Theory became reality

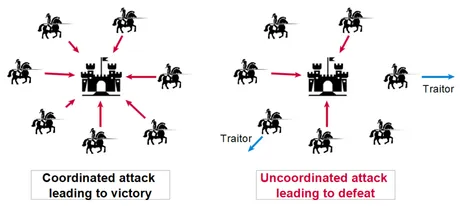

When Bitcoin first launched it claimed to have solved one of the world's toughest networking enigmas. And just like that, the Byzantine Generals Problem was solved using Byzantine fault tolerance after decades of the greatest minds thinking it was an impossible task. However this was highly theoretical in the early days. It wasn't truly known if any of this was going to work for a long period of time. After all, unknown unknowns have a nasty habit of popping up from within the concrete jungle.

Now that Bitcoin has been up and running long enough for environmentalists to claim it's going to use more energy than all countries combined and boil the oceans, we can be 100% firm in the belief that POW mining did indeed work exactly as expected. The war for decentralization has only just begun, but it's nice to know that we have that solid foundation of money itself acting as the backbone for all the other changes that need to be made going forward.

The dreaded 51% attack.

The biggest threat to POW mining is often referenced as the 51% attack. However, this is a bit misleading for a couple of reasons. In this post I will explain how Bitcoin has essentially outgrown this attack vector and no longer has to worry about it. There are plenty of other threats to worry about that are far more relevant to the current age.

Speaking of age, it seems that time moves differently here in the cryptoverse. Every four year cycle here feels like a generation (20-30 years) full of unique ups and downs. Coins are birthed and destroyed within these wildfires of chaos. The money flowing into the space is more than enough to fund thousands of scams, and yet those scams dissolve just as quickly when the bear market crushes them. All part of the process I suppose.

Speaking of scam tokens.

I've seen this video circulating on crypto-twitter (or more accurately maxi twitter) over a dozen times now. Them Bitcoiners can't get enough of Charles Hoskinson's babyrage. I find this comical for a couple of different reasons. For one Bitcoiner's take it way too far and make ridiculous claims about everything being a security except Bitcoin (even though there are lawsuits in play that definitively say otherwise), but also if there's one thing I hate more than delusional maximalists it's Charles Hoskinson and ADA.

That's because many years ago I learned that ol' Charlie boy was actually a big player on the Ethereum network and he left to go create a new coin (Cardano's ADA) that could more easily bend the knee to the current establishment. Essentially he left ETH to purposefully create a shitcoin founded on centralization and regulatory compliance, and that rubbed me the wrong way. So imagine the irony of being named in a lawsuit against Kraken six years after launch being deemed a security.

Hilarious and well deserved.

So what does he do in response to this lawsuit? Well he cries about Bitcoin of course. Because why do something productive and cooperative like point out that Ripple won their lawsuit and it's quite clear that most cryptos aren't securities when you can instead try to make the argument that Bitcoin is one? LoL seriously this guy is such a tool it blows my mind that anyone can take him seriously. Thanks for reminding me how ridiculous you are, Charlie.

Bitcoin was premined.

First and foremost I think it's worth pointing out that premining a token clearly doesn't make it a security. We already know this for a fact as Bitcoin has been deemed not a security and it has a premine. Of course there are a lot of unique details with Bitcoin. It has no CEO or foundation. It's also very much expected by a fair number of users that the 1M premined tokens are never going to be spent anyway, putting them in the same category as lost coins.

However, at a certain point, declaring this or that a security becomes extremely nitpicky. We're all well acquainted with this concept in that the SEC just picks and chooses the rules as they go, even when what they are saying today runs in direct opposition to what they've said in previous years. Even when they definitively lose devastating lawsuits in court they continue on applying that exact same logic to other networks. It's pretty transparent that they've completely lost the narrative but they haven't been put in their place just yet.

So what's this have to do with 51% attack?

Well the argument being employed here is that a higher chance of 51% attack means higher centralization, and higher centralization must mean greater chance to be a security. This is wrong on both counts. An asset can not have a higher chance of being a security. The law is binary. An asset is either a security or it isn't. We already know that Bitcoin isn't one so why even entertain what comes next?

Because the attack isn't even possible.

An attack on the Bitcoin hashrate can only happen in theory.

It can not happen in reality.

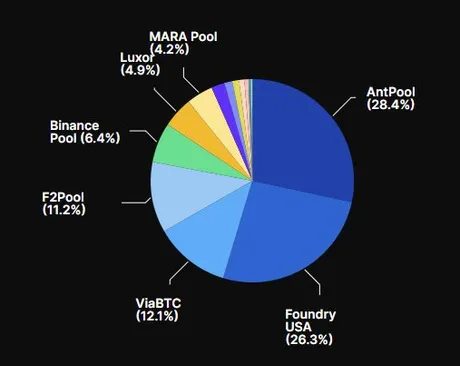

Sure we can look at the silly pie-chart and make the ridiculous claim that if the top 3 pools colluded to 51% attack the network then it is easily possible, but it is quite simply not. Why is that?

Because explain how it would actually happen is why.

Nobody can explain how this 51% attack would actually happen (step by step) because it can in fact not happen. The explanation that Charlie gives is the most absurd example one could possibly come up with. The top three mining pools get "subpoenaed" and get legally ordered to collude together in secret and attack the network? REALLY? Legit one of the dumbest things I've ever heard.

Is it even possible to keep something like that a secret? I'm thinking not.

It's called 'double-spend' for a reason.

In order to 51% attack a network the Bitcoin has to be spent twice, meaning that one must literally steal their Bitcoin back from another entity that was willing to trade them something of equal value. So how exactly is the government going to spin that? They're going to what? Steal money from an exchange and then tell everyone don't worry about it because stealing is legal? Completely asinine argument not based in reality. The exchange would obviously sue the government and easily win in court.

To recap:

- Bitcoin must be sent to another entity for trade.

- Whatever the Bitcoin was traded for can't be recovered.

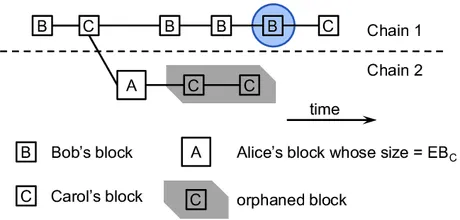

- The Bitcoin payment must disappear by orphaning blocks.

- The entity that was stolen from must have zero recourse.

- The attack must be worth the associated risks financially.

Yeah it's a lot of 'ifs'

Which is exactly why this type of attack is no longer possible. Imagine trying to buy real estate or a personal jet with double-spent Bitcoin. Again, not possible. The collateral could be easily recovered by the victim, but even more likely enough time wouldn't have passed in the first place to make the trade. One can't buy a house in 30 minutes.

3 Block Confirmation

It stands to reason that the only possible way to double-spend Bitcoin would be to orphan three blocks after trading the Bitcoin for another cryptocurrency on an exchange. This is the only reasonable way to prevent the victim from recovering their collateral.

The problem with this strategy? It takes 3 confirmations just to unlock the Bitcoin on the exchange. How much longer is it going to take to withdraw millions from the exchange without red-flags going up and delaying that entire process? Not going to happen.

51% itself is a misnomer

It's like saying if you count cards at the casino and have a 51% edge you're guaranteed to make money in the short term. Nothing could be farther from the truth, and at these prices every failed attempt would cost at least half a million dollars. Just because a single entity controls 51% of the hashpower doesn't mean they'll automatically be the first to create a secret sidechain of 3 connected blocks before the rest of the active miners.

Mining pools are not anonymous.

Mining pools are known corporate entities. They can be sued, and the employees can be jailed if they steal millions of dollars. This should be obvious but seems to go completely unnoticed every time this philosophical and extremely hypothetical debate gets rebooted.

Risks to reputation and liberty.

Given the numbers it is quite obvious that the only entities that could possibly pull off such an attack are indeed the mining pools. Okay, so let's assume they did it. Against all odds they 51% attacked the network. What now?

Well all the mining pools that were involved in the attack instantly lose all their reputation. This is a national news story. Everyone that was delegating hashpower to those entities moves them to another pool, and lawsuits start flying. The mining pools in question will almost certainly be utterly destroyed after a single violation. The entire business: poof.

How much money did the attackers steal? Well looking at the risks of such a blatant offense we'd have to assume they made off with something in the 9-figures range... hundreds of millions of dollars. The only problem with that is the market doesn't even have that much short-term liquidity, again rendering the entire attack completely impractical.

Layer Zero

Even in the absolute worst case scenario there is always the nuclear option. Devastating attack hits BTC? No problem, just hard fork it out of the system. Would Bitcoin lose reputation over something like this happening? Sure, but also they'd gain reputation by way proving to the world that it is the community that ultimately decides the truth of the ledger, not some completely lifeless and neutral algorithm.

Does Hive has less reputation today than we did before the hostile takeover? I would argue we have more rep, but that could be biased. What about Ethereum? Does anyone still talk about the DAO hack as some kind of permanent deal-breaker? I haven't heard that argument parroted in years.

What are the actual threats to Bitcoin?

Well the ultimate one is the underlying encryption itself. Many have referred to this as the quantum attack vector. While this would be a huge setback in the short term it remains unclear just how bad it would actually be and how long it would take to fix. Personally I deem the chance of this happening to be quite low with the chance of systemic risk being a significantly even smaller subset.

A much more reasonable threat to be worried about are the implementations of blacklists and whitelists imposed on the miners. Unlike a 51% attack this is something that could be easily accomplished through the legal system and would be completely justified by it through traditional KYC/AML precedent.

However even then I don't believe it would have the intended effect. Rather than stop Bitcoin transactions from appearing on the chain it seems much more likely that hashrate would simply move to pools that refuse to be regulated. In terms of decentralization this could actually be a good thing, with regulated entities like Blackrock opting for regulated mining pools while those who believe that Bitcoin regulates itself just fine moving to a pool hosted in a country that allows freedom of value transfer. It would be extremely difficult to get enough miners on board with this plan for it to actually work, but you never know it could happen.

Conclusion

It is not possible to 51% attack Bitcoin this day in age on a practical level that makes any sense whatsoever. In order for this kind of attack to occur, a theft of enormous proportion must take place. All of the entities that could pull off such a caper are already doxed and don't have the luxury or incentive to pull off such a crime. The risk of such an attack is far more concerning than any amount that could possibly be gained from it.

Bitcoin will continue to grow and the network will become even more difficult to exploit in this fashion. At this point in time it would be far more productive to worry about dwindling blockspace and the ability for the average person to even afford using the network. Inevitably Bitcoin will be co-opted by the very system it was meant to disrupt, and in doing so it will have ironically done its job.

Return from 51% Attack is not Possible to edicted's Web3 Blog