Sleep pattern

Today was the first day I've gotten any real sleep for ever a week. This cold has been so bad I have to wake up in the middle of the night multiple times to clear out my lungs before trying again. Not the most ideal recovery process.

Humans Used to Sleep in Two Shifts, And Maybe We Should Do It Again

Anthropologists have found evidence that during preindustrial Europe, bi-modal sleeping was considered the norm. Sleep onset was determined not by a set bedtime, but by whether there were things to do.

I've actually just been doing this naturally because of this cold. It's really the only option. Get 2-4 hours sleep and then wake up. I was trying to just sleep through the night in the beginning but that would just leave me awake the entire time.

So what am I doing at 4 in the morning while a hack up a lung? Dicking around on Twitter of course, which is readily apparent from my recent posts. To be fair this FTX drama is just too insane to ignore. Crypto Twitter is legit the only place it can be found.

crypto.com holds 20% Shib

People still talking about this like it means something. People are running around claiming crypto.com is insolvent because they own too much shit. Their users own too much Shib. That's why they have Shib. Such ridiculous logic employed during this time.

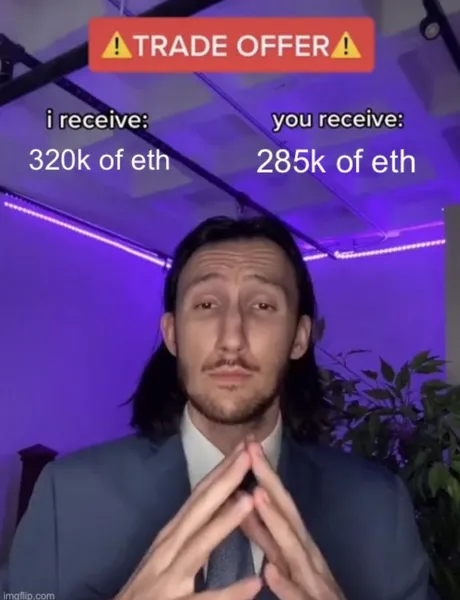

crypto.com sends $400M in ETH to Gate.io

Alright so crypto.com sends like their entire stack of Ethereum to Gate.io during this whole process of exchanges proving they own assets. Then crypto.com comes forward and says the transfer was an accident. So now they look completely incompetent. Then on top of that they leave 35k ETH on Gate.io only getting 285k back.

SAFU

Binance halts FTT deposits

Looks like he deleted the Tweet, but several exchanges are freezing FTT deposits all together. FTX is fully compromised. I love how exchanges say they are freezing funds to protect customers when they are really just protecting themselves. Classic narrative framing.

Huobi does the same shit?

FTX "hacker" sends money to Binance and Vitalik?

lol why Vitalik though? Sounds like BS but... I'll remember for later.

Blockfi was forced to play the shell game.

So they didn't deposit funds on FTX on purpose, they were forced to when bought out by FTX. Wow.

Are exchanges passing around ETH loans to pass audits?!

Seems like, eh?

These exchanges are saying they have all these funds and then immediately moving the funds to other exchanges. Gate.io has already been caught claiming the ETH from crypto.com was theirs. So either these exchanges are signaling to us that they are actually insolvent, or they just want to make the asset number look as big as possible because it's a bit of a competition. We have to lean toward the insolvency side. Exchange tokens across the board are getting hit hard and a crypto.com backrun is underway. We'll see if they can handle the heat or if they burn to dust.

SBF plays 4 hours of league.

Good on you, guy.

I'd do the same.

FTX had ZERO Bitcoin assets and $1.4B liability.

It's come to everyone's attention that FTX didn't have any Bitcoin even though they owed back $1.4B BTC to users. Wow, that's so fucked up. They sold every single Bitcoin that was sent to them and flushed it down the Ponzi scheme. So lame.

Twitter high yield money market account.

Hm yeah I'll believe it when I see it. Musk has proven he's not only incompetent with this whole Twitter situation... he's also oozing with hubris, insecurity, self-importance, and completely addicted to this social media in a toxic way. Musk is a bit of a workaholic, so it's very obvious that he spends pretty much 100% of his free time dicking around on Twitter trolling people and fishing for likes. So weird.

And let's be honest. Simply buying Bitcoin is going to be better than anything Musk could possibly come up with. Bitcoin has higher yield than any legacy asset. Considering the current price we aren't that far away from an only-up bull run. Quite possibly the worst time to be attempting WEB2 banking.

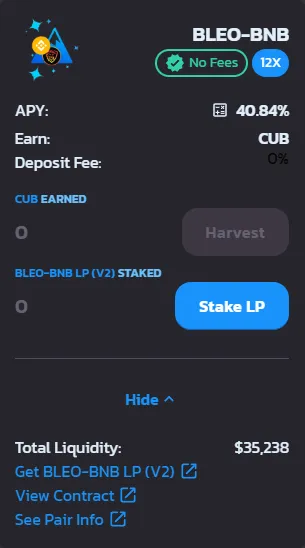

CUB yield on the LEO farm is super high. LEO liquidity is dwindling, and we can probably guess why. Big players (like yours truly) can see that a consolidation is approaching. I'm tempted to farm that yield until I realize that I don't want my tokens for sale. Expecting some big upgrades in the coming months.

Conclusion

It looks like there's a very high chance that the fallout from FTX is far from over. Let the bank runs commence. Any bank that can't deliver what they promised is insolvent and will inevitably loose all trust. Huobi and crypto.com and gate.io are all dicking around. Hard to believe crypto.com would say it was an "accident" when that makes them look like idiots and the evidence suggests it was clearly not an accident. Just wow.

Posted Using LeoFinance Beta

Return from Bad Omens to edicted's Web3 Blog