This is getting crazy. How long did Coinbase have one currency? Then two, then three, then four. Now, coins are getting added like hotcakes.

I've written a lot about Maker/Dai and Golem:

https://steemit.com/ethereum/@edicted/maker-and-dai-still-looking-strong https://steemit.com/maker/@edicted/maker-will-reign-supreme-above-the-other-stable-coins https://steemit.com/news/@edicted/makerdao-doubles-debt-cap https://steemit.com/maker/@edicted/figuring-out-makerdao

https://steemit.com/golem/@edicted/proud-owner-of-31-golem-coins https://steemit.com/golem/@edicted/brass-golem-is-live https://steemit.com/golem/@edicted/golem-and-friends-will-change-crypto-mining-forever https://steemit.com/cryptocurrency/@edicted/golem-coin-gnt-graded-b

To have everything be added on Coinbase in one fell swoop with no warning is absolutely insane to me. Things are really looking up for 2019.

Dai

This is the number one ultimate chain Coinbase could have added in my opinion, and I was thinking it would take them much longer to figure this all out. Dai is a stable coin pegged to the dollar using only Ethereum as collateral. Therefore, Dai's collateral is stored directly on the blockchain, not in a bank. This is huge.

Other stable coins are using banks for collateral. Banks operate on the concept of fractional reserves. If a bank has a total of a billion dollars worth of deposits, they may only have $50 million in reserves at any given time. In the world of crypto this is wholly unacceptable, because the volatility of the sphere is so violent that a "run on the bank" could occur at any time, making the bank insolvent because it runs out of money.

This can't happen with Dai, because every Dai coin ($1) is collateralized by $3 worth of Ethereum on average. The bank of Dai can never go insolvent no matter how bad the bank-run is.

A bank can be regulated, shut down, sanctioned, sued, boycotted, and/or outright banned. The money in a bank can be frozen. Dai is immune to all the vulnerabilities that banks have. It is so much more reliable than money in a legacy system.

What was Dai missing?

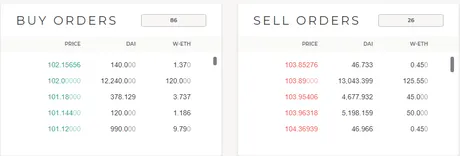

The only thing that Dai was missing was liquidity. Coinbase will increase Dai liquidity by 100 fold. No longer will we have to deal with this BS:

Before now, there has always been a big gap of liquidity between buyers and sellers. A null or void zone if you will. With Dai on Coinbase I can't imagine this happening. With USD and USDC available on Coinbase Dai's volatility will drop to near zero.

The new volatility of Dai will be superior to Tether/TrueUSD/Cloud/Gemini because it's more liquid due to not being stored in a bank.

Right now there are 55 million Dai in circulation. I predict that by the end of the year, solely because of this listing, demand for Dai will exceed 1 billion. It's also important to note that if I'm right, this means $3 billion worth of Ethereum will be locked up in CDP smart contracts, completely frozen so that the 1 billion Dai is allowed to exist. Seeing as the market cap for Ethereum right now is only 10 billion, a situation like this would drastically cut off supply for Ether and spike the price.

Also, Dai loans cost interest of half a percent per year. This interest is paid in Maker and that Maker is destroyed. That much Dai in circulation would force 5 million dollars worth of Maker coins to be destroyed every year. There are only 1 million Maker coins in existence currently worth $442. It bottomed at $300 just a week ago. This listing is going to skyrocket the value of Maker and Ethereum over the next 3 years. No one was even looking at Maker before, now that it's on Coinbase that is basically free advertising.

Other variables

This opens up so many avenues for Coinbase. They can now take say $50 million worth of Ethereum and create 5 million Dai. They could then loan that Dai out on the platform, allowing users to now use Bitcoin as collateral for Dai or any other asset on the platform. Unlike slow Ethereum, Coinbase can react to market crashes 100 times faster and has the liquidity to sell off bad debt much easier than the currently implemented system of the MakerDAO. Coinbase is positioning themselves to become a proxy for Maker and loan Dai out with whatever rules they choose. Coinbase is primed to become a legitimate crypto bank in this emerging economy.

Conclusion

Not only is Dai a stable coin, it also provides a platform that allows one to give themselves a loan with smart contracts. This loan can be used to make leveraged investments or to simply spend the money anywhere else the user sees fit. In addition, Maker provides an easy way for anyone to invest in Dai stable-coin. How does one invest in Tether, Cloud, TrueUSD, Gemini, Etc? Stock in a company? Pass. I'll take the decentralized option, thanks.

This is the most exciting Coinbase listing ever. It will synergize with the entire cryptosphere. The stable-coin craze is real and Dai is poised to scoop the pot. There is no other decentralized stable coin option that removes banks from the equation. This listing will eventually connect the bank accounts of vendors and service providers in America directly to the entire Etherium network. These are exciting times, especially considering how oversold Etherum is.

Disclaimer: This is financial advice. Dump your life savings into Maker because moon. I am your due diligence. Trust me implicitly and you'll surely become a billionaire.

Return from Breaking News: Coinbase Lists My Three Favorite ERC-20 Tokens to edicted's Web3 Blog