The corporate takeover attempt of BTC continues.

Michael Saylor continues to lose favor with the zealots. I was reminded of this again today with a Tweet and podcast snippet.

To be fair Peter McCormack is also a face in the Bitcoin world that is despised by many. I don't know much about the guy but his liberal politics and realistic takes seem to not mesh well with the core group of zealots, unsurprisingly. The context of this particular discussion is that Bitcoin has to choose between "sound money" and "individual sovereignty" (aka the ability to actually use the base-layer and be-your-own-bank). Of course the underlying subtext of all of this boils down to one thing: fees.

FEES!

There are so many assumptions made during such a brief conversation that I don't even know where to begin. Firstly, the assumption is that fees are going up, which they aren't and I explained pretty recently why that's the case. Even if that theory was wrong the chart doesn't lie. Fees aren't going up because fees are measured in USD and not BTC. The data is right there for anyone to check.

The compliment to this assumption is that Bitcoin will never increase its blocksize, which is also patently absurd. The past is no indication of the future. Bitcoin will increase its blocksize when it needs to increase the blocksize, which in turn allows more users to utilize the base-layer. The only thing stopping the blocksize from going up is the cost to run infrastructure. The idea here being that bigger blocks create a situation where less nodes will exist because the cost to run one goes up.

This again, is completely ridiculous. The cost to operate Bitcoin is not going up, and even if it was the idea that Bitcoin NEEDS AS MANY NODES AS POSSIBLE is a complete farce. Bitcoin already has tens of thousands of nodes. That number could get cut in half and then in half again and everything would be fine.

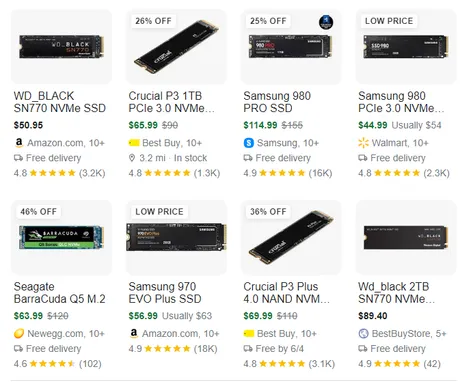

I bought the computer I'm writing this post on in 2016. Back then my solid state drive (SSD) cost $200 with 500GB of storage and that was a pretty good deal at the time. Today I can buy an NVMe upgrade which is double the storage, triple the speed, and half the price. The cost of tech only goes down over time. It's exponentially deflationary; just ask Taskmaster.

There's also an assumption being made here that people actually want to take responsibility and be their own bank. Most people... don't. It's not even an argument or topic of debate. People are much more comfortable leaving the technical details to the "experts". We do not build our own car, phone, or house. We trade our services in exchange for the services of others. It's the foundation of the entire economic model of humanity, and that's not going to change because we made some improvements to the monetary system.

The entire economy is based on trust; integrating a trustless base-layer like Bitcoin into the mix doesn't change that, but rather gives everyone the permissionless option to make that decision on their own without being forced into it by the gatekeepers.

The assumption that people are just going to magically stop trusting institutions en masse just because there's an option to do so is a completely absurd expectation. This actually is something that Saylor alludes to in the snippet so he gets one point in his favor on that comment. Corporations aren't suddenly going to cease to exist; there's just a new field to play the game on that doesn't discriminate or exclude. This is definitely a novel and new approach, but it won't nuke everything we've built and replace it instantly with some magic new thing. These transitions take decades.

Finally, the entire conversation revolves around the most critical assumption that Bitcoin is and will be the only option anyone ever has. Again we all know this not to be true, but even if it was accurate and there were zero other viable long-term options today... to assume that nobody is EVER going to come up with another solution and everyone is just going to be locked into BTC is just full-on maximalist delusion. Might as well bring back the Gamestop meme-stonk crew who seemed to think the exact same nonsense: that the entire world would be ruled by a single asset. This is who we're trading against, boys and girls.

Conclusion

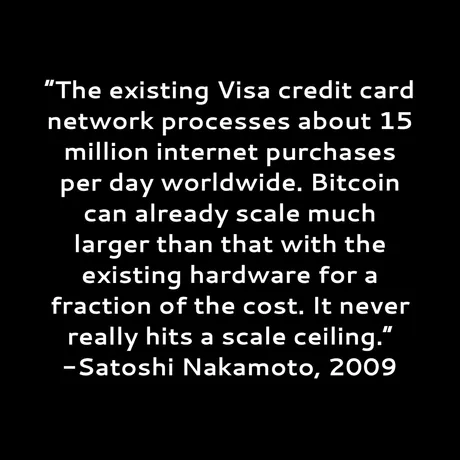

This silly little idea that we need to choose between sound money and sovereignty goes against basic logic and directly contradicts statements made by the creator himself. None of it is based in any reality other than the powers that be trying to wrangle control for themselves.

It's always a good reminder that people at the top are constantly thinking like this and getting it wrong. No one can predict the future, not even these billionaires at the top. Chaos theory always wins in the end and we just have to wait and see what happens before the path becomes a bit more clear. This scheming can only go on for so long before being completely disproven by the free market.

Return from Big Dog Bitcoiners & Their Word Salads to edicted's Web3 Blog