https://www.bloomberg.com/news/articles/2021-05-20/treasury-calls-for-crypto-transfers-over-10-000-reported-to-irs

https://www.cnbc.com/2021/05/20/us-treasury-calls-for-stricter-cryptocurrency-compliance-with-irs.html

The coordinated attack on Bitcoin continues.

Further, as with cash transactions, businesses that receive cryptoassets with a fair market value of more than $10,000 would also be reported on.

Not that this is a surprise or anything, but the constant never ending FUD and regulations being thrown out during such a small window of time of pretty suspect imo.

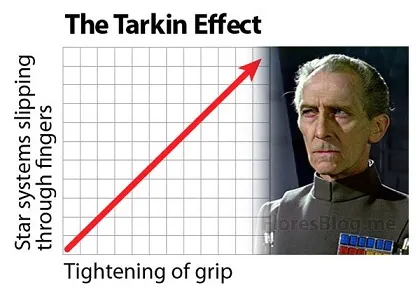

At the end of the day more regulations on the centralized tendrils of decentralized assets (crypto exchanges) just push more people away from using the exchanges in the first place. These regulators think they can control this situation... they obviously can not: that's the entire point of crypto.

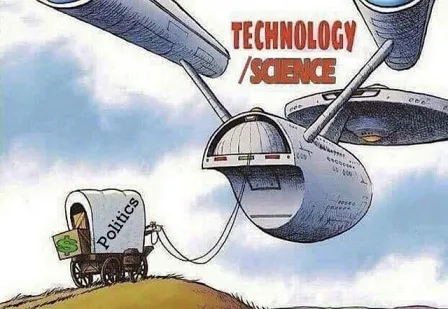

Devs are going to continue to churn out code a thousand times faster than anyone could hope to contain. Every regulation that comes down, no matter how reasonable or justifiable, is simply going to heavily incentivize the decentralized option that CANT be regulated. In this case this means decentralized exchanges.

From there it means products/services being sold directly for crypto. Why transfer $20k to your bank account when you can just buy whatever you want with Litecoin or whatever? Privacy tech will also be on the rise because legacy law does not mesh with crypto and it becomes literally impossible to obey the law.

Most importantly, a strong link to cash is being forged.

Most people think we are headed toward a cashless society... not me. The physical nature of money is literally going to be the ONLY thing fiat has going for it in the next ten years. I think it's quite obvious that peer-to-peer links between cash and crypto will be forged, and anyone will be able to swap cash for crypto & crypto for cash in person.

The Craigslist of crypto awaits, it just hasn't been built yet. Of course it will be banned by the app stores but by that time I expect there to be decentrazlied avenues around that as well.

Chainalysis Data Shows Hedge Funds Bought the Bitcoin Dip

Wow I'm shocked that the establishment would actively buy Bitcoin after purposefully attacking it with everything it has for the past week. Shocked I tell ya.

Vitalik says that BTC might be left behind due to its vast energy usage

Et Tu, Vitalik?

I would not want to be recorded for all time being on the obvious wrong side of history. Even Vitalik wants to jump on this ridiculous Green Propaganda that Bitcoin wastes energy? Again, turning energy into currency is not a waste: it's a free market. It's a feature, not a bug. It's a miracle invented by an anonymous entity. Doesn't get any crazier than that.

At the end of the day POW has extreme advantages over every other kind of consensus algorithm. It creates checks and balances between the block producers, the devs and the community. It offers increased security. It's a totally unique solution that isn't going anywhere: especially not because China burns coal for energy. That's a China problem, try again, propaganda machine.

Again, Bitcoin promotes sustainable energy in a big way. Spinning any other narrative is parroting propaganda.

DUTCH CENTRAL BANK FORCED TO BACKPEDAL ON BITCOIN ADDRESS VERIFICATION PROCEDURES AFTER COURT RULING

This is a fun one.

The judge’s opinion in the case was generally favorable towards Bitonic’s complaints, and, on April 7, she gave the DCB six weeks to review its policy. Wednesday evening, the DNB formally acknowledged the legitimacy of Bitonic’s complaints and revoked its mandate for stringent address verification requirements as part of the registration regime.

Yeah, so you know all those regulatory fears about requiring exchanges to KYC self-hosted wallets? Look no further than the Netherlands to see how it's all bullshit. Exchanges will fight these changes tooth and nail and prove how worthless they really are.

Okay, so you KYCed a single layer of self-hosted wallets. How is that helpful? lol. Immediately transfer the money to another wallet that isn't KYCed. Oops, your regulations just failed, idiots. Did they not realize that BTC can be transferred to a non-KYC wallet? Like... seriously. KYC on a single layer of self-hosted wallets doesn't give them any more control over the situation than KYC on the original exchange account. Bitcoin has more wallets than atoms in the universe.

Conclusion

2021 is so bullish. They are literally throwing everything they have at Bitcoin right now while they still can. Hell, I'd prefer if Bitcoin crashed all the way down to the doubling curve at $20k. That way I could feel safe going long and leveraging debt just to increase gains by the end of the year.

On a very real level there have been far too many coincidences for all these events to be totally random and independent. Bitcoin is under attack. I mean, it's always under attack 24/7 but right now even moreso due to these recent events. They want people to panic and sell their stack, and they are winning.

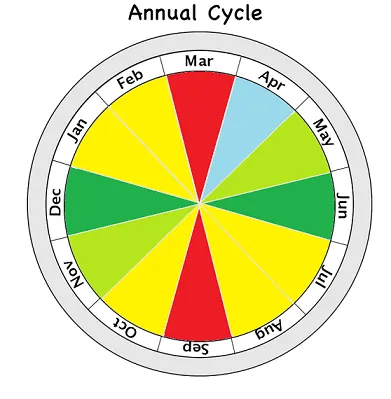

Take a look at my handy-dandy chart. Feb/March/April aren't good months. Where is Bitcoin right now? Right where it was in January during the last good month we had. Market was bubbled... market came down to Earth. 2021 isn't over.

Posted Using LeoFinance Beta

Return from Aftershock FUD: $10k regulation travel rule to edicted's Web3 Blog