Hive is undergoing a massive trend reversal.

This trend reversal is happening on Bitcoin and even the stock market as well, which is pretty surprising considering the current economic situation. Bears are in disbelief.

It is quite obvious that the FTX collapse was the ultimate 'anger' moment.

Even though BTC only crashed 24%, everyone and their mothers were absolutely furious and totally irrational. Pseudo legal "experts" were popping up on the scene to tell us that given the "evidence" that Sam-Bankman Fried deserved three consecutive life sentences. Seriously does that sound reasonable to anyone? He's just some dumb kid that flew too close to the sun. You would have done the same. Most people are Bronze League Heroes. That's the standard.

That situation was so grossly misrepresented in so many ways. It's still being reported that he intentionally defrauded the people and even the government. It's pretty obvious that's not how it went down, but this post isn't about FTX or SBF... so.

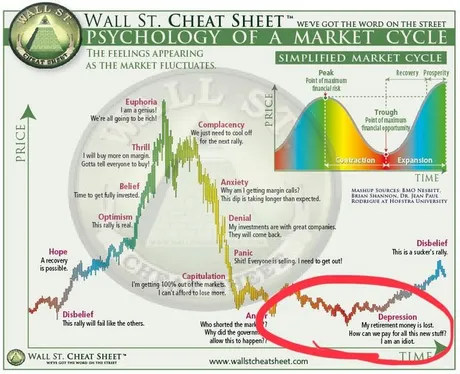

The point is that the most clear signal we've ever seen for 'anger' (potentially ever given all bear markets) was November 9th, 2022. Now all the bears see the current "bull trap" and are still somehow convinced that we are going to crater back down to $12k. The bears are delusional. We completely skipped the "depression" phase and moved straight into "Disbelief", as is often the case. It's actually ironic because the bears point to "depression" like it's a given, but this is actually just even more signal that we are in the "disbelief" phase of the cycle.

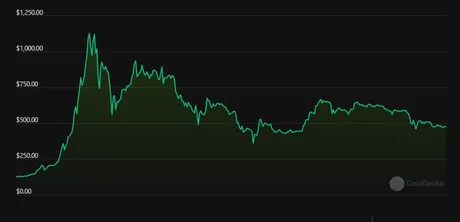

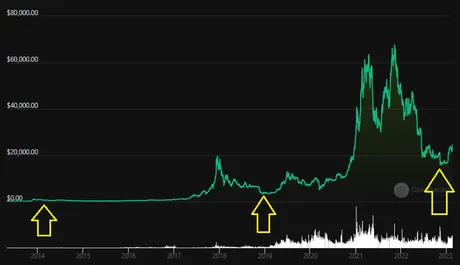

I would challenge anyone who reads this assessment to show me on the Bitcoin chart where 'depression' is. Bitcoin bear markets have NEVER like the Wall Street "cheat sheet". Never. Ever. Liquidity in crypto is thin, and the low is always made immediately during the anger phase. It happened in 2014, 2018, and 2022. There are no exceptions.

2014

ALL

We can see that never in the history of ever has the price of the market moved in the way that bears are currently deluding themselves into thinking it will. Combine this with the fact that all Bitcoin bear markets pretty much last exactly 12 months and the spot price is still wildly oversold under the doubling curve ($55k) and it's not hard to see that even though the economy is shit that doesn't magically mean we are going to make a new low. Markets are irrational... and even if they weren't it would still be smart to buy Bitcoin in this environment. The system is failing, and crypto is the answer.

Threats of recession

We've already been in a recession for over a year. Average bear markets (stock market) last 18 months. The current administration refuses to accept that that we are in a recession because their approval rating is abysmal and the current situation is largely their fault. Ignoring these inevitable dead-ends, the threat of another Great Depression is highly unlikely. I used to write blogs about how the GREATEST DEPRESSION was coming. But honestly we have to think about it logically... how would that be possible?

The Great Depression happened long before the Internet existed, and shortly after the Federal Reserve came into existence (what a surprise). Since then technology has accelerated out of control at a rate that leaves those from The Greatest generation in shock and awe. Old people are completely bedazzled by new technology and business models popping up. Just ask Charlie Munger.

When money can be printed on demand and thrown at any problem under the fractional reserve system... the systemic risk of the Greatest Depression goes down, but such events keep chipping away at any ability for the population to thrive and have the life that they want.

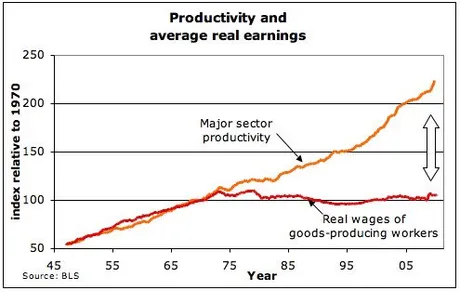

Central banking combined with the fractional reserve system have been siphoning the gains of technology since the inception of the Internet. We can see this on the charts of wealth generation vs the average wage for workers.

The divergence here is staggering and obvious.

We can see that right around the birth of computing and the Internet that pretty much all of the exponential gains of technology have been syphoned into the pockets of the elite and their cronies. Instead of sharing with the middle class and building a Utopia: greed did what it always does. We can count on that. This is why we can't have nice things.

However, the very important thing to derive from this information is that a GREATEST DEPRESSION is not possible. Why? Because a GREATEST DEPRESSION is bad for everyone, including the elite. They know it would be better to simply dial back the siphon a bit rather than blow up the entire economy and leave everyone fucked. There's no point in lording over an Empire of Dirt. But don't worry about them... because that UBI they give you is going to come with infinite surveillance and a social credit score to boot. They'll be just fine.

When the Great Depression happened, there was no such buffer. Once too much value had been siphoned out of the economy by the elite everything crumbled and there was very little that could be done about it. This is simply not the situation we find ourselves in today.

Okay well he shorted TRX so at least everyone on Hive can respect that.

This Capo character has become the laughing stock of crypto Twitter

People can't get enough of making fun of this guy as clear and obvious trend reversals kick in exactly during the time in the 4-year cycle that we would expect them to kick in. Such a punching bag. Too easy. This is why you don't short assets that move up exponentially over time. Shorting crypto will always be an uphill battle that should only be done during the proper bear-market year. That year has passed. These people are going to get wrecked.

Conclusion

Bears are in disbelief, even though Bitcoins 4-year cycle has yet to fail us. 3 years on, 1 year off. Over and over again, Bitcoin's 4 year cycle continues. And yet there are still bears who think they can get the upper hand by continuing to short even after 12 months of bear market. Why? Because the legacy economy looks like it's in trouble. Is that really a reason to be bearish on crypto? Isn't the entire point of crypto to eventually replace the broken system?

Crypto is both technology and money at the same time, and it is absolutely flabbergasting the establishment at this point. They no longer have the ability to siphon the exponential gains of technology using archaic forms of currency, because cryptocurrency is currency and will not bow to lesser forms of money.

That doesn't stop the elite from trying to classify it as anything but currency. It must be property! It must be a commodity! It must be a security! It must be anything but currency, because if it was legally currency they'd completely lose their grip on their ability to control money. They can slow down this process to a crawl, as we have seen, but they can't stop it from happening. It's only a matter of time.

Posted Using LeoFinance Beta

Return from Bull Market or Greatest Depression? to edicted's Web3 Blog