Whelp... $$$

Bitcoin is still at $55k but Ethereum is murdering it. Continuing to push all time highs.

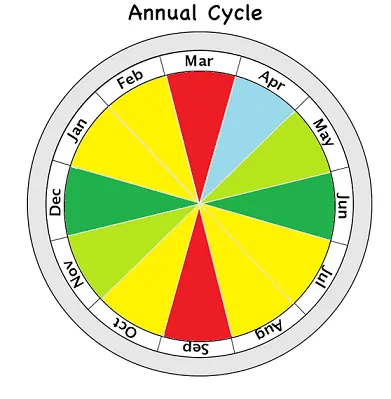

Again, if patterns from 2017 somehow repeat this time around ETH should flip BTC at the end of the year, signaling a full on bear-market meltdown and the peak of this mega-bubble run.

Another Flippening I'm looking out for is XRP.

Again, if XRP hits the #2 rank (maybe even #3 at this point) this could also signal the beginning of the end.

Even BNB could flip ETH at this point. There are no rules. However, ETH has a huge advantage over BNB in that it has been 100% officially deemed "not a security" by the SEC and already has institutional adoption trickling in.

The chance that BNB gets that kind of green light is extremely low. I think it's pretty obvious that BNB is more of a Stock 2.0 than an actual decentralized crypto, and that's fine. CZ knows what he's doing and BNB is one of (if not the best) consistently performing asset out there with actual fundamental development.

Great time to buy BTC

Even though alts are outperforming and BTC is losing dominance, it's still the smartest and safest thing to buy on multiple levels. No network has higher security or decentralization. The naysayers can grasp at straws all they want:

BTC is becoming more centralized: corporations own it all.

That's a laughable statement. First of all the centralized custodians of Bitcoin don't actually own the Bitcoin. They are just holding it for their clients. They are bound by the laws of the legacy economy. "Not your keys not your crypto," only applies to Bitcoin governance. According to the legacy economy ownership works much differently. Ignoring that fact would be a huge blindspot.

Secondly it is extremely ignorant to make the claim that BTC is becoming more centralized when new players are entering the space and buying a ton from whales. The whales are selling a tiny bit of their stacks into corporate sharks. That's literally the definition of decentralization. Bigger stack flowing into smaller stacks: duh.

Out of gas?

Within four hours, @deathwing was able to create a Hive >> BSC bridge for those who've run out of gas. There is currently no frontend for this service, so if you need gas on BSC all you have to do is send at least 20 Hive to @bscbridge with your MetaMask (or whatever) public-key as the memo.

This comes with a 2.5% fee (pretty steep on a relative scale) but it avoids the need to circumvent the IP block imposed by Binance against Americans and other countries, and you can do it directly from your Hive account.

This bridge isn't good for larger amounts, as the bot has significantly less than 1 BNB on it at the moment. If you send too much money or there are any errors it will simply send your Hive back to you.

CUB developments have been delayed and delayed again. ERC20 >> BEP20 Bridge coming sooner™. Kingdoms should also come around but the recent upgrade to pancake swap adds an extra complication.

On the frontend, many people use an interface called React in combination with JavaScript. I've been thinking about doing some React tutorials so I can create better frontends for my own projects. Maybe one of these days I'll take a job from Khal.

April is coming to a close, and it can't get here soon enough. I'm ready to say "I told you so" when May comes around and everything is once again breaching all time highs. Hopefully Litecoin gets there as well as I have many friends who are all in on it from back in the day (DCA down to $60 a coin).

There are so many developments going on it's impossible to keep up.

Hive Hard Fork 25

So I found out recently that RC pool technology will be coming out shortly (weeks) after HF25. Apparently this technology does not require a hardfork (softfork) and can be added retroactively after HF25 goes into effect.

This kinda blew my mind for two reasons. The first is that RC pools are a more important upgrade than any of the consensus rules are are changing in HF25, and all of the consensus rules that we are changing in HF25 are huge upgrades. RC pools will allow us to scale and fix the exploitation that occurs with account onboarding and delegations (especially during mega-bubble spikes). No one will be able to Sybil attack the network by farming accounts for 10HP delegations like they did in 2017. Huge huge upgrade: it increases scalability and onboarding exponentially.

The second reason why I'm baffled by this development is that I don't understand how implementing RC pools is a soft fork. I just assumed that organizing our resources like this would conflict with the previous system, but I guess not. Perhaps @blocktrades could jump in and explain it because I think that's pretty interesting. Ah well any Hive dev will do there are a lot of competent people around here.

HF25 Recap:

- HIVE >> HBD conversions (5% tax)

- Increasing HBD yield farming and limiting to savings accounts.

- Removing the convergent curve (x2 rewards for comments).

- Modifying competitive curation to flat-rate kickback.

- RC pools.

The list just keeps getting better.

RC pools will come weeks after the actual hardfork but we can still include it for all intents and purposes. In fact it's better that it will be added after the fact to reduce complications of HF25. We are changing quite a bit.

When it really comes down to it on paper this appears to be our best hardfork of all time by a huge margin. Definitely looking forward to it. RC pools are a huge deal and most people have no idea why.

Hive DEFI

By fully separating our bandwidth resource from our monetary resource, we fix a lot of problems. On top of that, we also create another way to yield farm on Hive. Everyone with a lot of HP will theoretically be able to sell their RCs to anyone that needs them, or simply donate them to a project they want to support. It's a "free" replenishing resource that has a lot of value. The more valuable RCs become, the higher Hive tokens will spike in price. People love DEFI farming and passive income.

This probably sounds stupid at the moment, but it will make way more sense when bandwidth on this network is actually a scarce resource. Our current max blocksize is 65KB, meaning we have a maximum bandwidth of 22KB/sec.

We run this entire network on 56k modem speeds and we make bold claims about how scalable we are. Pretty funny honestly. One popular dapp later the entire blockchain will be full and running a node will start getting expensive. Good thing our devs seem to be really good at optimizing costs.

It's easy for witnesses to just "raise the blocksize" but doing so makes nodes much more expensive to maintain. The higher our blocksize, the more nodes will drop out due to prohibitive overhead costs and the more centralized we become. We have to walk this tightrope very carefully or risk pushing devs out that would have otherwise brought a lot of value to the network.

Conclusion

This mega-bull run is far from over, no matter what the newbies who've never experienced a standard 30% retracement say. Developments are rolling in from every angle, and sooner or later price is going to reflect that. In fact, prices are going to get so high you had all better DCA the top so you can defend the bottom when it hits. It's our job to stabilize the network, not buy lambos. You aint rich till the bear market is over, and the bull market has only just begun.

Posted Using LeoFinance Beta

Return from Alt Market Strong; Maximalism WRong to edicted's Web3 Blog