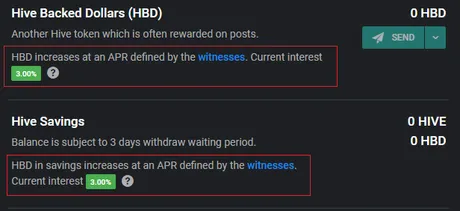

Alright so I've had a day to think about the proposed changes regarding HBD increasing APR and quarantining that yield to the savings accounts. I did learn some things from the smart peoples who run this pony show.

I'm actually not 100% sure where the inflation for HBD comes from. I know the witnesses set the target, but I'm not really sure if this money appears out of nowhere or if it comes from somewhere else. Any help on that front would be appreciated.

So apparently the inflation does indeed come out of thin air.

HBD APR is printed in addition to all other Hive/HBD rewards.

It's amazing how I can keep learning new things about this network even after extensively studying it for years. Truth be told a couple years ago I would sometimes just theory-craft problems/solutions for the network that didn't even exist because my understanding was so limited back then. Easy way to bait people into commenting & telling me I was wrong so I could learn quicker. :D

And so I will now theorycraft another non-existent problem!

To quote @blocktrades:

To make staking of HBD more familiar to the average cryptocurrency investor, it seems likely that it would make sense to make a change to the current interest payment mechanism: instead of all HBD receiving interest, only HBD in savings accounts would receive interest.

Ah so the goal is to mimic other Defi platforms eh?

This is a problem, because if we're allocating high yields to HBD holders in the savings accounts, competition is not a factor. Under the current rules it doesn't matter how much HBD is in the savings accounts, all that money will be increased by a static APR.

Essentially we are writing a blank check

No matter how much HBD flows into the savings accounts we are going to award that money the same yield percentage regardless of how much demand there is for this function. If the goal is to mimic other defi platforms, we are definitely doing it wrong in that regard.

Take CUB for example

When more people enter the CUB farms, APR goes down. That's because CUB inflation is created linearly (1 CUB per 3 second block on BSC). Pegging APR to a certain level means instead of linear inflation the network is now engaged in exponential inflation. This means that inflation creates more inflation. Read by post on APY to see how out of hand exponential inflation can get.

To quote @blocktrades again:

It’s been suggested that this interest rate should be increased to something more substantial (e.g. 10-20%)

Wow, 20%. That's a sick yield (compared to the current 3%). Let's go with that. So in the next Hive fork it looks like we are going to implement Hive >> HBD conversions. There's a 5% burn tax here to mitigate exploitation. This effectively caps HBD at an upper bound of $1.05 before it becomes profitable to destroy Hive in order to flood market demand.

But if we're offering HBD in the savings accounts 20% APR (22% APY) it will take less than 3 months to earn back that 5% burn penalty. After that it's all profit. Someone with deep pockets could swoop in and pump quite a bit of HBD into our savings accounts.

Awesome! Let them!

Right? If someone did this that means a lot of Hive is getting burned to create the HBD. The price of Hive would go up. Score. At the same time, the 10% haircut is still in play, and if too much HBD exists compared to Hive's perceived market cap (as determined by the witness price feed average) the system could become unstable again and break to the upside, only to wreck us on the way down during the next bear market cycle just like in 2018.

Why is this a non-issue?

Well for one this scenario kind of assumes that the network isn't paying attention to what's going on as it allows someone with deep pockets to continually burn Hive and shove the HBD into the savings accounts with the expectation of a 20% return. The Hive witnesses can kill that party whenever they want by lowering the yield of the savings accounts.

There's also the issue of outside competition. Why try to make a play like that on Hive when there are tons of other defi networks out there that have higher yields than 20% (and lower deposit fees than 5%). Financially it doesn't make a lot of sense.

But you know what also doesn't make a lot of sense? Mega-bubbles. In particular, despite trying our damndest to stabilize the price of HBD with the dev fund it is still trading at $1.70. Clearly there are entities out there that are more than willing to try and exploit our tokenomics and create a pump and dump due to our thin liquidity. It's possible that HF25 could ironically make it even more worth it for these people to engage in this behavior.

Conversions take 3.5 days.

It's also important to note that HBD >> Hive conversions take 3.5 days to complete. The average price of Hive over this time period is used to determine how many coins are minted. This average exists to eliminate potential manipulations: IE buying cheap HBD and immediately converting it to Hive and dumping for more HBD. I have to assume that the reverse conversions will work the same way, except with a 5% burn fee to even further discourage conversions and encourage marketplace trading.

Analysis

Mostly false alarm clickbait, but that's how theorycrafting goes sometimes. I could spend hours thinking I've made some discovery by refactoring the variables of a complex system only to realize nope: nice try no cigar.

The main message of this post would definitely be to keep an eye out on HBD yield. If our goal is to mimic other defi networks we probably shouldn't be writing these kinds of "blank check" APY yields, but then again even a 20% APR is only a 22% APY. The numbers don't get absurd unless multiple years pass by without fixing the "problem".

True threat

I guess my greatest concern would be if the people who are already engaged in the market manipulation of HBD see this as an opportunity to double down without having to take much risk. Again they could use conversions to mint a lot of HBD and try to push us to the haircut limit on purpose.

If they fail they won't lose much, or may even gain a return from the yield on the savings accounts. If they succeed HBD will break to the upside again and we start this process all over again. Except this time when HBD breaks to the upside they were able to buy millions of HBD at a price of $1.05 without having to suffer slippage overhead.

Regardless of all these slight concerns: I've made it abundantly clear that I am a stanch defender of high inflation. If it were up to me I'd rewind Hive's inflation back to a flat rate of 10% a year. Anything we can do to increase inflation and put that power into the hands of citizens themselves is a good idea and promotes network growth while leaning in to the undeniable defi trend.

Seeing that HBD savings account inflation doesn't pull funds from anywhere else is a huge benefit in my opinion, even if we should consider variable APR rather than writing a blank check for anyone who wants to enter the savings accounts. Truth be told this might not be something we need to worry about a the moment as the witnesses can just dictate the APR manually until we figure it out.

Posted Using LeoFinance Beta

Return from "Blank Check" Money Attack to edicted's Web3 Blog