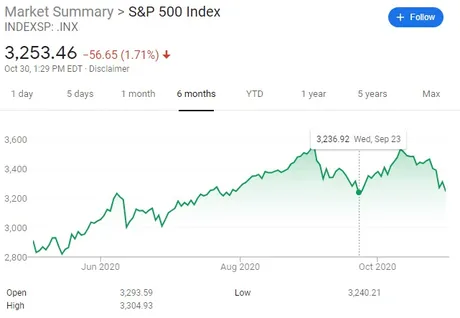

Dow falls 250 points, S&P 500 slides more than 1% as Wall Street heads for worst week since March

Yep

Stocks are getting relatively crushed, which makes sense. The market doesn't like uncertainty, and what's more uncertain than riots, a global pandemic plus flu season, and a presidential election calling for recounts and martial law?

Not great.

At the same time, many are looking for support here, as we enter the same range we were in last month when everything bounced on Sep 23rd back up to relative all time highs.

Meanwhile, risk-on asset Bitcoin has been holding relatively steady, defying the stock market and decoupling from this mess. Many wonder how this is possible. Shouldn't corporations/countries/banks entering the market make Bitcoin even more correlated to the legacy economy?

The Answer? Absolutely not.

Corporations are padding their RESERVE balances. This isn't money that's going to be traded around on a whim. It's straight up tucked away in some cold wallet likely protected by multiple Multisig wallets. This is straight up HODL money now. No more trading. Locked in.

This trend will actually likely continue. The more legacy players get involved in Bitcoin, the more it will decouple from the stock market. Why? Because Bitcoin is addictive AF. We all know how it works. You get some, you want more, the cycle continues. Therefore, of course if a little money is exiting the legacy economy and entering Bitcoin, it's going to make an absolutely huge difference when it comes to these correlations.

The correlation is FUD anyway.

Bitcoin correlations to the stock market mean absolutely nothing. Stocks could go up 5%, Bitcoin could go up 100%, that's a correlation. Stocks could then dip 5% back to where they were and Bitcoin could also dip 5%, that's a correlation. None of that means anything because Bitcoin made a 95% gain while the stock market was a complete wash.

Money flows like water in a river. When the river dries up, everything suffers. That's where these correlations come from, and they are largely irrelevant because Bitcoin is capturing the Unicorn share of the market.

Meanwhile, we're seeing in spectacular fashion that Bitcoin is once again stomping the altcoin market, or rather more accurately altcoins are retreating to Bitcoin due to the massive stability being provided at $13k (x3+ where it was in March). Impressive.

HBD's supply is 4,693,052 while Hive has dipped to a $42,034,224 market cap. This means the haircut should start kicking in. Less (or zero) HBD will be created from posting and converting HBD to Hive will be haircut based on the 10% rule (x10 HBD supply to ~$47M and compare to Hive market cap).

Even stranger, our very own LEO is performing just as strongly as Bitcoin (if not better). I have to imagine once we get our peg to Ethereum back on November 10th or whatever we'll be doing even better. Very surprising indeed, but we have a microcap and have acquired a ton of bulls over these last few months, despite the wLEO hack... so it makes sense (sort of). In fact, many users are bullish on the hack in retrospect. After all, I did get 33k coins out of the buyout that I absolutely was not expecting.

Conclusion

Again, the market will be looking for support here across the board. No matter what happens, I think Bitcoin will be able to defend support in the $12k to $13k range due to corporations FOMOing into the market. Truly, they are only dipping a toe in at the moment and they aren't going to exit anytime soon.

Best case scenario the market as a whole does find support here and starts ramping up into November via the mythical Black Friday and subsequent mad dash to buy things for Christmas, go on vacation (less likely), and essentially just spend more money on a seasonal level.

Retail loves Christmas.

At the same time, don't be surprised if the POTUS election, COVID/flu season, and riots stand in the way of this year's Q4 gains. Once again Bitcoin becomes the safest bet. Too bad I'm not a maximalist.

Posted Using LeoFinance Beta

Return from Blood in the Streets; Bitcoin in the Sheets to edicted's Web3 Blog