Worst kept secret of Bitcoin.

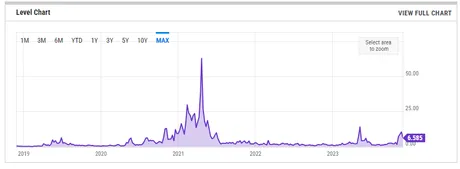

Everyone knows that Bitcoin fees have a tendency to to be volatile and spike out of control. If I'm being honest I'm actually impressed that it has performed so well in this regard. Seeing as fees spiked to well over $50 a pop in 2017 I naturally assumed they'd be much worse today and especially during the previous bull market in 2021.

Bitcoin fees surprisingly trading in range.

The same cannot be said for Ethereum with its ridiculous $200 transactions, but for the most part Bitcoin has remained surprisingly consistent even with a rising price. We can very clearly see that fees during the 2021 bull market were pretty much exactly the same as they were in 2017 even though the price point was over three times higher at peak.

Spikes in demand

We can see that we also had some more recent ~$10 mini-spikes as well in terms of BTC usage. These were caused by Ordinals NFTs and BRC-20 tokens being listed directly on the Bitcoin network. Many Bitcoin users view this as an attack on the network, and I actually tend to agree with that assessment. Bitcoin has a very niche role within crypto and it doesn't need to be bloated with "shitcoins" as it were. There are plenty of other networks that perform this function better and cheaper than ol' grandpa BTC.

A more purist viewpoint

On this other side of this coin is the fact that Bitcoin is a network that regulates itself. Nobody has the authority to claim others are not allowed to use the network for certain functions. The only requirement for posting to the chain is paying the fee, and thus those who are willing to pay the higher fee are going to get their data inscribed no matter what. This is simply something we need to accept, and it is both the advantage and disadvantage of maintaining a permisionless ecosystem.

Node incentives

Would it be nice if Bitcoin increased its blocksize to make way for cheaper transactions? Sure would, but then again how can we be sure that all that extra blockspace isn't going to be gobbled up by more Ordinals nonsense? In all likelihood there is a very real chance that demand will simply increase with supply and the only thing that changes is a higher expense to node-runners.

This is why financial incentives are so critical within crypto.

What is the financial incentive for a person to run a Bitcoin node? Unless one can monetize that data somehow or at least extract value for themselves the answer is zero. Nodes are not allocated emissions on the Bitcoin network; only miners are, and most miners don't even have to run a node. They just delegate their hashpower to a mining pool that does.

Bitcoin is already slightly above 500 GB in size after 14 years. The Hive network has only been around half that time but already has a bigger blockchain. However, the huge difference between Hive and Bitcoin is that users that run nodes get paid. It doesn't matter if a Hive node is more expensive to run than a Bitcoin node if the reward of running a Hive node is greater than the cost. Meanwhile Bitcoin node-runners get a whopping $0 for their troubles. This will continue to be a problem in terms of Bitcoin being able to scale in any kind of decentralized way.

Hybrid multisig?

It stands to reason that Bitcoin fees will continue to go up especially if the spot price is trading within the six-figure range come next bull market. What can we do to combat this? Well, the traditional approach comes in the form of centralization and custodianship. Just keep your BTC on an exchange or within the Lightning Network in order to keep smaller amounts liquid without paying absolutely ridiculous fees. This strategy allows all the real on-chain transactions to be aggerated together to avoid taking the huge hit.

Of course this is a very sub-optimal approach.

Everyone knows one should not keep their crypto on exchanges if they can avoid it, and now with the recent 'replacement cycling attack' on the Lightning Network it's more clear than ever that Bitcoin on the LN isn't really Bitcoin at all, but simply another derivative of it just like the paper BTC we see on exchanges.

So I was thinking about how I'd try to solve this problem, and obviously what I came up with wasn't great, as it turns out there are much smarter and more capable people working round the clock so defeat issues such as these. Regardless I do wonder if there will be some kind of multisig solution that could be employed in the future.

The year is 202X and BTC is trading at $1M.

By my estimate the absolute minimum of Bitcoin one can keep in their wallet is around 0.01 BTC. Anything less than that and fees absolutely decimate the position and make it totally untenable.

That's a million sats.

It can easily cost over 10k sats to send a transaction, which would mean at least 1% of our money would be lost on a single transfer during any kind of bull market. If BTC was trading at something crazy like a million dollars this would mean anyone who actually wanted to use the network directly would have to have at least $10k invested... not only invested but also already cashed out from an exchange (which can be exponentially more expensive to do depending on the exchange).

It becomes clear that within one or two 4-year cycles Bitcoin will completely price out the vast majority of users and most will be forced into altcoins or to more centralized custodians like exchanges and LN.

But what if we created our own custodian?

Sounds like a regulatory nightmare, does it not? However I believe it would be possible to come up with a more decentralized solution that may be able to loophole around such things. My first iteration of this idea was incorporating a simple multisig solution. If one person can't afford to host their own wallet then why not batch them together within a single wallet using multisig?

Of course that doesn't really solve the problem at all, unfortunately. Those with a small amount of Bitcoin within the multisig wallet would still be trapped there; unable to pay the fee to leave. In fact getting Bitcoin into the wallet in the first place would likely result in the same issue.

Batch transactions

Grasping at a solution from here requires that those who own a lesser amount within the wallet have to wait for others to withdraw their funds so they can piggyback off of a bigger transfer in order to pay a smaller fee. This would work but comes with two major drawbacks:

- Users might have to wait a very long time to get their money out.

- The multiple outputs would have to be routed in a trustworthy way.

- Doesn't help get BTC inside the wallet (only exit).

I'd say that these problems on their own make the entire concept pretty lack-luster. Dealing with all of them at the same time is a bit silly and needlessly overcomplex.

Hybrid/Hydra system explained.

Think of it like a savings account and a checking/spending account. There are two multisig wallets. The Bitcoin multisig would be the savings account. In fact the entire point is to hodl the BTC directly on chain without being subjected to the obscene fees. The spending account would be something like Litecoin. I like to use Litecoin as an example because it is often compared as the silver to Bitcoin's gold (not that I necessarily agree with that analogy but it works for this example).

So say the multisig wallet has $500k worth of Bitcoin in it owned by a couple dozen different users. The Litecoin multisig would only have something like $10000 inside and is utilized as the entry and exit point of the system (on/off ramp). When someone wants to own a piece of the entire multisig position they deposit LTC to the proper address.

In turn they'd be offered "shares" within the small ring of nodes that manage the multisig operations. This would be a lot like LP tokens on AMM systems. For example: depositing $1000 of LTC might get you one of these tokens. There would be 500 of these tokens issued on a wallet with $500k inside so that everyone knows who owns what.

Upper and Lower bound thresholds.

When the amount of LTC gets higher than a certain amount (say $20k) then $10k is used to buy Bitcoin and add it to the core position. When the amount of LTC is lower than a certain amount (maybe <$5000) the opposite would occur with BTC being used to buy LTC and refund the spending account. The best way to accomplish something like this on a technical level would be to employ some kind of decentralized exchange like ThorChain to ensure that nobody has to be trusted to make these transfers.

It is in this way that users could leverage the cheap operation fees and deep liquidity pools of Litecoin while at the same time hodling as much BTC as possible. It would be possible to maintain a 99% Bitcoin allocation while only needing to leverage the remaining 1% to the spending account. Personally I think 95%/5% or 90%/10% would be a better ratio (less swaps) but this can be decided by those who create the multisig. Again I used Litecoin as the example here but the pair technically could be anything (even HBD).

Devil in the details

But what incentive does anyone have to boot up a derivative node network like this in the first place, let alone a group of users working together? It all comes down to money, and the standard business model for exchanges or custodians like this would be a small fee on transactions. Would the service still be worth using/running after adding such a fee? Unclear.

There's also the huge issue of trust. Even if the wallets were multisig it would be easy to Sybil attack something like this where one person creates 20 keys and acts as though they are all separate trustworthy people. It is in this way we can see the value of Hive and DPOS, where accounts on our network have strong reputations without the need for being doxed, while the associated voting mechanics are baked directly into the cake.

Privacy

It's also worth pointing out that all the money exiting this "exchange" is only trackable by the nodes running the multisig. Meaning this type of implementation could be easily leveraged as a privacy solution or even a full-on mixing service. Obviously the regulators wouldn't like that too much but there's also not much they can do about it if the code is open source and a thousand different operators are running their own version of the thing.

These nodes could even be set up to never record the user's history in the first place so that even court orders to hand over the data would have little affect as the data being requested does not exist. We've seen this occur a few times with end-to-end encryption services in the past where the only information provided was usernames because that's the only data that exists.

Cooperative

I also rather like this idea because it creates a cooperative between Litecoin and Bitcoin, two networks in which people are always pitting against each other in a make believe competition that does not exist. Litecoin can help Bitcoin, and Bitcoin can help Litecoin, there is no competition.

Conclusion

Can Litecoin and Bitcoin be paired together like a checking/savings account? The devil is in the details, but it seems like it would be possible with the right infrastructure. Of course none of this matters until Bitcoin fees are astronomical but at the same time I think we have to assume that such a fate is inevitable. There's a very good chance it comes sooner rather than later considering recent developments.

Return from BTC/LTC Hybrid Multisig to edicted's Web3 Blog