Putter putter putter

I have been very low-energy lately... just like the crypto market. I'm quite bored. I shouldn't be bored, but yet I am bored. XRP was up 20% today. Who cares? People say it's because it's the year anniversary of their court victory. Seems like a dumb reason but to each his own.

It's funny because a 20% gain in something like the stock market is huge but in crypto everyone just yawns and asks to be woken up after a 10x or whatever. How many of us have been focused on the lottery winners of the meme-coin casino that Solana has created this past cycle? All I can guarantee is that it won't end well. We've all seen the casino collapse like a dying star only to be reborn during the next cycle.

One of the biggest issues with crypto's insane volatility is that it's very hard to correctly manage a portfolio. It's so difficult in fact that this is the exact reason why HODL ideology was born. This is the, "Don't even try to manage a portfolio just hodl it no matter what and try not to think about it." This tends to work out pretty well especially for assets like Bitcoin that are making huge gains every year on the average but it also lacks a lot of the discipline that comes with managing finances.

At some point money is just money and we have to trade it for something with actual practical value. Investments can be ironically unsustainable in this way. Doesn't matter how much we are up on paper if that value was never used for anything other to make more money.

Needless to say I've been thinking a lot about the tools that crypto has built and the things that we've done to somewhat fix these problems. It's interesting because even though we've built these tools most people still tend not to use them.

Take automated market makers for example. This is a technology that allows us to DCA in and out of these mega-volatile assets using a smooth-curved automated algorithm that does all the work for us. And then what happens? The price moons and people say things like "oh look at that you took an impermanent loss" when really it was just responsible DCA strategy. Such degeneracy much wow.

50% loss on 75% retrace

How many crypto users actually start taking gains off the table or putting them into these financial instruments? It's actually quite few. We tend to do the exact opposite of what we should. When the FOMO is highest we take loans against our assets and buy the top in the ultimate expression of greed. Not good!

In my opinion there's a very good chance that the next bear market for Bitcoin results in something like a 75% downswing. Alts will suffer 90%+ losses like they always do. The 4 year cycle tells us this will happen in 2026 and everyone will be screaming "but this time is different". Call me crazy, I'm thinking this time is not different.

It just somewhat baffles me that money in a BTC/USD liquidity pool only loses 50% of its value in that situation (75% dip), and that doesn't even count the real yield earned from the liquidity pool charging traders the 0.3% fee or whatever it happens to be. Now that these Layer 1 Dexes like Thorchain and MAYA are gaining traction and the technology is getting better with things like streaming swaps there's potentially quite a bit of money on the line just waiting to be made.

It's totally possible that money in a BTC/USD position would partially or completely mitigate a 75% loss. Streaming swaps could bring in enough volume to allow liquidity providers to earn somewhere between 25%-50% yield in a year depending on how crazy the boom and bust cycle was. Being in an LP like this for one or two years could completely eliminate a bear market in theory depending on the various factors. This is something I'm going to be considering a lot more often when the time is right.

Of course these things do have some annoying counterparty risk associated with them. That and there are also other tools available to us now that could be even better in theory. Take Thorchain's loaning protocol for example. We could be locking up our BTC in one of those contracts and extracting 50% of the value as stablecoins at 0% APR with no liquidation risk. If Bitcoin crashed in half from that point the loan wouldn't even be worth paying back and that's just a free win. So many good ways to play the next bear market and I know for a fact that most will have their eyes glued to the shitcoin casino and the FOMO generated from random 1000x gains. Couldn't be me (this time... hopefully).

Conclusion

My head is in a different place today. While everyone else is wondering when the bull market is going to arrive (spoiler alert: it's 2025) I'm wondering how I'm going to not fumble the bag this time around like I have during the last 2 cycles. Bull markets are easy. It's the bear markets that are absolutely insufferable.

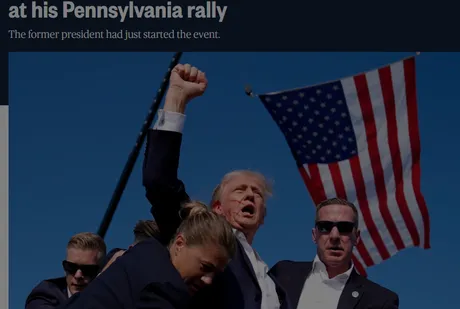

Crypto has been quietly gaining a lot of momentum in terms of the tech and the adoption levels. The price does not reflect this, as the broken clock is only correct twice a day. And apparently Trump just got shot in the ear in my state. Okay then. Sure sure. Because why not.

Return from BTC/USD LP Mitigation to edicted's Web3 Blog