Most people think the barrier to entry for Bitcoin is the price per token.

Price valuations for Bitcoin have gone completely insane. Anyone can look at a chart and see that 1 Bitcoin used to cost $1. I personally remember when we hit $1 parity and I was thinking "seems kind of overpriced". Then I did the math on the 21M total cap and realized a $21M market cap was still absurdly low. Now we have made it to the trillion level. No sweat.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

At these levels, the doubling curve is going to catch up to the current price by the end of June. That's powerful. The curve is increasing $2000 a month during a period where the greater legacy economy has never been more uncertain. Bitcoin has a great buffer going forward.

Unfortunately for the rest of us, that fantastic "buffer" is really all the liquidity and value stored inside the alt market. When shit hits the fan Bitcoin is going to cannibalize the alt market hard and increase dominance back up to 60% like we've already seen multiple times now. No matter what happens the answer is still the same: buy some more Bitcoin. Because again, the barrier to entry is at all time lows:

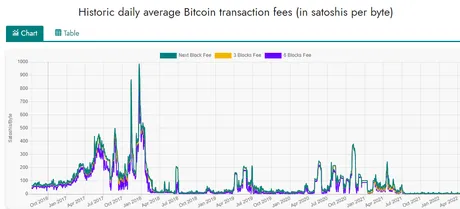

THIS is the real barrier.

It's the trading fees.

How much does it cost to move BTC from one wallet to another?

Look at those numbers!

We have crashed all the way down to the minimum fee of 1 sat/byte.

This assumes you're willing to wait an hour instead of ten minutes.

But still, that's powerful.

Seriously, look at how insane that is.

We can legit move millions of dollars around right now, with the full security of the worldwide Bitcoin network, for 10 cents a transaction. Doesn't get much better than that, yet people are still hesitant to buy Bitcoin. Why is that?

It's because most people do not understand the value proposition of Bitcoin. Everyone calls it a store of value, when it's really a store of security/trust. Newbies find themselves afraid to buy at any price because they do not understand the value proposition and are wrongfully being fed lies like: "POW mining is a waste of energy".

Really? A waste of energy?

The only reason why people believe this propaganda is that they don't understand what the energy is being used to do, so they call it a waste. They do not understand (or even know about) The Byzantine Generals problem. Their opinion is irrelevant because they are simultaneously uninformed and also trusting the wrong sources of information.

Seriously, think about it:

Would we add up all the energy expended by transportation (cars, planes, etc) and then make the claim that 100% of that energy expenditure was a "waste of energy". Obviously not. That's an absurd statement. People and products need to get from one place to another. Logistics is one of the most important things in the world economy. And yet that's the exact same logic people use to calculate that 100% of POW mining is a "waste of energy". It's an absurd notion propagated by the uninformed and seeded by the exact people that crypto threatens.

2023: The Year of the maximalist.

On July 25th, 2021 I made this prediction that 2023 would be the "year of the maximalist". I assumed we were going to get that mega-bubble by now and that such a mega-bubble (combined with a recession) would crush the alt market and once again make Bitcoin the dominance crypto asset.

Right for the wrong reasons

I still believe that my conclusion was totally correct: 2023 will still be the year of the maximalist. It's going to outperform everything. Every stock, commodity, and altcoin will get stomped by Bitcoin in 2023. While the mega-bubble never happened, the recession is still imminent. This actually makes the prediction even more relevant.

Why's that?

Because Bitcoin isn't overbought. We are very close to the doubling curve so we aren't even in a bubble. If we enter a recession while Bitcoin is trading on the curve it's going to outperform everything and grind down the alt-market pretty badly. For some, this will be a tragedy. Hopefully the rest of us will spin it as an opportunity to stack up on Bitcoin and buy back into alts after they get wrecked.

Binance still charging $20 to withdraw Bitcoin.

Even though the price of on-chain transactions for Bitcoin has cratered to the bare minimum, none of the centralized exchanges are paying it forward and allowing their users to exit at the lower fee. That's corporations for you I guess. Binance is moving around Bitcoin for 10 cents a transaction and then charging users 0.0005 BTC to exit. Yet another reason to seek out badass decentralized options like ThorChain.

Conclusion

The scalability and growth of Bitcoin is fully dependent on the price that it costs to actually use the network. That price (1 sat/byte) is currently at it's lowest levels ever. In fact, it can't even go lower than 1 sat/byte. This is the best possible deal we are going to get.

The ability to utilize the Bitcoin network right now for 10 cents a transaction is huge, and no one is even talking about it. Hash rate for Bitcoin is at all time highs, which means that the Bitcoin network is more secure now than it ever has been. There's also a correlation between high hash rate and high price. Something is amiss when hash rate is at all time highs but transaction fees are at all time lows. This is the perfect opportunity to stack up on more Bitcoin before the year of the maximalist (2023) kicks in.

Posted Using LeoFinance Beta

Return from Bitcoin: The Real barrier to entry. to edicted's Web3 Blog