No, I'm not talking about recycling. Recycling is overrated. Reduce and reuse are superior forms of conservation.

I'm talking about crypto. Big surprise, I know. We need to end this whole speculation nonsense. Cryptocurrency is the foundation of a superior economy and we need to prove it.

How to close the crypto-loop.

It's quite simple really. People get paid in crypto to do a job, and crypto is accepted at vendors to be spent by the citizens who worked for it. Loop closed. Fiat obsolete. Easier said than done, amirite? How can we begin to bridge the gap?

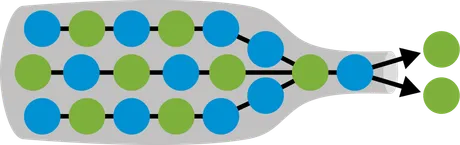

Fiat to crypto and crypto to fiat bottleneck

The establishment is watching these entry and exit points like a hawk, and for good reason. This is the easiest way to control a speculative asset that can only be acquired by piggy-backing on top of the established fiat currencies. The obvious response is to break this control.

First will come the decentralization of fiat to crypto. This is what projects like Dether are trying to accomplish. Dether is basically trying to be the craigslist of crypto. Hand someone cash and they'll give you crypto for it. It's a long shot but maybe it will work out. However, there are many more examples of decentralizing fiat/crypto pairs. Only one of them has to come through for the bottleneck to be rendered useless. Even better still, once the bottleneck has been neutralized then the establishment will have significantly less incentive to regulate the remaining centralized exchanges.

Second

Small businesses need to be approached with zero-risk zero-cost solutions to accept crypto payments. Vendors already accept credit cards, which charge the vendors around 2-4%. Most companies operate off of razor thin profit margins, so this small number is actually very significant. The more cryptocurrency undercuts this overhead the more incentive small businesses have to accept it.

The overhead cost of initially implementing the infrastructure should not be placed on the vendor. Cryptocurrency is strong enough to take the brunt of all the overhead costs.

Projects like TenX and BitPay are already working hard on this problem, but I believe that their business model is just the beginning. They are trying to pair crypto to fiat through ATM cards and it's kind of a regulation nightmare. I believe there is a better solution in the future.

This is why I'm constantly thinking about Steem and it's place as a payment coin. Three second blocks guys. Three seconds! That is at least just as fast as these new chipped cards.

Volatility

Because of the razor thin profit margins, small businesses can not afford to hold volatile crypto assets. This means payments must be transferred to fiat or a stable coin immediately.

How hard would it be to set up a bot that transferred Steem to Binance and then exchange it for a stable coin? I'm guessing it would be stupidly easy. (It's SUPPOSED to be even easier, but unfortunately our stable coin SBD isn't stable.) These connections that haven't been made are so trivially simple I can hardly believe they don't exist yet.

Three seconds for the transaction to get confirmed. Three more seconds for the Steem to get to Binance. Near instant to trade the Steem for a stable coin. On the average, the speed of this chain of events guarantees that the volatility will be reduced way below the 2% minimum fee of a credit card. This is especially true when you consider that Steem has no transaction fee and the Binance fee is a max of 0.1%.

Not only that, volatility is not a fee. Volatility is simply a risk. Can you imagine a vendor accepting a credit card and sometimes magically being paid an extra 1% instead of always losing 3%? This is a real possibility with stable crypto payments.

If you look at other "payment" coins like Litecoin it still takes 2.5 minutes per block. To be confirmed on Binance you need 4 blocks (10 minutes). 10 minutes compared to 3 seconds is obviously a huge difference. These so called payment coins will continue to simply be stores of value until they evolve a bit more. Steem is already here and raring to go.

Dether

This is another reason why I'm bullish on the Dether project. Not only are they trying to be the craigslist of crypto buying/selling they are also making a push for crypto to be accepted in stores. Already their app (which I haven't gotten working yet) is an extension of the MetaMask wallet and provides access to Ether, Dether, and Dai coins. Dai coins are a decentralized stable coin pegged to $1. All of these coins exist on the Ethereum blockchain.

Uh, Okay, but what does this have to do with Steem?

Now the small business has crypto in a Binance wallet in the form of a stable coin. What then? Perhaps Binance was the wrong choice because there are no fiat/crypto pairs yet. Unfortunately, Coinbase also doesn't have stable-coin to fiat pairs. You would have to turn your stable-coin into Ether and then risk another volatility swap and two more trading taxes. EthFinex has the ultimate USD/DAI crypto pair but is also currently banned in the USA. The more obvious choice is Bittrex because they have four crypto/fiat trading pairs and two of them are stable coins.

No, Seriously, what does this have to do with Steem?

If Steem wants to be taken seriously as a payment coin we need to have a stable coin. SBD has failed in that respect. We must either connect to a decentralized stable coin like DAI or make our own stable coin that actually works. With the advent of Steem oracles and SMTs this may be a real possibility. We'll have to wait and see. Until then, this community should really be making bigger pushes to be accepted in stores.

Why hasn't it happened yet?

Their are no carrots. Very few people are willing to work for free and risk that work be all for nothing. There are no short-term incentives for this community to actively engage in Steem being accepted in stores. Again, perhaps SMTs will change this, but again, that involves just waiting around for it to happen. Such is crypto.

Possible solution: Crypto Cashbacks.

Again, back to Dether and Binance. Dether wants to be the craigslist of crypto, and small businesses now hold crypto. What if there ended up being more customer demand to buy crypto than there was to use it as payment? Imagine it, you go into a store and it says, "Now offering cryptocurrency cashbacks!".

I assume everyone knows what a cashback is. Your card gets charged extra and the store gives you cash in return. What if instead of cash you got crypto instead? If it was legal, profitable, easy, fast, and low-overhead everyone would start doing it.

Now you're in a situation where perhaps, as a business owner, you don't even need to use an exchange to swap your crypto for USD; you can do it directly with your own customers. Crypto is not even close to mainstream yet, so it would be great exposure and an interesting novelty product at first. If the demand outweighed the supply, vendors could start charging a novelty fee for crypto cashbacks and make even more profit. As luck would have it, Dether already offers this functionality and sellers can charge any fee that they want to. Honestly, I think that this is a real possibility considering that most people currently think the space is totally speculative. Once you show them that it isn't and you provide easy access they will be all over it.

proof of brain

Proof-of-brain is more like trick-the-brain. The way this blockchain is set up has a very interesting effect on the psyche. When you upvote someone, it doesn't really feel like you are giving money away, but you totally are. Imagine if you couldn't upvote anyone. Instead, all inflation would be placed into your account in the form of SBD and you would now be expected to tip people with your SBD. The end result of these two systems should be the same, but they would not be because users would be even less willing to give up money that is already sitting in their account. Steem creates the illusion of obscured ownership. The way that the system is set up has the effect of promoting slightly more decentralization.

I bring this up because the Steem platform can use it's unique model as a foundation for business that can not be accomplished on the vast majority of other blockchains. We can delegate resources to the projects we deem valuable in a way that other blockchains simply cannot do at the moment. This is a big reason why we have a real shot of becoming a legitimate payment coin. Creating short-term incentives and baby steps for the community is of the utmost importance. Leadership and organization are the biggest hurdles to overcome in a decentralized environment, but I believe that we can overcome. If we don't another community surely will. It's only a matter of time and everybody wins.

Third

Haha, yes, I'm still counting. First, we break the bottleneck. Second, we get vendors to accept payments directly. Third, we provide jobs to the community. This is by far the most difficult step to achieve, which is why I believe that this order will be followed.

This is another reason why I bring up proof-of-brain, because I think that Delegated Proof of Stake communities are in a much better position to pay workers for things that need to get done. The infrastructure isn't here yet, but the foundation has been laid.

Personally I feel like an idiot spending time writing this post on the off-chance that I make a few dollars. When I look at projects like Steem Monsters absolutely flooding my feed I know in my heart that I should be putting all my effort into the blockchain games I want to create. Unfortunately, it's a massively daunting undertaking.

Even stranger is that Steem Monsters doesn't even incorporate Proof-of-Brain and the community just seems to be throwing money at it left and right. I want to make games on the blockchain where people get paid to help develop them. I want to go even deeper than that. I want people to get paid to simply play my games. If you like Steem Monsters, just wait until the paid-to-play business model becomes a real thing. Make no mistake, even if I remain apathetic there will be many others lining up to fill that opening.

It's an extremely difficult task: simplifying the act of development so that a larger community can partake. However, it is bound to happen. Many games out there have die-hard fans that are more than willing to create content for free. Imagine what it will be like when those fans are actually getting paid for their work.

Conclusion

The crypto-web has a long way to go before it's taken seriously by mainstream society, but one way or another, that time will come. Leadership, organization, and fair distribution are the key. Patience is a necessity. Close the loop; kick fiat to the curb.

Return from Close The Loop to edicted's Web3 Blog