Koinos mining update.

This organic and fully unendorsed (by Koinos dev team) market on Uniswap continues to thrive. We continue to see a baseline value of 3 cents a coin due to the overhead artificial scarcity of mining and claiming proofs with gas fees.

I almost FOMOed in a bit more last night, but I stopped myself for one reason and one reason only:

Koin can not moon.

It's a great network to farm. Anyone can farm the mining operation, the Uniswap pool, or both. This is the same reason it can't moon. Miners will always sell in the face of buying pressure, and big buyers have a high incentive to just start a mining operation to avoid the low liquidity of the Uniswap pool. Again, all of these factors point to high volume but a relatively stable price until Koins start running out.

I was reading the README the other day and found something interesting.

https://github.com/open-orchard/koinos-gui-miner/blob/master/README.md

Proof rewards are handled via an internal market maker that exchanges hashes for KOIN. Each proof submitted will mint KOIN in to the market maker at a

predetermined diminishing rate. Over the course of 6 months, 100,000,000 KOIN will be minted.

Now, I'm not sure how quickly the rate of Koin minting is diminishing, but so far it isn't much. In five days we've distributed 3.9M tokens. 0.78M a day. We are targeting a 180 day mining period for 100M Koins, so obviously it will dip going forward a little bit or we'd end up minting 140M instead of 100M. Truthfully, this might end up not affecting the market until the last month or two of the mining process.

Equilibrium.

I mined a 4 per week difficultly reward last night at around 7 MH/s. I got 255 Koins in return. At a value of 3 cents this is only $7.65, which doesn't include the $2 gas fee or the price of mining itself. Remember, all miners want to make as much money as possible, so these are big overhead costs.

At the same time, it looks like ETH fees are starting to go down a bit (finally). I can now transfer ETH to another wallet for 12 cents today, whereas a few days ago it was costing triple that. This might allow the base value of Koin to dip to a lower level. We'll see.

Make no mistake, I'm still ultra bullish on Hive.

Koin can't moon, but Hive can go x10 in a couple months given the flow of money as it pertains to retail. I have a friend in Sacramento who makes a living buying people's old junk and flipping it for a profit. He usually focuses on retro video games. If you're selling N64 games at a garage sale for $1 a piece, he's there to buy them and flip them for a profit. He's actually expanding his business and making an impressive amount of money at this point considering his Scrapper title.

The other day he said something to me of extreme note.

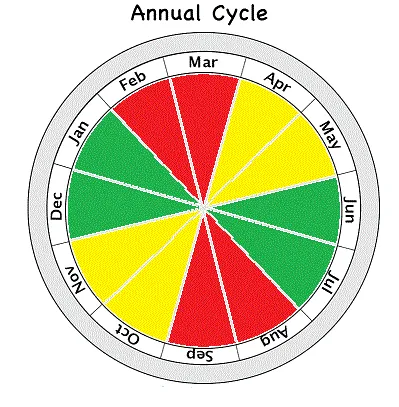

He said we are approaching November and December, which is when he's able to make the money money by a huge margin. He's looking to take some of those gains and reinvest. Yep, he's on the same retail investment cycle as all the rest of them. This cycle has a major effect on the cryptocurrency market, as I have spoken to many times.

We must think of money like water, and during late Q4 the Nile river is flooding. Take a look at the mechanics of the current equation we find ourselves in:

- Bitcoin inflation was cut in half 5 months ago (7 in December).

- Corporations are diversifying their reserves into Bitcoin.

- We are approaching a relative peak in terms of money velocity/flow.

Corporations adding Bitcoin reserves is the huge kicker.

Think about it. As far as strong-hands go, nothing is stronger than corporate reserves on a balance sheet. When compared to the fickle nature of retail flow, there is no comparison. By the time Christmas rolls around the supply of Bitcoin for sale is going to be gone. I can all but guarantee Bitcoin trading above all-time-highs in as little as 10 weeks. We don't even need to go x2 at this point to achieve this. The writing is on the wall.

All roads lead to Ethereum.

This is what the post was supposed to be about, but everything here is connected, and that's somewhat the point. We don't see markets emerging from Bitcoin pairings, and if they do it's on a centralized exchange.

Ethereum is the obvious go-to DeFi hub for every other project to connect to. No one can connect to Bitcoin via smart-contract... that's not even what Bitcoin is for at this point. If we're being honest, it probably never will be because Ethereum has already taken a huge lead in that department. Take into consideration the dozens of "Ethereum-killers" and Bitcoin will almost surely stay situated in the niche it's carved out for itself: Network security, dependability, static unchanging censorship resistance, most nodes with lowest overhead, etc.

Bitcoin is the Anchor

I often describe the cryptosphere as a ship we are building to carry humanity into the future and usher in a new stage of human evolution and scaling up. The old ways have created systems that profit from lies and controlling data to the extreme. We live in a digital world, and trust is now the most valuable resource, to the point of needing to record that trust across thousands of nodes located in every country. We are borderless.

Bitcoin is the anchor. When we are worried about being swept away by strong winds and a violent ocean, what's going to keep us from drowning? That's Bitcoin. Many people are still in this extreme fear phase, which will almost certainly flip when Bitcoin hits all time highs again.

If Bitcoin is the safety-net anchor, then Ethereum is the hull of this ship. Everything on the ship is starting to connect to the hull; it has to. If you're not connected to the hull of the ship, then you aren't really part of the ship now are you? Interoperability is key. We are all in the same boat.

On an even more global scale of this analogy:

If the Earth dies, we all die.

Simple as that.

Early in this game.

The ship is not ready to sail! We are developing pieces to it on land and speculatively investing in those pieces as to how valuable they'll be once they're on the ship and actually have fundamental value. It's like Bitcoin is the anchor of the ship, but we're currently using it for silly things like dropping it on Wile E Coyote for laughs or seeing how well it functions as a paperweight. It does these things very well, and we can see that it's going to work when the ship is finally ready to set sail.

In crypto, diversification == risk.

Want to play it safe? Stick to the anchor. You'll do just fine I assure you; Probably better than the average player. However, during the mega-bull run we get every four years, everyone can see that Bitcoin is often the worse performing asset even after going x20. Small cap coins have a way of mooning. Everyone gets greedy; everyone is looking for that shiny new thing with the most speculative value to the ship.

Where does Hive fit in?

We have a community here that is EXTREMELY resistant to being stomped. This is because we've been stomped on so many times in the last 3 years. We are tired of being stomped, but if we get stomped on some more we'll still be around and continue evolving into a stomp-resistant chain.

Hive has a huge advantage when it comes to communication. Look at the Bitcoin and Ethereum networks... hell... look at all the networks. How do they talk to each other? 99% of the time the answer is not "on chain". Meanwhile, we have the ability to sign messages on chain for free and even encrypt them if we want. It's a big advantage that not a lot of people are considering or even realize.

Communication is the foundation of everything. It is the only thing that elevates humans above the rest of the animal kingdom. If we couldn't communicate, technology would be at a standstill. Money would not exist. We'd of never scaled to this unbelievable level to begin with. Everything we've accomplished we've done by working together and building on the backs of our ancestors.

Currency is the language of conveying value.

So on Hive we can convey language in the form of value and ideas with near zero overhead cost. We can do this with cryptographic security that all but insures most of these messages are legit and from the intended party. We even have account recovery for those that get hacked. Pretty good system we've got here. The current speculative value per coin is largely irrelevant at this moment. Talk to me again in a couple months when it is moreso.

What about LEO?

Ah, well, I took $5000 out of my anchor fund and put it into wLEO. We all know what happened then. I now find myself in a super awkward position. Caught with my pants down. OOPS! However, as we can already see with the insane market recovery (still 1:1 ratio, really?) that these "DEVISTATING" situations are just hiccups down the road during the bull market. If that had happened during a bear market we would have been 'DESTROYED'. The bull is here.

That being said I don't even want my anchor money back. I'm investing in the hull of this ship. Skies are clear and the water isn't that choppy. This is one reason why I like farming the Koin pool, because half of those assets are Ethereum and Koin has a stable baseline value from mining overhead.

Conclusion

Ethereum consistently outperforms Bitcoin during the bull market and underperforms during the bear. AKA it's simply more volatile. This makes sense, it's a newer project and it has worse decentralization in many ways. However, in other ways it is unarguably much more decentralized than Bitcoin because it's connecting to everything and everything is connecting to it.

A large flood of liquidity from Q4 retail is about to enter every market. Bitcoin had its inflation cut in half and Corps are putting it on their reserve balance sheets during the calm before the storm. Come December, they'll be holding while retail is buying, making the storm even more violent. Simple equation for moon, and it will likely continue for an entire year, with volatile swings occurring during the retail cycles just like always.

The tides are rising.

Get ready for chop.

Posted Using LeoFinance Beta

Return from All Roads Lead To Ethereum to edicted's Web3 Blog