As "luck" would have it...

The first bank closure of 2024 happens to be located in my state of Pennsylvania. As is the standard with these types of foreclosures the feds have moved in to capture the bank and bail it out with FDIC insurance. Republic First Bank was a relatively small bank so this should not be that big of a deal, but it definitely could point to foreshadowing of even bigger bank failures later this year.

If we recall last time this was all going down in 2023 these bank failures seemed to be good for Bitcoin... even though many conspiracy theorists were claiming that Bitcoin and crypto at large were the targets (as the biggest three were all banks that handled crypto operations and the bleeding was backstopped right after they seemingly allowed at least one to fail on purpose). This was called "Operation Choke Point 2.0" in reference to another time they illegally targeted a particular type of bank user (sex work). Will crypto continue to be a target? The current events all shout a resounding 'yes'.

Of course the reason why banks are so screwed is because the FED hiked rates so hard and fast and that didn't give a lot of time for everyone else to rebalance their positions accordingly. The liquidity issues within the economy still exists as the battle with "inflation" continues. We crypto degenerates seem to want rates to come back down to create a climate of easy money and number go up antics. Perhaps this is a sign that the FED will be forced to lower rates soon™.

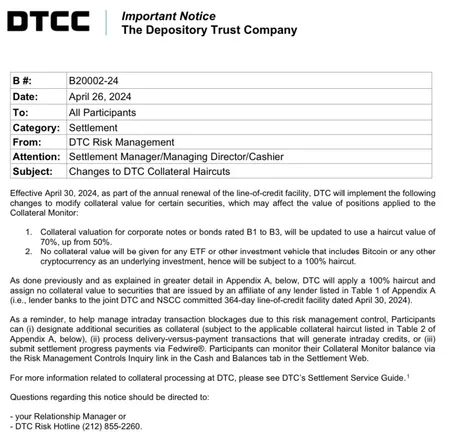

Yesterday there was some very sharp dumping in the market so I immediately checked Twitter to see if anything crazy had just happened. It just so happened that a very big thing did happen. The Depository Trust & Clearing Corporation (whatever that is!) declared that Bitcoin has no collateral value and jacked up the haircut to 100%, giving Bitcoin derivatives a $0 value starting April 30th... which just so happens to be the same day that the Hong Kong in-kind spot BTC ETF launches.

Secondly, any ETF or other investment tool that includes Bitcoin or any other cryptocurrency as an underlying investment will not be given a collateral value and will therefore be subject to a 100% deduction.

This likely throws a wrench in the plans of agencies like Blackrock in terms of being able to collateralize the ETF shares to play games like create a futures market and allow users to draw loans from their position. Can't draw a loan from a position worth $0. I have no idea how much power the DTCC has... maybe they don't have authority over Blackrock and this is just a bank thing... so banks that hold BTC derivatives have a higher chance of going under? Unclear. I'm sure we'll find out more about this later. Maybe @taskmaster4450 can provide some insight.

No matter what the situation is it's clear that the banks are in trouble and the ones that deal in Bitcoin are not going to have a fun time going forward.

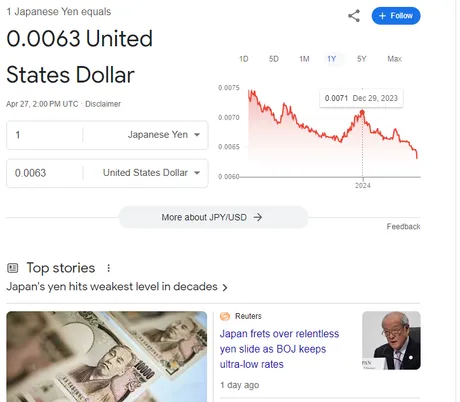

So Japan is screwed...

This is nothing new as Japan has been screwed for a long time. The Ponzinomics of fiat is rearing its ugly head. Fiat and debt-based economies only work given a state of cancerous growth with a new sucker being born every minute. Japan was one of the first countries to experience an inverted curve in their demographics with less and less debt-slaves being born to propagate the scam.

So what will Japan do? Who knows. People are saying they need to dump treasuries. Sounds like a bandaid solution to me. It's a shame none of these failing entities seem to want to embrace crypto because I don't see any other way out except to slowly abandon the debt-based ponzi.

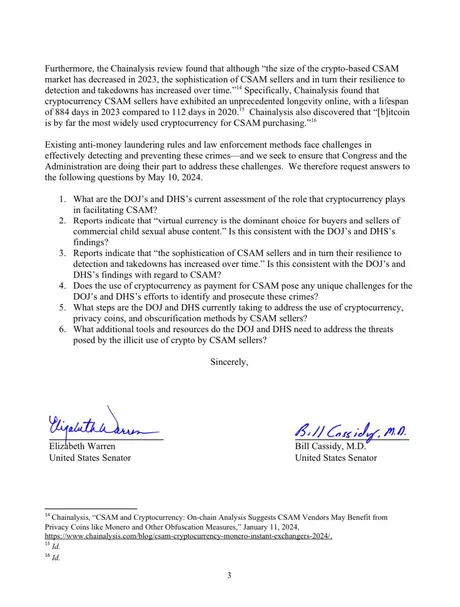

child sexual abuse material (CSAM)

Elizabeth Warren coming in hot with claims that crypto funds pedophilia in a letter to the Department of "Justice". Is anyone gonna tell this bitch she's like 10 years too late for that? That was the narrative being peddled long before 2017 when crypto was nothing but a fringe whisper in the background.

The central banking playbook has always been DRUG DEALERS TERRORISTS CHILD MOLESTERS when they can get away with that hogwash. For some reason they think this narrative is going to stick after all this time. It won't. They need to go back to "Bitcoin wastes energy" except that can't because Blackrock has already slapped that one down now that they're in the game. So now they try to go retro. Hm! Good luck with that.

Conclusion

This is the THIRD DAY IN A ROW where I was able to just spew highly relevant crypto related news. It's got to be some kind of record I don't remember if there's ever been this many current events to cover in rapid succession like this. And what has Bitcoin done in the face of this rampant stream of FUD? Absolutely nothing. Still trading in a tight wedge near all time highs. We are still in the, "Bad news has zero affect on the market," phase. Bull market vibes for sure, even if we have to wait till the end of the year to see some real fireworks. Hunker down and weather the storm.

Return from Bank Failures, Currency Collapses, and Pedophiles, Oh My! to edicted's Web3 Blog