So we've all heard of APR...

But what about APY?

What is that?

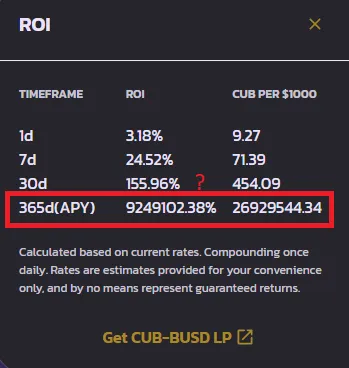

Nine million percent gains in a year?

That can't be right.

Must be some kind of bug, yeah?

Actually... not.

APY is short for Annual Percentage Yield.

How is that different than APR?

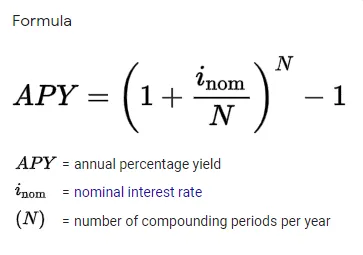

Yield is what you get when you compound your gains. The interest you earn is rolled into the collateral. In essence APY calculates how much one earns on the principal, the interest on the principal, the interest on the interest, and so on. It all gets compounded into a single money "farm".

It can't be that high...

Can it not? If we earn 3% APR a day, that's 1095% APR per year. However, if you compound the farm you take 1.03^365 power and end up with x48,482. After removing the initial principal, we're left with x48,481. Converted to a percentage would be a 4,848,272% gain. Many would call this a pretty decent return.

Unsustainable

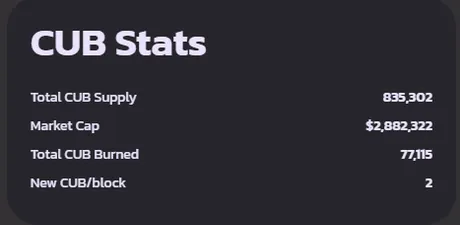

APY assumes interest creates interest, but we know that interest does not create interest on the CUB network. A flat rate of CUB (1 per block) will be created on a linear scale after Monday's yield reduction.

The reason why these APY numbers are so obscene is that they assume a constant interest rate, and this interest rate is anything but constant on CUB Finance. Every coin that gets minted is essentially thrown back into the pools and increases competition on the farm: thus reducing the APR/APY over time.

Because APR is fixed rate but APY is an exponential function, the difference between the two becomes massive on high yield assets. We can see the example I did was 3% interest per day, but the interest per day on the screenshot I took at the top of this post was 3.18%. No biggy right?

Well if we take a look even a small difference like 3% vs 3.18% is huge when calculating APY. In my example we got a 4,848,272% return while an APR of just 0.18% more turned out to be 9,249,102%. A 6% difference in APR created a 52% difference in APY due to the exponential nature of compounding interest.

What about 1% APR per day?

Competition in these pools will continue on as all the CUB gets rolled back into the farms, further reducing the APR/APY. 1% APR a day (365% per year) yields an APY of 1.01^365 - 1 = x36.8 gains. Still an unbelievable return (literally), but as we can see exponentially less than x48,481.

Wen Equalibrium?

When will the APR reach equilibrium in these pools? Under the current system: never. Every time CUB is minted there is literally nothing to do with it other than pump it back into one of the LP pools or the CUB den. Doesn't matter if you dump the CUB either, it will just be purchased by someone else and rolled into a farm no matter what. APR would continue to drop indefinitely if nothing further was built on the platform.

Although there is this.

We are burning the deposits from 19 farms to destroy some of these Cubbies. However, this assumes that users will continue to make these deposits, which they obviously wouldn't if the yields were too low to justify the investment.

Regardless of all that, I find it quite impressive that even with just 4% deposit fees that we've somehow burned almost 10% of the circulating supply. Good job, CUB fam! Considering 20% of those funds don't even burn CUB (LEO rather) that's quite the achievement. Let the snowball roll.

If we stop building on CUB it will devolve into a Ponzi scheme. Who is the value being extracted from? Anyone who holds CUB. An investment in CUB is an investment in speculation: we're either speculating that more legitimate value will be built or that enough users will enter the party late and hold our bags while we dump on them.

Anyone remember Drugwars?

I made some good money on that lovely Ponzi.

But I mean we're all here because obviously CUB is not a Ponzi. CUB gonna kick some ass and take names. I'm really not seeing any sort of competition on any level whatsoever. Truly.

Exchange Listings

There are a few people out there who see CUB as nothing but a greedy cash-grab. Why not just focus on the LEO token? Of course that would be completely ignoring the 40% price increase that we saw when CUB was launched. All of these systems synergize together to create more value.

An obvious way to get stake out of the farming contracts to increase price and reduce farming competition is to get an exchange listing. Perhaps if we are rocking it on BSC a Binance listing will be easy.

Other ways to add utility:

- Layered farming

- Lending dapp

- Stable-coin minting

We also have to assume that there are a bunch of DeFi applications that haven't even been invented yet. Once they are, we can port them to CUB and add even more functionality.

Weren't we talking about APY?

Yep, and the way to increase APY and make it so CUB can employ compounded gains is to increase the number of coins we burn and have more options for where the money can go (contracts, exchanges, and the like).

It should be obvious that if we burn as many coins as we are minting, that's an effective inflation of 0%, but the farms will still be generating massive value. Something to think about.

Even more mind-blowing, APY doesn't take into account that CUB is not a stable asset. APY is only showing us how much more CUB we'll have in a year, not how much more value we have in a year. If the value of CUB increases in a year, we'd have even more gainz.

Conclusion

Albert Einstein reportedly said it. “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it.”

I remember in grade-school we were taught about compound interest and how crazy the exponential numbers get. You know what they didn't teach us? That all that money and value was going siphoned to the central banks via infinite money printing. Fun stuff.

With crypto, we can actually start capturing the yields that the central banks have been hiding from us for hundreds of years. Disruption is coming to a financial system near you. Are you ready for it?

Posted Using LeoFinance Beta

Return from APY? to edicted's Web3 Blog