutal year-long bear market. We assume this is happening again right now in 2021.

The obvious rational for these mega-bubbles is clear: they happen due to Bitcoin cutting the block reward in half around every 4 years (210,000 blocks), effectively cutting total inflation in half, thus causing a supply shock to the markets 12-18 months later.

In 2012 the block reward was cut in half from 50 BTC to 25. We saw the price of Bitcoin spike from $100 to over $1000 in 2013. In 2016 the block reward was cut in half from 25 to 12.5. We saw the price of Bitcoin spike from $1000 to $20000. In 2020 the block reward was cut in half to 6.25 BTC. We've seen the price go from $20,000 to $60,000 so far, and the market still appears to be immensely bullish. We've yet to see where we will peak this time around, but logic dictates we will at least graze $200k and possibly go all the way to $400k based on these patterns.

Stability is better than mega-bubbles.

Sure, mega-bubbles are a swing-trader's best friend. We have the opportunity to sell at the peak and even short the market on the way down to make massive gains before buying back in. However, this is a zero-sum game tactic, and for every one person that gets filthy rich, a wake behind them is left where dozens of newbies got wrecked. This is bad for retention and it's bad for Bitcoin's reputation in general. It would be much better if Bitcoin was simply making consistent gains every year without much risk involved. This would automatically queue mainstream adoption and shut the naysayers up real quick.

| 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|

| $25.6k | $51.2k | $102.4k | $204.8k |

| 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|

| $409.6k | $819.2k | $1.6M | $3.3M |

Is this possible?

I think it's not only possible, but guaranteed to happen in as little as eight or nine years. I came to realize this just the other day as I was randomly inspecting a Bitcoin block explorer.

What did I notice?

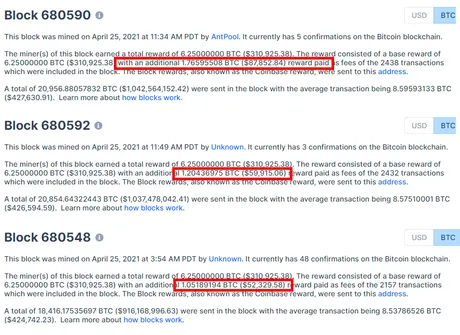

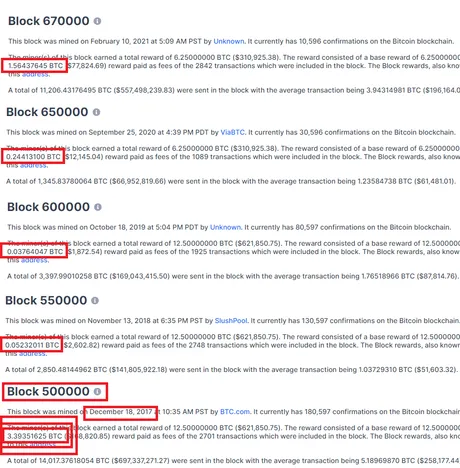

Something that I hadn't taken into consideration before: it won't be long before mining fees overtake the block reward. Scanning through a few recent blocks I saw something that shocked an astounded me:

Mind-blowing

Bitcoin miners are raking in over a full Bitcoin just for transaction fees on some of the more recent blocks. That's legendary. Let's compare that to other blocks.

We see that even back in February fees were just as high, but back in September when Bitcoin was still at the doubling curve they were about x6 less in terms of BTC (not USD). In 2018 and 2019 during the bear market fees were dirt cheap and even x5 less than they were in September.

However, the most interesting block is block height 500,000. This was in the middle of the last mega bubble December 18th, 2017. BTC.com mining pool picked up a whopping 3.4 BTC just from fees: that's insane.

Corporate adoption.

Institutions are entering Bitcoin, and it's pretty safe to assume they don't care about fees much. They are using Coinbase to buy the BTC, so they don't even have to pay on-chain fees, and when they do pay on-chain fees, they are transferring so much BTC at one time that the fee is totally meaningless.

It's quite obvious that due to all these variables, the miner rewards for fees are going to spike even higher than they did in 2017. I predict that some blocks will even rake in as much as 5-10 BTC just from transaction fees. That's ALREADY higher than the current block reward of 6.25.

So what happens in 2024?

The block reward will be reduced to 3.125. Then in 2028 the block reward will be reduced to 1.5625. Then in 2032 the block reward will be reduced to 0.78125.

It becomes quite obvious when looking at these timelines that cutting the block reward isn't going to make a damn bit of difference in as little as 8 years. Who cares that the block reward is 1.5625 when the fees are raking in 5 BTC+ per block? At a certain point in the relatively "near" future the halving event isn't going to matter at all.

And I think that's a great and amazing thing. Bitcoin inflation is going to be effectively reduced to near zero in less than a decade. Everyone always talks about how low inflation will be in 50 years, but we absolutely don't have to wait that long.

This is all working perfectly as intended. While the network is young it is vulnerable and needs to greatly incentivize security. As the network gets older it can simply defend itself and pay miners with just the transaction fees. It's a brilliant system really. BTC will still be the highest security network in the world even though it pays miners near zero inflation.

Welcome stability.

I believe this dynamic will greatly enhance stability and completely eliminate these pesky mega bubbles. Instead of Bitcoin spiking x10-x15 above the curve the biggest bubbles we should get are around x3-x4 just like normal. This will make the markets much easier to predict and take a lot of the guesswork out of trading and knowing when to support the network by turning bearish as the market overheats. Buy low sell high. Stabilize the network and get paid at the same time.

This will be a massively valuable event because then we will stop having year-long bear markets: Bitcoin will be in a continuable bull market. Once Bitcoin stabilizes that stability will trickle down into every other project. Crypto is a sliver deck. Any advantage Bitcoin gains trickles down into the entire cryptosphere. Bitcoin anchor strong.

Conclusion

In less than a decade, for all intents and purposes, Bitcoin will have zero inflation but will still be the most secure network on the planet. Fees will be outrageous, but Bitcoin wasn't designed for high velocity: it was designed to generate wealth. All we have to do is HODL.

Funny thing is, inflation is a killer dapp, and most people do not realize this yet. Bitcoin will not be the #1 coin by market cap forever, in fact I predict that ETH might flip it at the end of the year for a short moment. Be ready for maximalists to cry their sweet tears when it happens.

Again, everyone thinks inflation is the devil, when in fact inflation is a gamble (a good one). Bitcoin eliminates this risk by eliminating inflation, but that opens the door for other networks to utilize inflation in a superior way. We already see the crazy stuff going down with yield farming how high these tokens can moon even with absurd inflation (and in fact because of the inflation).

Bitcoin won't always be the top coin by market cap, but it will be the most secure and stable coin for decades. That is its niche, and there is no competition on that front. Looking at the numbers, I think we can get there in as little as 8 years (12 maximum). By that time I imagine it will be the world-reserve currency, but somehow won't even be the highest value project. Crazy thought. We are entering the Age of Abundance and we are standing on the ground-floor.

Posted Using LeoFinance Beta

Return from 2029: The Last Bitcoin Mega-Bubble to edicted's Web3 Blog