When it comes to valuable assets and what kind of function they perform in society we usually point to three main categories:

- Unit of Account (UOA)

- Store of Value ( SOV)

- Medium of Exchange (MOE)

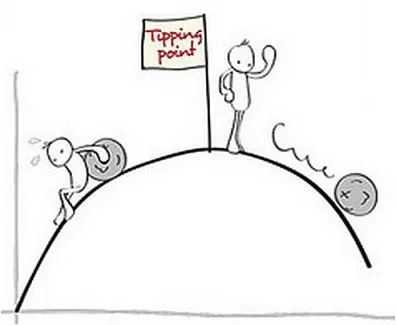

These categories are especially relevant to currency itself. When measuring unit of account, the only asset that provides this feature today is fiat currency. No other asset in the world has the same divisibility, fungibility, and countability features that fiat currency has. Most importantly, no other asset is as stable over time as fiat currency is. This is the main feature of currency that sets the legacy economy apart from crypto. Crypto (at least one) will have to become more stable than fiat in order for the tipping point to be reached and for crypto to reign superior over its dinosaur ancestors. Is this possible? I would argue that it's only a matter of time.

It's currently believed that assets can not have all three qualities. There are tradeoffs, and designers much pick and choose the priorities for their currency carefully. The recipe for a successful fiat currency is stagnant and unchanging: make it as stable as possible at the cost of it never being a store of value and constantly losing said value over time.

While I agree that these tradeoffs are real and it's difficult to achieve all three qualities, I also have to assume that it is possible to do so. When we look at the rampant corruption of central banking this is a huge overhead cost in terms of the store of value category. Those central bankers gotta get paid so they loan money out expecting interest in return (money that doesn't exist) and engage in absurdly unsustainable business practices.

Bitcoin is doubling in value every year and I would argue that it makes absolutely no attempt at being a unit of account. The value of goods can't be measured in Bitcoin because it is far too volatile, and that's fine. Bitcoin was never meant to be a unit of account. However, would it be so ridiculous to try and design a network that had much higher stability and still gain at least some value every year? It might not be 100%, but 5%-20% isn't an absurd target in this regard.

What is it that central banking does that crypto can't decentralize and automate the governance model? I would argue that there isn't some magic function out there that central banking provides that decentralization can't mimic. By cutting out the corruption of central banking I believe it is possible for a stability focused crypto to also gain value over time while also being a better medium of exchange (borderless/permissionless/private). There's nothing about fiat that can't be replicated by crypto (except perhaps the physical nature of cash; which is seemingly being phased out anyway).

Needless to say, stable coins don't count.

Stable coins are simply an extension of fiat. The central banks control stable coins. Crypto needs to provide its own stability to compete with central banking. This will mark the tipping point for the space.

Medium of Exchange

It's no secret that fiat is currently a much better medium of exchange than crypto, but this is simply due to the size of the networks. Everyone has been using fiat and effected by it since birth. Fledgling communities like Bitcoin and friends pale in comparison. This will not always be the case.

Medium of Exchange is the one feature that crypto is pretty much going to get for free as infrastructure improves. Once these networks are big enough, the potential superiorities of crypto will become reality and will never look back. The legacy economy requires every transaction to ask permission and be validated by a centralized agency. Eventually this overhead cost will be its own downfall.

Ask for forgiveness, not permission.

Store of value

There isn't a single fiat currency on the planet that is also a store of value. This is the biggest edge that cryptocurrency has in the fight against central banking. The prospect generating a passive income and breaking free from debt slavery is a very big incentive for many investors.

Personally, I think it is a mistake to even call Bitcoin a store of value. Gold is a store of value. Property is a store of value. My hundred+ year old silver coins aren't more valuable because they are old; they are valuable because they are silver. A silver dollar from 1920 is worth around $10 only because of the silver in the dollar, which really gives us an idea about how much value central banking has leeched from society over the last 100 years (~90% loss of value).

The reason I think it's a mistake to call Bitcoin a store of value? It's not storing value; It's generating it. Silver gained x10 over a hundred years when compared to the dollar. How much has Bitcoin gained in ten years? The difference is not even comparable. We have to chart Bitcoin on logarithmic graphs so it will even fit on the paper. Comparing it to gold, silver, or property is a huge mistake in this regard. Crypto is in it's own class when it comes to value generation. The value is based on the size and quality of the network, and the room to scale up these networks is near infinite when compared to stagnant assets like precious metals. Bitcoin will have hundreds of times more functionality in the decades to come, while gold will still be gold in 20 years.

More on time.

Time is going to give crypto the edge in terms of medium of exchange, but the same is also true when it comes to unit of account. The higher the market cap of Bitcoin gets, the harder it will be to manipulate the price with aggressive pump and dumps. In the end, we may not even need a coin focused on stability, as the volatility of Bitcoin will be completely overshadowed by it's SOV capabilities.

Conclusion

Bitcoin's aggressive growth and valuation over the last ten years is definitive proof of how badly we've been getting swindled by the central banking mafia. We were told deflationary economics was a recipe for disaster. We were told we needed to sit tight and trust the people in charge to do the right thing. We were lied to, and Bitcoin is a mirror that exposes these greed demons for what they really are. Currency can have it all, we just need to have an algorithm in charge of governance rather than the epitome of humanity's greed issuing our money.

Posted via Steemleo

Return from Can Crypto Have It All? to edicted's Web3 Blog