Every once and a while I think back to this short speculation video I saw by @louisthomas back in November 2020. For frame of reference Bitcoin was trading at $14k at that time. Yep, those were the days where stacking was as easy as breathing.

In any case, there is a macro pattern in the market that might indicate the next mega-bull run peak might hit somewhere around October 4th. Considering how well the market looks right now this is something we need to look at, as most gains in this volatile market are made in a grand finale right in the final weeks of peak FOMO. This is a serious matter because we've confirmed a supply shock in Bitcoin twice now at both $29k and $40k during extremely low volume that normally would have warranted a crash. We may be much closer to a massive peak than most realize. The winds change quickly in crypto. Dog years have nothing on us.

My cycle chart hasn't been doing me any favors lately. I told everyone April was the safest month to buy, and it clearly was not. Now I'm saying the same about September. What if September ends up being a really bullish month for Bitcoin?

In that case October really could be the peak of this next mega-bubble, which would catch a ton of people off guard, as the market often does. Luckily my trusty doubling curve has far greater accuracy than the tertiary cyclical chart.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

The doubling curve sits at around $23k in October. Bitcoin has to hit at least $150k before I'm worried about peaking, and $200k+ brings us into the extreme danger zone.

Granted, I can't really imagine any of this happening, but denying the possibility entirely is incorrect, as that would put us in denial if it does actually happen, paralyzing our ability to act accordingly.

News Flashes

Binance CEO CZ playing 4-D Chess.

Immediately after announcing that Binance would lower cashouts from 2 BTC a day to 0.06, a new exchange called Mandala has been revealed connected to Binance that still has the 2 BTC rate. These exchanges share liquidity and security, so once again CZ seems to be flipping the bird to the regulators and dodging their clumsy ban hammer wielded by the ogre that is the legacy economy.

RUNE! THORchain!

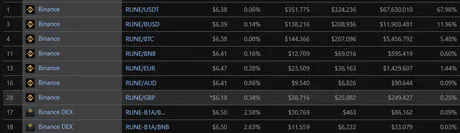

Binance Expects Mass Thorchain volume.

https://www.coingecko.com/en/coins/thorchain#markets

7 pairings to Rune

RUNE has very few exchange listings, but Binance has listed it SEVEN TIMES. This is insane compared to how few exchanges have actually listed it thus far.

Seven listings and the main exchange, and two on their DEX. It's blatantly obvious that Binance is expecting massive volume to travel to and from THORchain and associated Rune token. Seriously though... seven pairs.

On that note I'm a bit annoyed that I still haven't bought any even though I've been told quite a few times to do so. I was so close to pulling the trigger at $3.34, and now weeks later we are already double that. However, considering the state of Rune and the number of recent hacks, it's still not too late to get in.

Even @khaleelkazi is trying to acquire 600k RUNE (600k!) in order to launch a node and bridge the Thorchain ecosystem to the LEO/CUB ecosystem.

As a reminder, every token on Thorchain is paired to Rune. Every pair is half Rune, meaning that if they get the kind of volume that Binance is expecting the token price will go at least x100 out of pure necessity.

And it really does make sense that Rune would get this much volume, because the entire point of Rune is to eliminate the need for pegged tokens and allow the security of these associated chains to stay intact without going through a centralized agent to maintain token pegging. Once they work out the bugs it seems to be all but guaranteed to take off in a big way.

Conclusion

It's a bit of a shock how fast we find ourselves in such bullish territory, but here we are. I would have been scoffed at for making such a claim two weeks ago. Now it's quite clear that a mega-bubble peak on October 4th is actually possible (however improbable).

Regulators are freaking out but crypto keeps dancing around them as expected. They really want to put a lid on this thing, but what they don't realize is that when a pot is boiling this hard it can't be capped by such a failed system using laws that are completely out of touch with reality and only benefit the elite.

Expect the regulators to continue their escalation. There's really no other way around it. The bigger crypto gets, the harder they will push to kill momentum. Be ready at peak FOMO to take some gains and bet against the market, or be prepared to get blindsided with everyone else.

Posted Using LeoFinance Beta

Return from Are you mentally prepared for an early run up? to edicted's Web3 Blog