Today is a dark day!

Binance is reducing their daily withdraw limits from 2 BTC to 0.06 BTC. It was really only a matter of time but this is a huge reduction right before a potential mega-bubble: not great.

To support the ongoing security of all Binance users, new withdrawal limits will be established for those who have completed only Basic Account Verification.

Of course they could have done this without blatantly lying through their teeth and acting like they are doing their customers a favor. This is clearly caving in to regulatory pressure and limiting the ease at which one can shadow-bank and move large quantities on funds around on Binance.

@khaleelkazi so upset he turned on auto-correct.

If I'm being honest this change probably isn't going to affect me much. Sure, there have been times where I've moved significantly more than 0.06 BTC off of Binance. Currently a USD value of around $2300, 0.06 BTC per day is obviously exponentially less than 2 BTC per day.

However, that's still over $2000 a day, which is obviously quite a bit. For most people in the world that's more than an entire month's salary moved in a single day. The funniest part is how they are still measuring this limit in BTC, so when BTC goes x10 it will magically become a $20,000 limit. I wonder when they still stop measuring this limit with such a volatile asset (if ever).

Competition

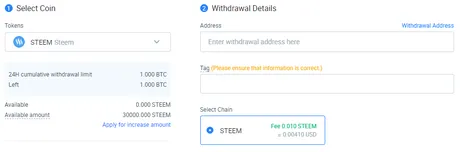

There are still some other very good non-KYC exchanges out there. Best one is Huobi Global in my opinion. I logged into my account for the first time since the hostile takeover, and it appears that they still allow a full 1 BTC to be transferred in a 24 hour period, which again, is obviously a massive amount considering only an email address is required.

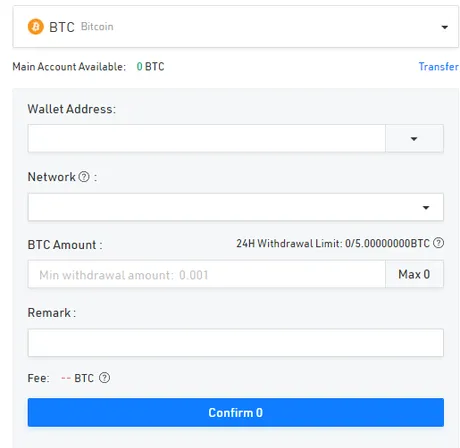

There's also KuCoin, which is a bit behind Binance and Huobi, but still pretty good. Let's log in and find out...

Wow, am I reading that right?

Kucoin allows 5 BTC per day.

Pretty wild.

So there are still plenty of options out there for those looking to move around money without overreaching KYC limits standing in the way. However, this is a perfect example of how the most popular centralized tech solutions will automatically get slapped by the regulators first. Binance is number 1, and this latest crackdown pretty much plays into that.

The interesting thing about regulations is that they can't stop crypto. We cannot be boxed in. We take the paths of least resistance, but when those paths become more resistant we find other paths. These limitations are only little bumps in the road in the long term.

DEX technology will continue to advance at exponential levels. More bridges to fiat will be discovered. Many of them will be peer to peer and impossible to stop. The ability to trade crypto for goods/services will completely undermine regulations altogether. At that point they'll have to regulate the vendors, but as I've said before it will be impossible to regulate the vendors once crypto city states start popping up: flailing around and they declare autonomy at their own peril.

Another ironic thing about pricing the withdrawal limit in BTC is that users won't want to use BTC to withdraw. The withdrawal fee on Binance for BTC is 0.0005 (~$20). Who wants to spend 1% on fees just to move money around. This will make other options like LTC much more attractive, because trading fees are only 0.1% maximum (less if you have BNB), and fees on LTC are x100 times less.

Conclusion

It's not great that CZ is caving to regulators. This is a big hit to Binance Mafia, and I'm sure he's not happy about the decision. I'm sure for them it will be worth it though to get the regulators off their backs.

Expect these crackdowns to continue. The more mainstream crypto gets the more these dinosaurs will demand control of it. However, the lumbering beast of crypto can't be tamed so easily. When one door closes, another opens. It's impossible to corner the market when the market is open source. Crypto finds a way.

Posted Using LeoFinance Beta

Return from Binance Caves in to Regulators to edicted's Web3 Blog