Looks like I'm a bit late to the party on this one but whatever, it's time to milk another shitpost just like all the other shitposts. My shitpost will not be denied.

So far the pool looks good.

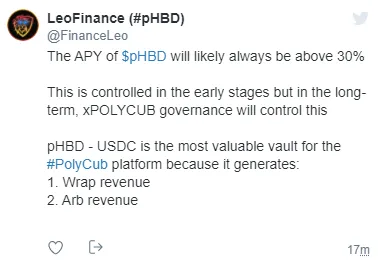

58% is very very high but it also just launched so it's bound to go down a bit. The LEOfinance team assures us it will never go below 30%.

Again, I'm not really convinced that this math will actually work out, but it also doesn't really matter as I have already described several reasons why users would want to farm this pool even if it was lower than 20%. A 'Guarantee' of 30% is pretty good in this context.

We see there is currently a seed of $232k total liquidity in this pool with a yield of 58%. 10% of that yield is from the HBD being locked in the savings account on Hive used to as a subsidy and peg to pHBD. Currently the pool has an x1 multiplier, which is very generous considering that's just as much yield as the LEO bridge pLEO/MATIC.

We also need to see where we are at when the end of the month comes and we get another halving event. That even alone could easily lower the yield from 58% to around 35%, and that assumes no one else is going to enter the pool in that time, which seems highly unlikely as it's a good deal and we want more liquidity to enter.

How much HBD can we buy out of this pool?

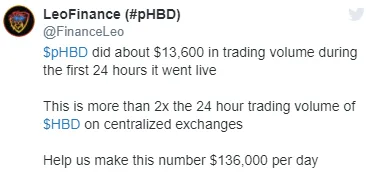

Seems like a good sign...

Won't know for sure until the yields stabilize, and we are only 5% of the way to our goal of $5M in the pool. Even then at this low levels the pool is very useful.

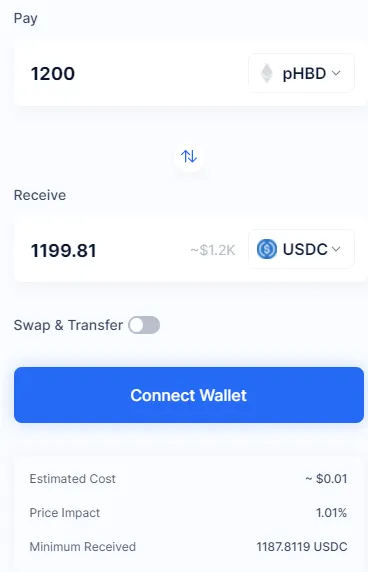

We can see that HBD is already slightly overvalued due to the demand to buy them and stake them at this high yield. Clearly more people are going to start buying it off the other markets and wrapping it here to get more to supply that demand. We see that we can dump 1200 HBD right now and get 1200 USDC in return even with a 1% slip. This is a pretty good sign that all liquidity and volume numbers will start increasing across the board. I expect to see a positive feedback loop cycle soon.

0.25% fee

The wrap/unwrapping fee is a quarter of a percent, which isn't great but also isn't terrible. This will be more than worth it to pay in many circumstances, especially considering this pool is about to become exponentially larger than every other HBD liquidity pool in the world. Also the fee will be used for the greater good of the network and synergistically be used to benefit everyone on the platform so it's hard to complain.

Also it's important to note that this fee never has to be paid when HBD breaks to the upside and we dump it for USDC. In that case the USDC could be dumped for whatever else or even be used to buy HBD on centralized exchanges or the internal market on Hive.

At some point we are going to see demand for HBD skyrocket again just like we did before and price will be pushed to $1.05, sparking conversions and pushing the price of Hive up as the demand to hold our debt increases.

Again, so many things are happening for Hive and the price just keeps puttering around sideways around 80 cents. Eventually we are going to get another FOMO cycle up. Soon tm.

Conclusion

Things are grinding along nicely. Bonding will be rolled out soon, and then after that loans from the vault will go active. Stop asking wen, the answer is always soon.

Posted Using LeoFinance Beta

Return from Another pHBD Post to edicted's Web3 Blog