The Collapse of the American Dream.

Before we begin:

So I watched this entire video the other day because it was recommended by YouTube after some other related material I was watching. It seemed oddly familiar. Only after watching like the entire thing did I remember that I'd already seen it way back in the day.

According to YouTube, it was posted all the way back in January 2011, must have been watching this during my super stoner phase. Too bad I didn't buy any Bitcoin, amirite?

So the craziest takeaway I had from rewatching this video were the references to Alexander Hamilton.

My roommates have been listening to the Hamilton Broadway musical quite a bit lately. Because they now work from home I am subjected to their shenanigans. The entire play is pretty much the life story of this Founding Father and celebrating him while explaining his "untimely" death by dueling pistol.

So the crazy thing about this 2011 video on Central Banking is that Hamilton is referenced as a villain who supports central bankers. 17 minutes into the video Thomas Jefferson is legit quoted as to why central banking is evil. At minute 18 it shows Aaron Burr getting a high five for killing Hamilton... lol!

So it's crazy to think we have this masterpiece Broadway play that essentially celebrates the guy who implemented central banking in America (or is it?).

The only reference the play makes to this is his "financial system". Good call, Lin-Manuel Miranda · 2015 Woof.

The comments are interesting as well.

Apparently YouTube is censoring this video as far as it pertains to the "Federal Reserve" search. However, obviously it's not that censored because the only reason I watched it again was because YouTube recommended it... so there is that.

Ten out of Ten

I recommend the above video for anyone who wants to learn more about central banking. If you like old references of Back To The Future and The 300 movie, you're gonna love it :D... also, they sprinkle a bit of sexism and toxic-masculinity in there as well. Do not recommend that part for SJWs but the video is still worth it. Lot's of crazy info you won't find anywhere else.

For example:

Did you know that there was a secret meeting with codenames?

Starts at minute 19:

| Person | Codename |

|---|---|

| J.P. Morgan | Hula Girl |

| J.D. Rockefeller | Lube Job |

| Supreme Master Leader | name withheld for scary security reasons |

https://en.wikipedia.org/wiki/Jekyll_Island_Club

I wish they showed the other codenames, because Lube Job is just about the best codename ever in the history of codenames. And for an oil baron no less.

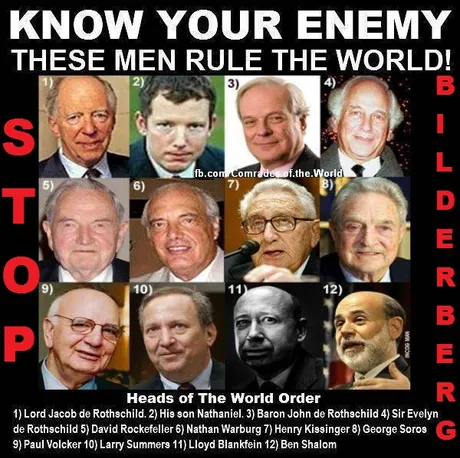

The most rudimentary of Google checks can find the "name withheld for scary security reasons"... not sure why they censored that.

Gee, what does the name Red Shield sound like again?

Again, not sure why they were afraid to make that connection. Maybe just to give the illusion like the video is privy to top secret information. I'll allow it.

Also JFK was the last president to stand against central banking.

What happened to him again?

Oh, shoot!

Pun not intended, but welcomed with open arms.

Central banks vs banks

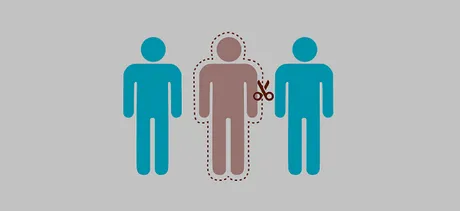

So how do they do it? How do central bank fiat currencies have a monopoly on stability? The answer is truly archaic. Central banks give 'regular' banks money for "free". And of course by free I mean it's a loan that accrues interest. Therefore, all banks are debt-slaves to central banks, owing back money that doesn't even exist, and the only way to pay back the interest on the old debt is to take out a new debt, leading to a cycle of never-ending exponentially expanding debt-slavery.

Middle-man banks then pass that debt slavery onto their clients without them even knowing it. They offer loans with the money they borrowed using an even higher and more exploitative interest rate than the central banks. They offer bank accounts who's value is extracted through inflation over time. They offer usurious credit cards that literally put a person's identity up as collateral.

To top it off, they charge VENDORS the credit card fees, so citizens again are forced to invisibly pay these fees via inflated cost of products and services, all the while thinking credit cards are a free service (not counting interest). Even patrons who never use a credit card pay for these invisible fees without ever knowing it. Truly devious and brilliant indeed.

How did we get here from there?

As the animated video explains, we frogs must be boiled slowly so that we don't jump out of the pot. Back in the early 1900's citizens were EXTREMELY skeptical of allowing paper money to replace actual scarce resources like gold and silver. Now that all those people are dead everyone simply accepts the new paradigm as "the way it's always been".

"New Normal" indeed.

It all started way back in the day when people started using gold and silver as currency instead of the archaic barter system. Vendors and merchants who got robbed acquired a demand for security and insurance. Bankers were more than willing to take the gold and silver in exchange for an I.O.U paper receipt. Thus, the first form of cash was created.

Fortunately, this prehistoric form of cash was much more divisible than precious metals. It was also lighter and easier to secure. Easier to stuff a mattress with cash than silver. Unfortunately, this cash was just worthless pieces of paper that could be counterfeit by bad actors or even the bankers themselves.

Automate out the middleman

Crypto is coming to "fix" this problem, and if you think it's the central banks who are going to take it on the chin, think again. Crypto eliminates the middleman. Who's the middle man in this scenario? The banks! Who loses? The people! Ouch!

Think about it: CBDCs are already pretty much a guaranteed thing. Once USD 2.0 hits the market and can be stored inside crypto wallets, what happens then? Every other stable coin pegged to USD will be viewed as competition to CBDC USD 2.0. There's a very strong chance of any stable-coin other than USD 2.0 on American exchanges being made illegal.

However, the issuers of stable-coins are corporations, and corporations have a lot of political sway and power, so they won't just roll over and let this happen. With this in mind, it's much more likely that once USD 2.0 is ready to roll out, USD will be printed into infinity, making every stable coin in existence worthless and extracting all value from anyone foolish enough to hold fiat currency. Welcome the New World Order 2030. Major shit is going to happen over the next 10 years.

Don't worry, the hand-selected corporations/banks will get bailed out by the government when this happens.

Shit rolls down hill.

Why can't we make our own stable coin?

This is something I talk about a lot. Central bankers are not geniuses. Quite the contrary. They've been in power so long the only innovative thing they are good at is stopping anyone one else from competing. They do this through force, be it physical or through the legal system. The biggest mobsters in the world perform most actions legally because they control the law and the justified narratives backing them.

This really raises the question: Why the F isn't anyone trying to create a stable asset based on the merit of the network itself instead of pegging it to USD? Clearly such a thing must be easier said than done, or it would of happened by now.

Again, how do central banks do it?

The only way to keep an asset stable is to add supply when the demand is high and remove supply when the demand is low. Central banks traditionally focus on adding supply rather than removing it. They simply print more money out of thin air and loan it to the banks at interest.

What if the banks don't take the deal?

Then the central bank lowers interest rates so that statistically more banks will take out loans. A higher interest rate means less money is entering the economy.

However, now we find ourselves in a position where the system is so broken that interest rates have been extremely low or zero for over a decade (since the housing crisis). There isn't a lot of rope left. The tools in their chest are rusting.

Now they flirt with negative interest rates (paying banks to use their product) while engaging in quantitative easing, buying stocks and bonds direct from the market. This allows them to remove money from the supply pool by selling the stocks/bonds to buy back their own USD product... seems flimsy at best.

Again, why is no one trying to make a real stable-coin?

How hard can it possibly be to make a decentralized network that adds money to the supply when its in demand while removing it when it's not? Apparently it must be really hard because no one is doing it. Either that or they're just lazy or afraid from the retribution received from the central banking sector. Who knows.

Truth be told, even Bitcoin could accomplish this stability if it wasn't under constant attack. If big whales got together and set price targets Bitcoin would not only be stable, but also stably doubling in value every year. The problem with that is if such a price target was set on the upper bound, central banks could just buy out Bitcoin in an instant and own the entire network. Not gonna happen. So we have what we have: a super volatile free market.

Conclusion

Central banks are fearsome enemies that own the entire world while 99% of the population remains 'blissfully' ignorant. Right down to the language of "Federal Reserve", everything they do is a complete farce.

I've just been told California is going to lockdown again for another month. "Together we can flatten the curve." Gotta love how easy it is to get half the sheep to agree with you at all times. They must be right because the other side is clearly wrong. Obviously both sides can't be wrong! Right? Right! Yeah, we're smart! lol Jesus Christ.

I trust them because they are trying to save lives!

The people in charge care about us! They prove it all the time! That's why they are doing all this, for our protection!

The real Trolley Problem.

Posted Using LeoFinance Beta

Return from Central Banks vs Banks to edicted's Web3 Blog