I usually have a lot of nice things to say about Binance.

- High liquidity.

- Low Fees.

- High volume.

- Low Risk (comparatively to other exchanges)

- Proven through multiple bear markets they are responsible.

- Decent customer service even though English is not their first language.

All this being said, we all know that CZ basically ran a script that used customer funds to attack the very governance of our network. When we asked for help his reply was, "I don't want to get involved," and then continued to help the attacker (through inaction and giving them first dibs on unlocked funds) rather than prosecute him as the obvious criminal that he is.

But honestly it is hard to fault CZ for such things. Maybe if Steem had been in the top 10 market cap he would have taken the situation more seriously. Instead we were in the top 300 and likely barely a blip on his radar. Such is life.

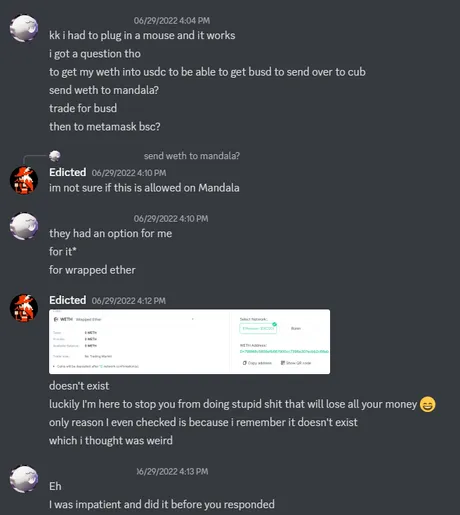

In any case, the story I wanted to tell today was of a friend of mine who sent me a question in Discord:

Hm let's see if I can actually find it in Discord... checking...

Ah there it is...

The day was June 29th. ETH was trading at $1100 (lol lower than today's $1200). Even though it only took me six minutes to respond... It was still too late. He had send wETH from Polygon to Mandala... which is like the one place Binance cloud doesn't accept wETH from. Very sad.

So now my friend still has 2.4 wETH trapped on Binance Cloud. He created a ticket with customer service. They told him to give them 0.001 BTC and they'd look into it. For $19, it seemed worth it.

However much more recently they tell him they need 500 BUSD to send back the money. I told him to create a new ticket and ask if he was being extorted, but the answer was the same.

Give us $500 to send you 2.4 wETH on Polygon.

And it's just so absurd on so many levels.

First of all, this is a pretty common mistake. One that likely happens all the time. It's really not that hard to transfer money back to the sender. There's no way to game that system. The entire process really should be automated. Just shows you how early in the game we are I guess.

It's also super annoying because they accept wETH from a lot of different places, but not Polygon, which is arguably more popular than some of the other places they do allow wETH from. So weird. So now he's in an awkward position of paying $500 for 2.4 ETH and hoping he gets the ETH, or just waiting and hoping that Binance lists wETH on polygon and he gets the money for free when that happens.

It's also just super lame that they told him to pay BTC and they'd handle it, and then they come back with the ridiculous $500 ask for something that happens all the time. And $500 is such a perfect number as well. It's very obvious that they just pick a number that they think people will pay. What if he had only transferred 1 wETH? Would they ask for $500? Probably not because that's almost half of all the money. I suspect they just pick a number near 20% of what was sent to them and expect people to pay it. Very lame.

Yep, so it's a frustrating situation.

For now he's just not paying the $500 and hoping for Binance to either list wETH on Polygon or for the next bull market to increase the value of the wETH to a much higher level so that paying $500 for it makes more sense. Not the worst thing to happen. At this point there are no good options left. It is what it is.

Conclusion

Just wanted to let you guys in on this classic scenario of centralized exchanges dicking people around. It's easy to forget how risky it is when we allow "trusted" institutions to act on our behalf. More often than not crypto peeps learn the hard lesson rather than from the plight of others.

As a friendly reminder: never send funds to an exchange unless you actually click on the damn deposit button, your network is listed, click the network, and make sure wallets are not undergoing maintenance. It's really easy to get lazy not checking these things every single time, but sooner or later you're bound to get burned by not being redundant on the safety checks within crypto land.

Here's to hoping my friend gets his money back without too much trouble (as if it hasn't already been troublesome enough already). Binance and Mandala are out there providing services that no one else provides (no KYC with the highest liquidity on the market with the lowest fees), but still the tiniest mistake can lead to a big loss. Tread carefully.

Posted Using LeoFinance Beta

Return from Binance Extorts Buddy for $500 to edicted's Web3 Blog