The sky is falling, bros.

Okay I think we all have to admit that Operation Choke Point 2.0 is a real thing now. Simply too much has been stacked up all at the same time. The Shock & Awe strategy against crypto continues, and Bitcoin stands tall at $27k... seemingly completely unshaken.

I'm seeing reports of Coinbase users trying to move money around and it's taking a lot longer than usual. The last time I withdrew crypto funds from Coinbase I got the money in a single business day. Now people are saying it can take upwards of 10. I still haven't tested it yet, but it's a good reminder that we take upgrades for granted when they happen in the background and are then suddenly scooped away. None of this should be a surprise considering the three biggest crypto banks were seemingly targeted for destruction by the Biden administration.

CFTC

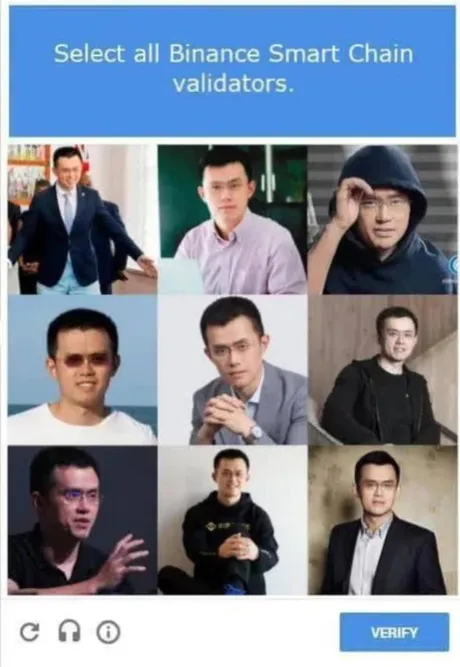

The commodities and futures trading commission are throwing a lot of wild accusations at Binance and CZ. Of course this is all bullshit for a lot of reasons, none of them being if CZ committed these crimes or not. It's bullshit because the Biden Administration has provided zero regulatory clarity for crypto but then insist on carrying on with this crusade of regulation by enforcement.

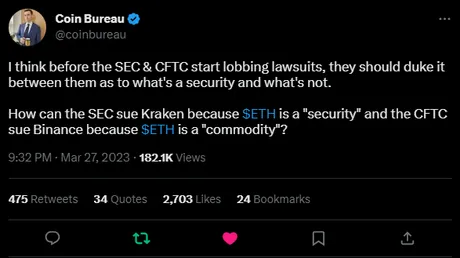

These people can't even agree what is a security and what is a commodity. Kraken gets sued by the SEC because ETH is a security. Binance gets sued by CFTC because ETH is a commodity. Really? REALLY!?! These institutions are a joke.

And it makes perfect sense why it has to be this way.

Again I've explained this before: the government CAN'T provide regulatory clarity. Why? Because they know for a fact if they do crypto devs will code circles around those regulations and become legally entrenched within the system in record time. Then they'll be protected by the laws that regulators created themselves. Can't have that! Better just keep regulating by enforcement! lol it's a pathetic joke and I think we have to assume the overreach will get even worse before it gets better.

Speaking of overreach...

Today is a red trading day and one of the only things that is up in price is Ripple's XRP (50 cents). Pretty hilarious. The XRP Army is nothing but persistent. Some of these whales must be pretty damn confident that the case is coming to a close in favor of Ripple. It actually won't even be that hard for them to get the upper hand. As long as secondary sales are not deemed to be securities fraud everything should be all good.

Ripple can theoretically lose the case on the grounds that the initial sale was a security and that might actually end up being the best outcome for all parties concerned. Imagine what would happen if the premine was burned legally by the government. Hive had to do this manually. Could be a free win for XRP holders.

What is CZ being accused of?

Basically the thing that SBF was doing on FTX: trading against its own clients and headhunting overleveraged positions that are supposed to be privileged information. Of course CZ denies each and every one of these claims.

Binance.com is the first global (non-US) exchange to implement a mandatory KYC program, and remains today to have one of the highest standards in KYC and AML. We block US users by nationality (KYC), IP (including commonly used VPN endpoints outside of the US), mobile carrier, device fingerprints, bank deposit and withdrawals, blockchain deposits and withdrawals, credit card bin numbers, and more.

Of course we know this to be... somewhat bullshit.

This is true about Binance but it is not true about Mandala, which is the backdoor into Binance Cloud that I use all the time. They know I'm using a VPN from the USA and they allow me to use their service anyway. It's quite obvious. Still, even after everything that's happened, I'd still rather Binance won this fight. I think we can assume it would be pretty annoying if Hive lost access to this backdoor, and nobody here has any love for the government. Binance clearly provides more utility than government does at this point. Hands down.

Binance.com does not trade for profit or “manipulate” the market under any circumstances. Binance “trades” in a number of situations. Our revenues are in crypto. We do need to convert them from time-to-time to cover expenses in fiat or other crypto currencies. We have affiliates that provide liquidity for less liquid pairs. These affiliates are monitored specifically not to have large profits.

Personally, I have two accounts at Binance: one for Binance Card, one for my crypto holdings. I eat our own dog food and store my crypto on Binance.com. I also need to convert crypto from time-to-time to pay for my personal expenses or for the Card.

Binance.com has a 90 day no-day-trading rule for employees, meaning you are not allowed to sell a coin within 90 days of your most recent buy, or vice versa. This is to prevent any employees from actively trading. We also prohibit our employees from trading in Futures. Further, we have strict policies for anyone with access to private information, such as details of listings, Launchpad, etc. They are not allowed to buy or sell those coins.

I observe these policies myself strictly. I also never participated in Binance Launchpad, Earn, Margin, or Futures. I know the best use of my time is to build a solid platform that services our users.

It's unclear how much of this is bullshit.

But honestly how is the CFTC going to prove it? I just think it's hilarious that everyone in crypto blindly agrees with the government on this one without any evidence whatsoever. lol? wut? Since when do we trust the government blindly? Because it fits our preconceived notions about the inherent risks of centralized exchanges? I mean sure but... also... #EchoChamber

Crypto users are trying to compare this situation with the downfall of every other exchange. Again, that's bullshit logic. The downfall of every other exchange happened because of their own incompetence. The regulators had absolutely nothing to do with it. Why are so many people assuming that Binance Global is going to shutter their doors when they don't even legally provide service to American users? Don't forget: no one is even talking about Mandala right now. The backdoor isn't even being looked at.

Bitcoin Stronk

The year of the maximalist continues, and Hive is at local lows against the big dawg the likes of which we haven't see since last summer during the heat of the bear market. It's unclear whether this is bearish or bullish, as a strong recovery seems just as likely and a breakdown to new lows against BTC. After all Hive losing access to Binance is a lot worse for Hive than it is for BTC. All I can say is I hope everyone has enough Corn to get through this one. Personally my bags remain comically overfilled with Hive, but that's just how I roll. #nofucksgiven

Conclusion

All is not going to plan for the Biden administration. They've been throwing absolutely everything they have at BTC but BTC just seems to be getting stronger out of spite. This is exactly the kind of environment in which Bitcoin can thrive and alts can and will get tossed around like rag dolls. Just like I predicted years ago: The 2019 vibes are strong.

The USG doesn't care that Binance may or may not have broken the law because breaking the law is bad and they need to "protect investors". The Biden Administration has been anti-crypto from day one and this is a clear and obvious relentless political attack. If we are being honest Bitcoin should be at like $14k right now after everything that's happened over the last few months. It appears as though the market cycle simply does not care what this administration says or does. All we can do is hold our ground and hope we don't get knocked out of the boat by this storm.

May the odds be ever in your favor!

Posted Using LeoFinance Beta

Return from Binance CFTC FUD to edicted's Web3 Blog