@taskmaster4450 does a pretty decent job of reminding us all that the banking sector is an extremely complicated entity that is constantly misrepresented and oversimplified to comically childish levels. Especially now when the banking sector is having problems: all the reply guys jump in and act like experts on the topic even though they don't even have basic cursory knowledge of how it works. This becomes particularly frustrating when noobs keep spewing the same old tired narrative over and over again without having any idea what they're talking about.

It's important to understand that the economy is a complex living entity.

Just like the world is filled with pretentious doctors that could give a dozen diagnoses based on a single set of symptoms, so too is the world filled with oodles of know-it-all economists who could give a dozen reasons for why the economy is sick at any given time.

Nothing within this ecosystem is simple, and the rabble coming in to give their two cents on the matter is like a pleb thinking they have the answer because they did a single search on WebMD. Certainly it is possible for the novice to come up with the right answer but the odds are certainly not tilted in their favor. It takes a lot of work to figure this stuff out.

Main Theme: Money Printing

Taskmaster's beef with a lot of people who talk economics revolves around the concept of where money comes from. Whenever the dollar loses purchasing power everyone just assumes it's because the money supply has expanded. However, this seems to have not been the case for the last twenty years.

Everyone points to the M2 money supply as the ultimate metric to show that printer go brrr, but this is simultaneously a metric that includes financial instruments that are completely locked within the retail banking sector.

We must remember that the Federal Reserve at its core is a bank for banks. They do not interact with the public: they interact with other banks. When the FED prints financial instruments and uses them to do things like buy securities (QE) from banks: those financial instruments are absolutely not liquid USD. They are locked within the banking sector.

These financial instruments can be leveraged indirectly to issue more loans and actually create real USD and expand the money supply, but this action is not guaranteed (even though this is exactly what we want to happen). In fact we constantly see evidence that when the FED engages in QE this doesn't really help the risk:reward landscape in the banking sector. Retail banks are not required to act the way the FED wants them to act just because the FED believes they've incentivized a certain behavior.

Banknote Hypocrisy

All the "printer go brrr" memes involve banknotes (cash). It's true... the FED (Treasury) can print banknotes directly. And yet the same people who make these printer go brrr memes don't actually use cash. In fact these same printer go brrr people think there is a globalist conspiracy to eliminate cash from the ecosystem entirely.

It is fully hypocritical to hold both of these ideologies within a single mind. Either the FED is printing a ton a cash and flooding the economy with physical cash (which everyone knows isn't happening), or the only real way to expand the money supply in any meaningful way is for retail banks to issue loans to their constituents.

My request to @taskmaster:

A lot of the focus here goes into why people are wrong and why they have no idea what the fuck they are talking about when they start flapping their jaws about the banking sector. I would like to see some focus on the flip side: how are people correct about the banking sector? Certainly the main theme cannot be incorrect.

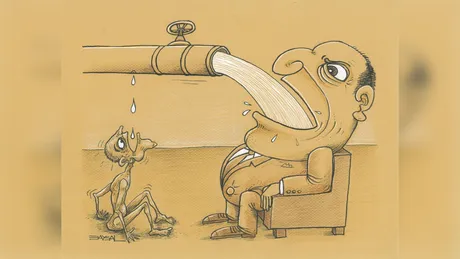

This main theme of central banking of course is that they are bleeding us dry like vampires and siphoning value from our lifeforce into their own. If this isn't accomplished through the process of money-printing and the expansion of the money supply, then another narrative must be provided so that people can understand what is actually going on.

We can't just tell people they have no idea what they're talking about and then not provide them with the actual reason for why everything is totally fucked. I've been waiting for the other shoe to drop for over a year, but it never seems to come. Taskmaster just keeps harping on this idea that the way people think it works is not how it actually works. Okay sure but we all know the banks are profiteers, and it's not being explained how they are raking in the lion's share of all the profits. This narrative-vacuum creates a situation in which the people hearing this information simply aren't going to believe it because it's an incomplete story. In one ear and out the other so to speak.

Here's my humble guess:

Given what I now know about the banking sector, most value must be being extracted through interest rates. This fits Taskmaster's narrative of how printer is actually not going brrr; in fact there is a worldwide dollar shortage that has been compounded by rising FED rates.

We know that money is debt and that all this debt is owed back to the banks with interest. Funny story: this interest doesn't exist. The money owed back to the banks is more than the total amount of money in circulation. As time passes these interest rates suck liquidity out of the economy. Thinking about money like a river: the water level is getting low; the ecosystem is becoming stagnant and decrepit without much needed velocity to keep pumping lifeblood into the ecosystem.

This is the situation we are in right now.

Moments like this are avoided during economic prosperity because economic expansion implies that the banks are giving out new loans to people and expanding the money supply. With this expanded money supply there's enough money floating around for everyone to pay back their debts. When the river runs dry we run into these problems. The result is the dollar shortage we are seeing today in addition to inflation, which should be totally baffling to the printer go brrr people. But somehow isn't. Call it cognitive dissonance.

Debt default

The economy grades on a curve, and there is always someone at the bottom of the meatgrinder no matter how financially responsible everyone is. During times of economic contraction defaults are high because money within the system is low. Again, more money is owed back to the banks than exists. The only way to navigate this situation mathematically is that a lot of that debt simply won't get paid back. Whatever collateral existed to secure that loan now belongs to the bank (like a house).

Centralization is bad for the economy.

The reason why the economy is in such trouble right now is because the gap between the rich an the poor is absurd and it only gets worse every year. Of course correlation does not equal causation, and this gap between the upper and lower class is clearly a symptom of the actual disease rather than the disease itself.

Collateral required

In order for a bank to issue a loan: they must have a reasonable expectation that they will be paid back. They are in the business of making money after all. If they issue ten equivalent loans at a 10% interest rate, they need nine out of ten borrowers to pay them back just to break even. Like many business ventures this is a game of very thin margins and high competition.

So what happens when the collateral is people?

Credit scores are collateral. People are collateral. The Bible calls this usury and it is generally frowned upon. After all those who cannot pay become debt-slaves.

However as someone who never paid back $10k worth of credit card debt I can tell you that there are many laws in place today that greatly soften the blow of punishment for not paying up. These banks are not loan sharks: they aren't going to break your legs over it. In fact I personally suffered zero drawback from not paying my debt. Six years later my credit score is higher than it's ever been.

Collateral is diminishing.

Technology creates economic deflation. If people start 3D printing houses then all the houses currently in existence go down in value. Inflation of houses creates deflation of value. Technology creates this inflation of product and deflation of value. If AI can start doing the jobs of 50% of the population this will in turn lower the collateral value of people themselves. This has already been happening for decades with the advent of technology, and more specifically mass production and automation.

None of these things bode well for a centralized economy in which the distribution of wealth is constantly being syphoned away from the lower and middle class. Within this context we can see that interest rates and debt might not be the problem at all (although it's not helping) but rather technology consolidating more and more wealth into the hands of the elite.

National Debt

I'll do a post on national debt some other day but this is a topic I'd also like Taskmaster to cover because I feel like there is a ton of nuance here that I still don't understand.

Conclusion

Everyone seems to think that the dollar is down and out. It's losing world-reserve status and printer has gone brrr long enough. Taskmaster seems to believe this is extremely wishful thinking based on a complete lack of knowledge of how the economy actually functions. I tend to agree with him.

That being said I would like to see less focus on debunking printer go brrr and more focus on how the banks are choking the economy like leeches. If we tell people the FED doesn't print money they will simply dismiss that information without a replacement narrative to show how they are siphoning value into their pockets and the pockets of the cronies around them.

Or perhaps the banks are not the problem at all, and the real problem stems from technology and the fetid centralization of wealth it creates. If this is the case we are all certainly in the right place, as crypto (and especially Hive) are all about getting a better distribution.

Posted Using LeoFinance Beta

Return from A Request for Taskmaster: to edicted's Web3 Blog