First thing's first:

2019-fractal-is-still-in-play-possible-ath-in-1-week

So where are we now? Three days later?

As predicted, we just bounced off $35k.

Jan 22, 3 PM:

Seems like no matter how this goes down there's going to be some kind of bounce off $35k, in both bullish and bearish scenarios.

I'm just now realizing that this would have been the easiest day trade ever. The problem is that it would have required extreme margin trading because the drop from $35k was so small. Being American doesn't always have its perks. Our regulations don't seem to take kindly to exchanges that allow margin trading.

So yeah, we got rejected from $35k as was blatantly obvious, but what now? Well, it looks like this fractal is going to continue playing out... Volume on Coinbase has risen from those dangerous 12k levels back up to 20k and the price is rising. A really good sign indeed!

In fact, there have been many many many bullish signals out there. @jrcornel is covering these events quite well. Check them out!

Q1

Even though I'm extremely bearish on Q1, it looks like we are going to dead-cat-bounce pretty hard for at least the next week. Again, I need to write more on my 20-point system, but in the interest of transparency, my readers should know that I'm still 100% all in, but I'm hoping for this bounce to play out so I can move 3-5 points out of the market (15%-25%). Never ever ever move all-in all-out of the market. MIN/MAX strategy gets you wrecked.

ON TO THE MAIN EVENT!

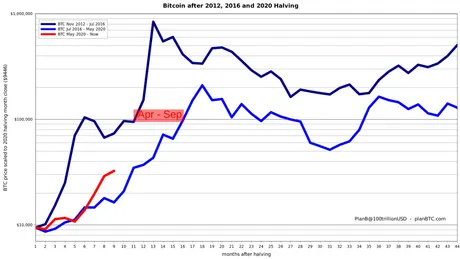

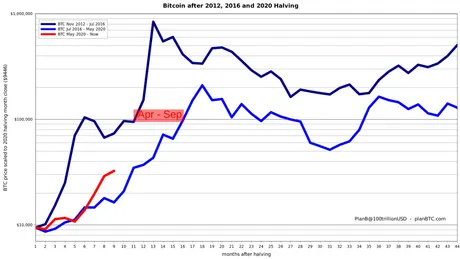

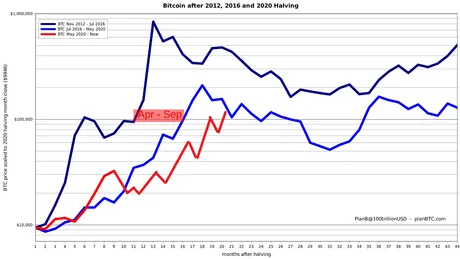

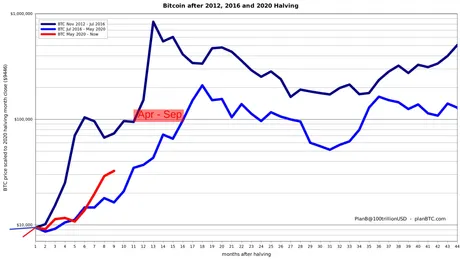

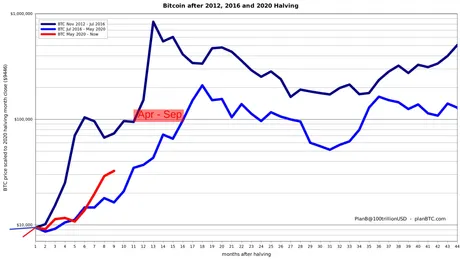

This information overlays every Bitcoin halving event (3 total) on a logarithmic scale.

Essentially, by extrapolating these 2 data points, it was theorized (from this exact information) that the next bull run would peak later than Q4 just like the 2016 run peaked later than 2012.

Of course during that time I called out this 'bullshit' because they were extrapolating data from only two halving cycles. That isn't nearly enough information to make any kind of meaningful projection. I maintained, like many others, that the next bull run would peak in Q4 2021.

Now that this third line has been added, everyone has forgotten about this whole concept that the bull run is supposed to come later. Everyone sees the third line and thinks, "Yep, still on track for Q4 2021." Maybe even sooner! This 'proves' it! We are ahead of the curve, after all.

WHERE IS THE COVID CRASH?!

It's kind of funny because this overlay doesn't show a critical piece of information relevant to all of this: the COVID crash in March 2020. You'll notice it isn't shown on the 2020 red-line because the halving occurred in May, and it's not shown on the 2016 blue-line either, as it hilariously cuts off literally right before the COVID dump, but makes sure to show the bump up we got in February after the Bakkt pump/dump finished deflating in summer 2019.

So, I ask again, @jrcornel :D

Isn't it incredibly strange that this chart shows us around 95% of all the available data from 2012 to current day except for an extremely key dump that happened in March literally right before the halving event took place?

I believe if, instead of charting this overlay from the day of the halving, we charted it starting 3-6 months before the halving, we'd see a much different story playing out.

I know we'd see a COVID dump that takes the price of Bitcoin far under the logarithmic curve (and thus far under the doubling curve simultaneously). I think we'd see that in response to that epic-level dump/pump in March, the current price of Bitcoin is spring boarded up with a ton of momentum that wouldn't be there otherwise.

I'm starting to think that those analysts back in the day were actually right about the next bubble being delayed, and all of them have backtracked on that stance because the red-line is currently ahead of the blue-line. Of course if that happens to change they'll be sure to say "I told you so" after the fact.

Possible Outcome:

Because of the COVID crash and subsequent x10+ in 9 months, I believe a crossover like this is extremely possible. This would put the real peak in Q2 2022, just like all those analysts back in the day said might happen based on the current two points of information.

The only reason why we are ahead right now could be due to the COVID crash in conjunction with extreme institutional greed trying to price in the Mega-bubble early. As we all know, anytime the market tries to price in something early before it has the legs to stand on it's own, there is bound to be an extreme correction in the market. I'm very worried that Q1 will be that correction given what I'm seeing.

If this is indeed the case, Q1 should be really bad for Bitcoin, with the potential to test $20k support and also the possibility to test doubling curve support at $17k (unlikely). If this were to happen, then we need to see how far above the doubling curve Bitcoin is during Q4 to see if that's the real bubble for the "psych-out" bubble.

Psych-Out Bubble

So imagine Bitcoin crashes in Q1 to $20k... then in Q2 it spikes up to $40k-$50k and everyone is finally like yes moon is here. Then in Q4 it spikes up $100k and everyone is wondering if this is the peak. Certainly, PlanB's stock to flow model says 'yes', Bitcoin will be worth $100k at the end of the year.

However it if plays out on a delayed reaction like many were saying back in the day, a 30% pullback in Q1 2022 (say $100k to $70k) would simply be a precursor to the big one in Q2, rather than the start of a year-long bull market like many will be worried about.

Doubling curve prediction

If the peak is indeed in Q2 2022 the doubling curve for Bitcoin would be around $38,000 during that time. As we all know, the mega-bubble can take us x10+ the doubling curve, so it's possible the next peak would top out at $400k unit-bias resistance during summer 2022. That would be pretty nuts, to be sure.

In addition, $400k is a number a few analysts have been throwing out there as the next peak, and the analysis they are doing is nothing like what I'm doing... so hopefully that adds a little more validity to the prediction. Multiple people doing different analysis but coming to the same conclusion is a pretty good sign. Who's ready for $400k Bitcoin come Q2 2022?

Mainstream TA

Many are using the fact that Bitcoin has gone so high recently ($42k) that there's no way it could retest $20k. This is backwards. Volatility breeds volatility. The fact that Bitcoin has increased in value so quickly (x10 in 10 months) is exactly why we can expect to retest $20k at the end of Q1. This market got greedy as hell and tried to price in a mega-bubble way too early. We need doubling curve support just like we had in 2017.

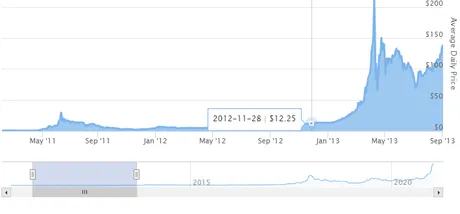

The 2012 Halving doesn't even count!

This is another thing to think about: the first Bitcoin halving is completely irrelevant. The market didn't realize how bullish it was, and the price IMMIDIATELY spiked in 2013 to what we now know as the doubling curve today: $100... from $10. x10 in 5 weeks because the fundamental gains of the supply shock rocked the market instantly. The market had no idea what hit it... but it would be ready the next time around (not!).

So what happened during the next halving in 2016?

Predictably, the market got very excited for the impending supply shock, and thus x10 price, so the market did what the market does best: got greedy and tried to price it in early. How did that work out?

QQ NOTHING HAPPENED!

Yep, the market was greedy and impatient as hell. We see that volcano pattern popping its head up every time this happens. The market bubbled and then the next quarter (3) was a bust. Everyone was very disappointed. And guess what? It's happening again right now! We are due for a quarter where everyone is disappointed and frustrated.

Why's that?

Again, go back 3 months BEFORE the halving and chart the overlays on top of each other. During the first and second halving the price of Bitcoin was stable as hell before and after the event. Super solid support the entire time. It was only after Bitcoin was in a state of supply shock for over a year that the price really mooned out of control and temporarily broke away from the doubling curve... only to return to the curve a year later (both times).

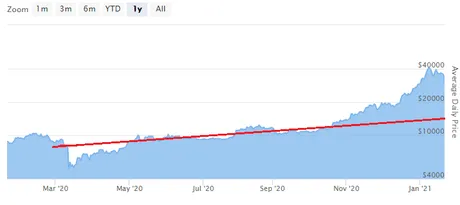

The price of Bitcoin hugged the curve at the end of Q2, Q3, Q4 and Q1. Translate that action to present day? That's the same as bouncing off $14k Bitcoin. We are trading at $33k... uh... oh...

What do we have now?

We have the price of Bitcoin dipping 50% underneath our hardcore doubling-line support, and then hugging that curve until November, and then skyrocketing x4 over three months as we now float x3 above the curve. We are seeing the exact same volcano pattern that plays out literally every time Bitcoin gets greedy and tries to price in an event before its time. Q1 crash imminent.

The biggest problem with this chart is that everyone is looking at the 30% retracements (where we are now) instead of looking at the gains and the doubling curve. Bitcoin went x10 in 10 months a year before the predicted mega-bubble. That is not sustainable price action to continue this rally as is.

Analysis

Bitcoin going up quickly doesn't reduce the chance of it going down quickly. The opposite is true: volatility breeds volatility in both directions. The fact that Bitcoin has been so wildly trading below and then above the curve way before the projected mega-bubble means we are due for an unprecedented correction that can't be predicted with the old models.

A pattern is brewing of 18 months inbetween every volcano cycle.

We've had 4 so far:

- Q2 2016 (trying to price in the halving event early)

- Q4 2017 (MEGA-BUBBLE MANIA)

- Q2 2019 (Bakkt pump/dump institutional hype)

- Q4 2020 (trying to price in the halving event early)

Call me crazy, but I think those predictions of the next bull run being delayed past Q4 have a good chance of turning out to be true. If this pattern completes the obvious timing for the next peak is Q2 2022, giving us plenty of time to deflate in Q1 back to $20k.

What to look out for? Crossover.

Essentially for this to play out the red line needs to cross under the blue in order to peak later. Don't forget that before this red line existed (pre-halving) everyone was using this exact chart to point to the idea that we would peak later than Q4. Everyone seems to have forgotten that history as they ride high during the current run. The chance for a crossover is high... they may have just gotten it right the first time.

Everyone seems to be expecting that the current mega-bull run is going to play out exactly like it did in 2017... which is exactly why it won't work out that way. According to the doubling curve, these predictions of a 2017 repeat are already extremely incorrect. In addition, when the market thinks the price is going up in the future, it always tries to price in that event early, and that bubble before the real bubble ALWAYS fails; every time. I'm fairly certain we are witnessing that go down right now.

Just ask Q2 2016, Q4 2017, Q2 2019, and Q4 2020. All these volcanos are 18 months apart, and they all inevitably crashed.

Again, I am still 100% all in and I'm only looking to exit 15%-25% should the 2019 fractal pan out and we get an epic dead cat bounce to near all time highs within the next week or so. After that: Chinese New Years and Tax Season are upon us; the bane of crypto bubbles. Rather than looking how far we've retraced recently, instead look at how far we've spiked up in such a short time. Pricing in a mega-bubble 12 months in advance is a losing strategy, as has been showcased multiple times now in this wild market.

All we can do in maintain balanced positions & hedge our bets so we can continue buying the dips and selling the spikes... slowly and steadily over time.

Posted Using LeoFinance Beta

Return from Bitcoin Halving Overlays Used to Justify Ridiculous Predictions to edicted's Web3 Blog