At the end of my last post I make the outlandish claim that a stable-coin might get created that's "pegged to itself". Volatility is a big enemy of mainstream adoption, and it has allowed these corporate weasels to come in and claim they have the answer when they are really just leveraging more debt. Business as usual. That little trick isn't going to work forever.

Perhaps nothing needs to be done. Many simply assume that Bitcoin will slowly lose volatility over time once mainstream adoption rolls around. The speculation will fade away and the world can come to consensus over its true value. I used to believe this sentiment, but now I'm not so sure. This kind of thinking seems to break down when you actually look at the details of the economy.

Inflation

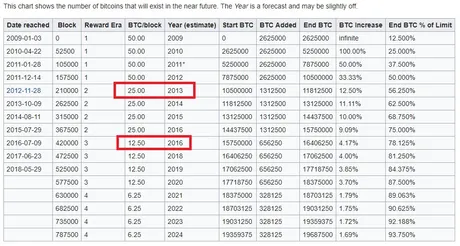

Bitcoin costs a lot of energy to mine. Large mining operations do not have the luxury of gambling on the market. They sell their Bitcoin immediately to cover the power bill. This creates a very steady flow of liquidity into the markets. However, around every four years the block reward is violently cut in half. In turn, this dynamic cuts supply and tends to spark a bull run.

Very Moon, Much Wow

This is not a very good model for a coin looking to be stable. Steem cuts inflation by 0.1% about five times a year. In two decades our inflation will be permanently set to 1%. By comparison, we have a much better economy to support a stable asset than Bitcoin.

Liquidity

Stability comes from liquidity. In order to maintain balance there has to be a large number of coins willing to be bought and sold within a narrow window.

Interestingly enough, volatility is part of what gives crypto its unique robustness. What if someone wanted to control a network by buying a majority share? They would only succeed in mooning the value of said coin. Crypto is highly resistant to hostile takeovers in this way. Volatility provides the answer.

Not broke, don't fix

Crypto is doing a very good job of not reinventing the wheel. There is no demand for a truly decentralized stable asset because we already have a "good enough" solution. Ignoring politics and focusing on the facts, USD has a pretty amazing reputation for being consistent. Why waste resources fixing a problem that doesn't exist yet? We have plenty of other things to do.

Logistics of decentralized stability

First of all, what is stability? If the price of food goes x10 that wouldn't make USD any less stable. Everything would have to go x10 for us to realize that USD is now completely unstable. Of course that has already happened, but because it was over such a long period of time we ignore it. Velocity matters.

I've been thinking about this topic for quite some time now. How would a decentralized stable coin pegged to nothing actually work? Say you initially peg it to USD with the intention of raising its value 20% per year. After two years it should now be worth $1.44. However, we haven't avoided the peg. It's still pegged to USD and if USD goes under so will this asset.

It becomes obvious that stability isn't about how much fiat you can get with crypto. It's about how many goods and services can be bought with the crypto; purchasing power is king. Purchasing power can go up for a variety of reasons. New technology is often reserved for the upper class until supply can meet demand. Increased supply will increase purchasing power of every asset.

In a world shackled by artificial scarcity it becomes clear that the blockchain is going to increase the purchasing power of every asset on the planet. From this perspective, stable-coins might not even be necessary. Who cares is the asset is volatile if you can still use it to buy everything you need even during the worst bear markets?

Thought experiment

Regardless, I've still wondered what it would take to create a stable asset not pegged to fiat. Perhaps we could create some kind of universal price index for goods and services and peg a coin to that instead. I'd rather know I could consistently buy bread with a coin than acquire USD with it. Let's call this the "cost of living" index.

Still, the devil is in the details. Even with an index that is a better measure of value than fiat, how do you ensure the governance of a coin revolves around stability? If the price spikes the community will be expected to sell into this demand. How can a hostile takeover of the currency be prevented? If the price dips the community will be expected to buy or burn liquidity. How can a decentralized community incentivize this behavior?

How does the Fed do it? Well, they use debt-slavery and infinite warfare as tools in their toolbox. These options probably aren't going to be very popular in a transparent ecosystem. However, it's easy to get tunnel vision on all the atrocities and not look at all the good work they've done. This unsustainable pyramid scheme has been kept afloat for quite some time, after all.

The Fed can't be bought out because they own USD. They own the power of inflation. If someone hordes USD they'll just print more and devalue that holding. Perhaps what we need is a coin that mimics this behavior without being so incredibly centralized.

The Bitcoin community owns Bitcoin inflation through the process of mining. However, inflation rates are not only set in stone, but also programmed with a half-life. This is not a model for stability. Quite the opposite.

The Steem community owns inflation through stake-weighted upvoting. Again, this inflation is set in stone and set to decrease substantially over the next 18 years. Again, this is not a good model for stability.

It becomes obvious that an untethered-to-fiat stable asset can not employ the consensus algorithms of POW, POS, or DPOS. A completely new algorithm is required. This new proof-of-trust algorithm would somehow determine the trustworthiness of community members and grant powers of inflation accordingly.

Such a system would be highly experimental because inflation would be variable and dynamically change based on the decisions of the DAO controlling the currency. Proof-of-stake fails because you can no longer trust that stakeholders are trustworthy when the shield of volatility is lifted. Trusted DAO members would be expected to sell high and buy low while also keeping the currency as stable as possible. Quite the balancing act.

Upon further inspection, it seems as though a self-regulating stable-coin, although seemingly simplistic in concept, would be a massive undertaking in terms of implementation. The linchpin of all blockchain technology seems to boil down to one simple problem: How do you measure trust in a transparent but also private ecosystem where the identities of accounts are unknown? The absolute most successful projects in this space will be the ones finding innovative solutions to the problem of decentralized trust, no matter what the actual application is.

Why am I beating the dead-horse of stable-coins and inflation?

Inflation distribution is the ultimate most important thing of any currency. It's why Bitcoin was invented in the first place. There would be no need for crypto if we could trust the elite to do the right thing. Stable-coins are an extension of the old broken system, and we shouldn't just assume that USD will remain stable just because it has a long history of doing so. Times are changing, and they are changing quickly.

Return from A Self-Regulating Stable-Coin to edicted's Web3 Blog