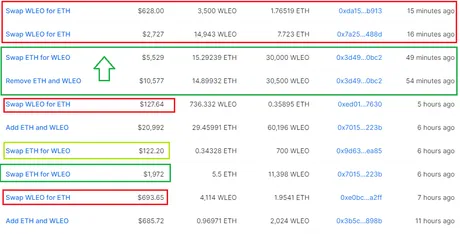

So this guy removed $10,577 liquidity from the pool... which is bad, but then he cashes the entire ETH side back into wLEO... wow. Bullish much?

This guy: 0x3d49a0f8B78d474d609Ae3c8D6CA9C641b710Bc2

I wonder if that was a power-up moment... the real yield farming on LEO.

I should probably have a bot to link people's ETH/Hive accounts.

Busy with other work at the moment though.

In any case...

wLEO/ETH is still trading at all-time highs despite two people dumping a total of 18,443 coins ($3355) on the market as the most 2nd recent transactions... still at 0.0005 ratio... 2000:1 wLEO/ETH. Pretty amazing considering where the network was just weeks ago. Anyone can move in or out of this market at will. Liquidity is still drying up in the face of huge selloffs... pretty good sign of things to come over the next few months.

Conclusion

- wLEO trades into ETH are frequent but often tiny.

- There are some really massive buys on the ETH side to wLEO.

- The big ETH trades far outweigh the little wLEO swarm.

- Prepare for this situation to escalate in case it does.

More to come...

Return from Big wLEO plays recently. to edicted's Web3 Blog