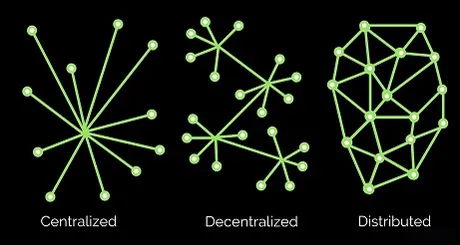

Decentralization is a Spectrum

Everything is Centralized. Everything is Decentralized. Central banking is Decentralized.

In the image above imagine the four central nodes in the 'decentralized' category were central banks. Each central bank is connected to multiple retail banks, and all the central banks are connected via the SWIFT system. It is in this way that fiat is obviously a decentralized system.

But it is obviously not decentralized enough to prevent corruption.

Which is why we are here to fix the problem.

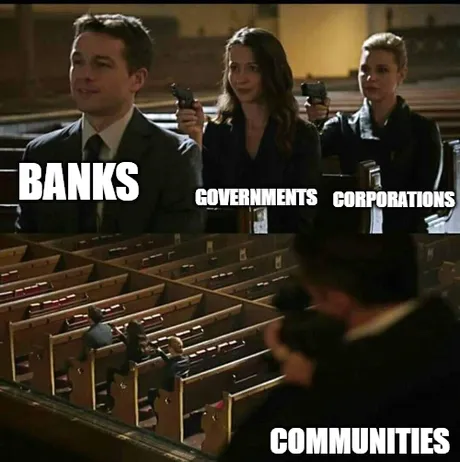

The Banks are in charge.

They even make it seem like they aren't in charge by calling themselves the Federal Reserve, even though they are a private bank with the majority share of board member seats. Now that the banks have been in charge longer than anyone has been alive, we all simply accept this new narrative as the way it's always been and the way it should be.

But the banks are weak.

The banks are dinosaurs. They are such hulking monsters that they don't even know what to do against an opponent that could rival them. All they know how to do is stomp on everything on the ground and make sure it can't grow to their size. Luckily, Bitcoin can not be squashed, and regulators have been playing whack-a-mole ever since its inception, growing back bigger after every bear market.

The BTC comet has already struck Earth.

It's only a matter of time now.

All the dinosaurs that don't evolve, will die.

But make no mistake,

many will evolve and perhaps be even more powerful than before.

CBDC

How will governments disrupt the Banks? CBDC. Interestingly enough, central bank digital currencies will not be central banks. A central bank is a bank for banks, and CBDC doesn't have any reason to give retail banks loans when they can just print money directly and distribute that value to the liquidity pools. Again, there's zero reason for a CBDC to issue loans. They are going to finally circumvent all those pesky laws that prevent them from issuing currency directly (a thing that the 'printer go brrr' people ignorantly assume they are already doing). CBDC actually allows printer to go brrr without limit, but it will still be forced to compete with the open-source opt-in attention economy.

This brings up an interesting revelation.

If a CBDC isn't a bank for banks (central bank) then CBDC currency isn't even debt. That's a huge upgrade for the entire economy. By removing debt from the economy everything becomes more sustainable.

Now, you might be thinking this is ridiculous.

Surely, CBDCs will be debt! And some of them might be. But the point is some of them definitely won't be. All CBDCs will be different. They will all do whatever they are programmed to do, in a permissionless environment. Imagine 100 CBDC currencies controlled by 100 governments. Surely, some of these currencies have been programed to have some pretty unique and interesting features.

But then the governments get 'killed' by the corporations.

And by 'killed' I mean disrupted. Remember all those "point" systems that corporations have in order to avoid securities regulation? Those will all turn into real unregulatable currencies eventually.

- The banks will have to compete with the governments.

- The governments have to compete with the corporations.

- The corporations have to compete with the communities.

None of these things are happening in a vacuum.

Once CBDC is implemented, it will logistically be impossible to ban other cryptocurrencies (unlike many assume). There's no way to spin the narrative that politicians get to be 100% in control of a currency that they force on everyone and all competition is not allowed. Everyone knows what Monopoly means. People are trusting, but they aren't THAT trusting. Everyone can see that obvious conflict of interest, even gullible citizens that normally would believe the 'official' narrative.

Not that it matters...

If crypto gets "banned" we've already seen that it can't get banned and people just ignore the ban. Just look at India: it doesn't work. Bans come from the top-down. That means when something gets banned (like Online Poker or Cuban Cigars) the ban doesn't target individuals; it targets the banks or the ports or the corporations or any other centralized bottleneck. Regulation is a centralized process. You can't regulate decentralized things, and people/communities are decentralized by nature. Only the institutions that govern the people can be regulated.

Conclusion

Decentralization is a cascading waterfall. While the banks are busing trying to control the governments, the governments are trying to control the corporations, and the corporations are trying to leech the people. What happens when the people realize... they don't need them?

It's poetic that this all takes place in a church. The church represents the infinite unknown and the faith-based mindsets that arise from trying to explain those unknowns. However, a new truth is emerging, and that truth is uncensorable and stored forever on the blockchain. This church is about to get ugly. Perhaps we need a new religion.

Return from Cascading Decentralization to edicted's Web3 Blog