I Just sold my 140 HBD.

I sold at 0.27 and got 519 Hive. 140 HBD for $223, not too shabby.

If I'm reading this correctly, this is a classic head and shoulders pattern. You really can't get much more head and shoulders than this. We should stabilize at this level for a little while and then inevitably crash later if the pattern is to complete.

I'm targeting a level of 2400 sats. This is where I sold my 10k Hive like a dumb dumb. I have a very good knack for pulling the trigger too early and selling right where the spike is going to dump to. If Bitcoin stays where it's at this would put us around the 17 cent level.

This is my new buying range (17-24 cents).

I don't think we can crash back to 10 cents probably ever again. Now that we've shown we can 10x while the rest of the market doesn't do a damn thing, no one's going to sell down to that level. I'm looking to regain my Orca status and keep it, permanently.

Set stop-loss to stun, commander!

I've set up stop-loss buy orders to purchase Bitcoin should the price increase to $8050. If Bitcoin reaches this level, I'm going all in. Everyone thinks we're going to see a return to 5k. We so aren't.

The market is extremely oversold and the halving is right around the corner. There are billions on dollars on the sidelines waiting for some good news about the COVID lockdown before they choose to enter. It's not a matter if this money will enter Bitcoin, simply a matter of when. Like so many others, many are hoping they can enter at the 5k level. It's just not going to happen™.

The next Bitcoin bull run will possibly send it from 2.5x to 3x above the doubling curve.

2020 Bitcoin doubling curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

We're already at $8500. Assuming a run up in May after the halving and the economy opens at the end of the month, we'd be at $9000. This would put a peak on Bitcoin at the $22,500 to $27000 level, with a crash back down to $10k-$12k in the months following.

I will personally start cost-average selling at the $19k level.

Wasn't this post supposed to be about Arbitrage?

Yes... indeed. Sidetracked.

Just look at that liquidity gap!

Jesus, I bought Hive at 0.27 and it's already up to 0.35. It's easy to see how if you buy/sell at the same time that's just free money in your pocket (assuming volatility doesn't get you).

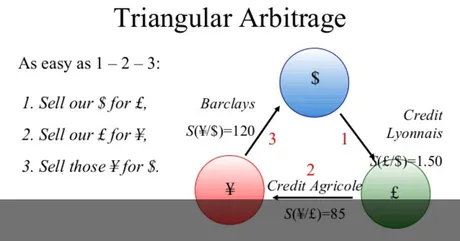

Another thing to look at is the ability to buy HBD on Bittrex with Bitcoin. Right now you can buy it at 13k sats ($1). What happens when you sell that HBD on the internal market for 0.35? You get 2.85 Hive... which is worth $1.27. Boom. Free profits if you move fast and avoid volatility. That's the trick isn't it.

Also the trick is having a bot that will do all the math for you and get everything done as fast as possible to avoid that dreaded volatility. However, the speed of the Hive blockchain works in our favor here. Not only can we move things for free in 3 seconds, this allows exchanges to transfer funds on your behalf much faster as well; not nearly as fast as 3 seconds but much faster than other coins comparatively.

Conclusion

Providing liquidity to markets is a paying job.

Where demand meets supply: markets are made.

I think I'm gonna stop talking and start making that money now.

Return from Bad Liquidity on Hive is Creating Big Arbitrage Opportunities. to edicted's Web3 Blog