Just wanted to give a little heads up on my test with Hive >> HBD conversions now that I actually know how it works.

Because of the recent market dip, I actually lost money on the collateral, but ended up making money overall, so it's become the perfect example of how we can make money even in some of the worst-case scenarios. This requires a little bit of explanation. Even then I don't expect it to make perfect sense to everyone; it's kinda weird.

If you recall when I was talking about this before...

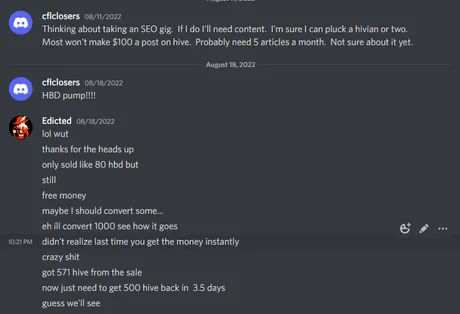

@cflclosers had alerted me to the HBD pump, which was thoughtful.

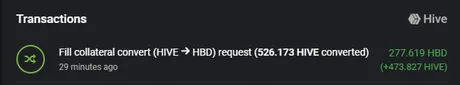

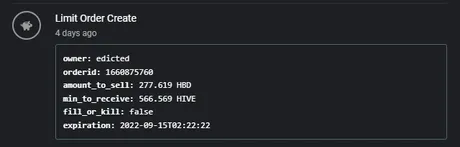

I instantly dumped my 85 HBD (which I forgot I even did). Then I converted 1000 Hive into HBD for testing purposes.

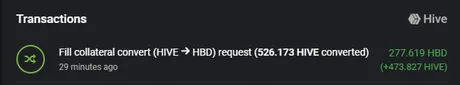

So I did not make back more than 500 Hive.

- Only 473.

- This is because the price of Hive dropped over the 3.5 day average.

- When I made the conversion, I was given a better price than when the conversion actually went through.

- This caused me to lose 26 Hive from my collateral, as the Hive being converted into HBD was worth less than the loan I was given 3.5 days earlier.

- However, I was up 71 Hive on the day of the test, so this became a 45 Hive net positive overall.

What was the price of HBD at the time?

I think that's actually a big problem with how this all works.

We measure the value of Hive instead of the value of HBD.

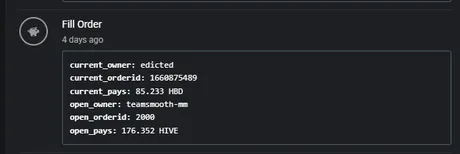

Looking at my first sale of HBD (before conversions) we see that I dumped 85 HBD and got 176 Hive. (48 'cents')

The bigger conversion was 49 'cents'

But this all assumes that 1 HBD = $1... which is obviously false in the exact situation that conversions are used. Our system is a bit backwards. There needs to be an on-chain order that allows the buying and selling of HBD in terms of dollars instead of Hive. The information to make this happen already exists in the price feed, but now the conversation is getting even more confusing so I'm gonna pivot back to the main topic at hand (also this may be a task better suited to off-chain bots and casual users simply having better access to them).

If I recall correctly Hive was about 63 real cents at that time, so when we reverse engineer the numbers (63/49) HBD was trading for around $1.30. Sounds about right.

Clearly this is a sweet spot.

Basically making these conversions when HBD is valued at $1.25 or higher is automatically going to turn a profit. Even in the worst case scenarios only a tiny amount of money would be lost from the gamble.

There are several reasons for this, but the primary one is that, for the most part, when HBD spikes, Hive is also going to spike. Makes sense because HBD is the debt of Hive. Demand for our debt increases and Hive gets destroyed to print more HBD. Both numbers go up and down at the same time. There's a heavy correlation here (especially with the relatively low liquidity).

So even though I lost the collateral gamble I was still up overall because HBD had broken its peg so badly. It's important to recognize how far we've come since 2017. It is literally impossible now for HBD to get to $13 like it did back then. In fact, at this point, now that everyone is learning that this system works, it's probably impossible for HBD to even hit $2 (at least for more than 1 hour's time). $1.25 is essentially a nice soft cap for HBD now even in the case of pump/dumpers trying to manipulate it. Pretty cool.

Conclusion

Even in the worst case scenario (Hive dumping after an HBD pump), converting Hive into HBD is still profitable when HBD is valued greater than $1.25. Even in the case of failure, the risk is extremely low once the price breaches this level and the most one can possibly lose is only a percentage point or two.

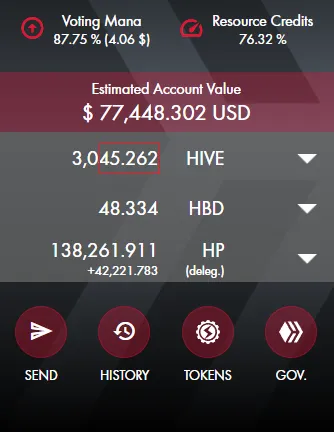

The next time this happens I'm going to leverage much harder and go all in on the conversions because the risk is so low. We can nest our conversions over and over again by dumping the HBD back into Hive and doing another conversion all over again. This allows us to convert 90%+ of our Hive into HBD instantly instead of only 50% from a single conversion.

HBD is becoming a real algo stable coin within a sea of other 'solutions' that are all failing systemically. When the smoke clears HBD is going to be one of the best (or the absolute best) option for algo stables. This bodes quite well for overall Hive price action long-term. It still needs a lot of work, but we'll get there. The grind continues.

Speaking of mad gains, it's important to note that when a real bull market hits, converting Hive into HBD is going to be insanely profitable. When the price of Hive is higher 3.5 day later, money was made twice; once when the HBD was sold at the inflated price, and again when more Hive is returned to the user 3.5 days later because the collateral being used to finance the loan is worth more, and thus less is taken out to print the HBD that got dumped. Once again, my not not financial advice is to automatically initiate Hive >> HBD conversions if the price of HBD is $1.25+. It's free money on demand 99% of the time.

Posted Using LeoFinance Beta

Return from +45 Hive on the most recent Hive >> HBD conversion test to edicted's Web3 Blog