Everyone seems to think that value in crypto comes from venture capital; it comes from the outside of these ecosystems from the legacy economy. Some rich billionaire pumps millions into a certain crypto at that makes the market cap of said crypto go up by millions. There are so many things wrong with this idealology it's hard to know where to start debunking it.

First of all, liquidity doesn't work like that.

The market cap is a ridiculous measurement that assumes one could liquidate every single coin at the current market price. This is literally impossible, as tokens being dumped lower the price. If there are no buyers the price will go to zero immediately (usually only happens during fatal hacks).

The same is true for the upside. For every dollar that actually gets pumped into a market, the cap might go up x10+ for each dollar put in. Liquidity is a pool that gets drained and filled in very weird ways, and market cap is an extremely flawed metric that tricks people into assuming some very incorrect conclusions.

To think that value comes from legacy fiat, the exact system we are trying to undermine, is quite foolish. Value comes from network growth. Can venture capital promote network growth? In theory, yes, of course it can. Does this actually happen in reality? Not really.

What is the goal of a venture capitalist?

To make money: that is all. VCs want to invest in tech startups at the ground floor, corner the market, and rake in an x1000 return with the power they acquired from the deal.

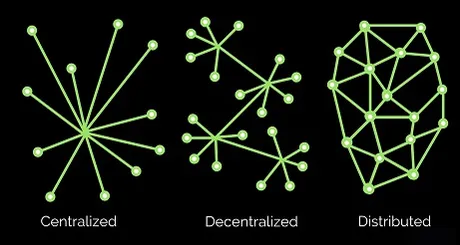

Can we see where this is going? Venture Capitalists want to control and dominate the things they are buying, which is totally counterproductive in the world of crypto. The more venture capital a project gets the less they are going to succeed. Real networks build value from within.

This becomes obvious when we look at enterprise blockchain aka permissioned KYC blockchain. It's a totally worthless inefficient piece of garbage that doesn't do anything unique. It doesn't matter how many billions they throw at it, it's not going to work because they want 100% control of the system. No one's going to sign up for that when their are superior options available (permissionless borderless networks with provable ownership).

Less blood-diamonds, more diamond hands.

These networks don't need anymore greedy assholes looking to maximize their returns. They need diehard loyalists who will stick it out no matter what happens. I saw this happen firsthand when Steem crashed from $8 to 8 cents. A 99% reduction in perceived valuation flushes out all the non-believers and leaves only grizzle and bone behind.

30 cents is still a very low valuation for Hive. Personally I value the token around 80 cents based on major support levels from 2017/2018. At the end of the day, todays price matters very little. Hive is going places and the community will ensure that, no matter how much funding is backing these projects.

Think about how corporations work.

The vast majority of the time corporations allow themselves to be bought by the highest bidder. Why is that? Because the outcome is better for all parties involved. Scaling up is hard when one is relying on paper thin profit margins. Scale up too fast and you may just end up bankrupting yourself without the volume and profit margins to justify that action.

Allowing the company to be bought by some juggernaut above you solves all these problems. You'll make more money selling your company, the company that bought you will make more money than allowing you to compete. Everybody wins. Centralization wins. It is the more efficient system for the real world.

But what about the digital world?

In a decentralized system with near zero overhead and infinite room to scale up, none of these legacy rules apply. Why would you sell your "company" when you can just... not do that and rake in all the profit yourself?

Not only that, with crypto, generating value on the network doesn't just boost the value of your own stake, it boosts the value of everyone's stake. This is the ultimate synergy. Everyone has an incentive to generate value for everyone, because the "corporation" is also a "central bank" and a "government" as well. Think about it.

- Currency

- Business

- Governance

Crypto has all of these things.

In combination with the low overhead (servers are cheap compared to how much money one can make with them) and a currency that is controlled by the "corporation/government" itself, things can spiral out of control quite quickly. There's absolutely no reason to invite legacy money to jump in on the ground floor and be a part of this thing. That's the entire point, to escape their clutches.

Frictionless systems.

I refer to this as the "Race to the Bottom", a concept I have been reiterating for three years now. The lowest friction wins, which means venture capital and legacy fiat dollars will never build anything interesting. Why is that? Because they are capitalists, and they will try to siphon as much value into their own pockets rather than trying to build the maximum of value for the network.

Therefore, when anyone real dev rolls around, clones the VC code (which can't be copyright enforced), and then gives it away for free, the VCs lose everything, and the original product becomes pointless. We saw this in enterprise blockchain a dozen times over, and we will see it again during the major capitulation phases where they give up building their own thing and finally buy into Bitcoin, Ethereum, and whatever else.

Socialism

Hive is already 20% socialist. 10% of our new money goes to witnesses, and another 10% goes to the dev fund. What is this money for? It's to pay for things that can't be monetized but still have great value to the network. Witnesses provide the security, upgrades, API connections, data organization, and whatever else. The dev fund pays for whatever we vote on. Certainly, there are pitfalls to socialism, but I think Hive has just enough to make it worth it.

Distribution

Many make the claim that the rich just get richer on Hive and it's a failed experiment. This sentiment is based on zero actual evidence, because the actual evidence points to the exact opposite occurrence. Mathematically there is very little way for Hive to become more centralized over time, short of whales buying more tokens with fiat/Bitcoin, which no one seems to have a problem with.

What are the signs that Hive is decentralized?

- Witnesses in the top 20 who don't have a lot of stake.

- 80% of all inflation is distributed by stake-holders.

- High-stake accounts are upvoting small-stake accounts.

- More than 50% of downvotes are legitimate.

- Convergent curve has been eliminated.

Normally in a corrupted system where money is literally equivalent to power in the form of voting, you'd expect only rich/powerful people to make it to the top. We see that has not even come close to happening on Hive. If any dev on the network started providing more value to the network than say @blocktrades... they would be voted into the top 20 instantly. Fact. This system is working much better than many are willing to admit. It's not supposed to be perfect, it's supposed to be good-enough.

Whenever someone with a large amount of powered up stake upvotes someone with low stake, decentralization happens. What happens when high-stakes accounts upvote other high-stakes accounts, trade votes, or self-upvote? Many try to say this centralizes the network, which it does not.

In the case of everyone self-upvoting, there is no change in distribution on a percentage basis. Five million powered up coins controls the exact same percentage of inflation as one coin does. This is especially true now that the convergent curve is gone. The one coin does not get devalued by the 5 million coins. They both control their fair share of yield.

This is especially true when we look at downvotes. Downvotes are a very mixed bag and spark a lot of outrage and psychological/social damage, but that's because we focus on a very small percentage of questionable downvotes. For the most part downvotes are justified, and mathematically only 51% of downvotes have to be good-actors trying to cut out corruption for the overall mechanic to be a net gain. Think about that for a second.

Is it really possible that more than 50% of downvotes on this platform are actually just douchebags swinging their big downvote dicks around treating this platform like their personal playground? If I'm being honest I bet that only happens like 10% of the time or less, but that 10% gets A LOT OF ATTENTION, so it gets blown way out of proportion. Overall, free downvotes have been a huge net win, which is why we didn't roll them back along with the rest of the Steemit imposed economic incentives.

Conclusion

Value comes from within. Venture capital injections and legacy fiat money is not some boon to be celebrated. It is the absence of stability. It is an attack on the network. It is a hostile takeover.

At the end of the day we need to beat these people at their own game. Take the things they've built to siphon value into their own pocket, open source it and give it away for free. DCA sell the spikes they create and DCA buy the dips to increase our stacks and make sure bad-actors don't get rewarded for their actions.

There's no reason to sellout anymore. These networks have low overhead and they scale with ease (especially if you centralize a particular service to one node). The profits are no longer paper thin, but rather a tidal wave of volatility that can yield 100x in a matter of months. Those who learn how to surf these tidal waves safely and not wipe out will be the ones who forge the future of decentralized government.

The new name of the game is no longer maximum efficiency and paper thin profits. The key to this new economy revolves around balance and cooperation. We need just enough decentralization to root out corruption but enough centralization to have focused direction and scalability. Hive is doing quite well on these fronts.

Posted Using LeoFinance Beta

Return from Building Liquidity from Within to edicted's Web3 Blog