Wanna see something crazy?

Yep

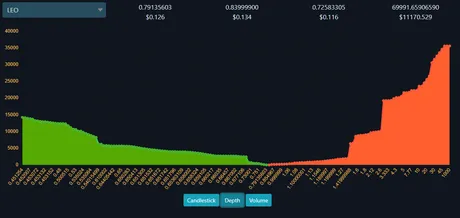

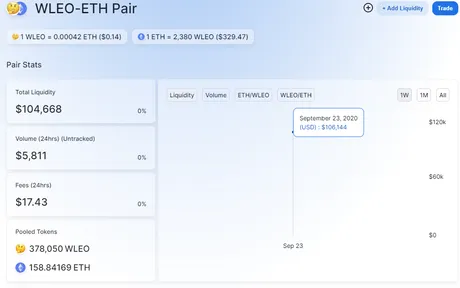

You can now buy hundreds of dollars worth of LEO (via wLEO) without impacting the price.

You ABSOLUTELY CAN NOT DO THAT ON HIVE!

https://leodex.io/market/LEO

Right now there are only 180 coins posted at this price. That's what? $20 in liquidity until the price spikes 15% on HiveEngine? Meanwhile anyone with ETH can crank it up to 11 and stack some serious bags. Not gonna lie... I'm thinking about it.

I still have to wait 5 days before my first powerdown goes live. I have 500 coins from blog rewards but I know for a fact that all the contact switching and gas fees create a high probability of loss.

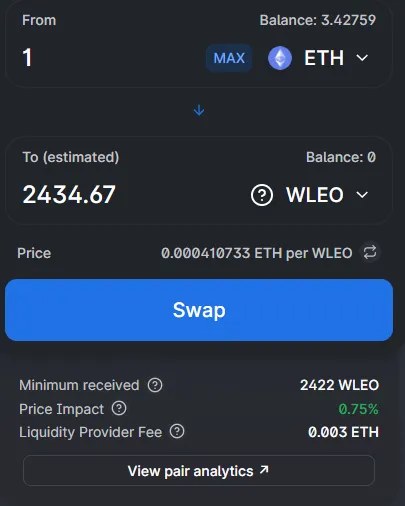

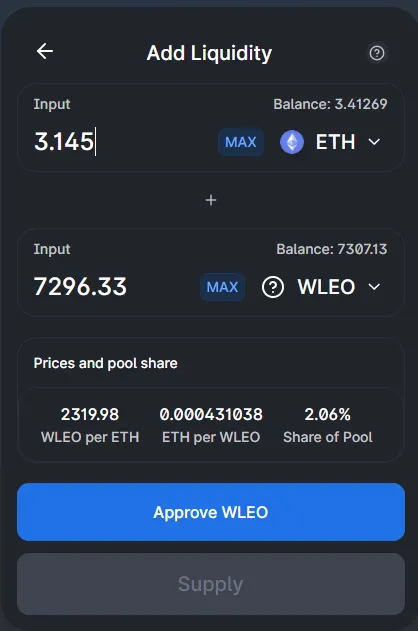

Just bought 3 ETH worth of wLEO

I just now threw down about $1000 on wLEO via Uniswap. There was less than 2.5% slippage, which is amazing... to be able to buy that much LEO and not have the price move. It's FOMO time, friends!

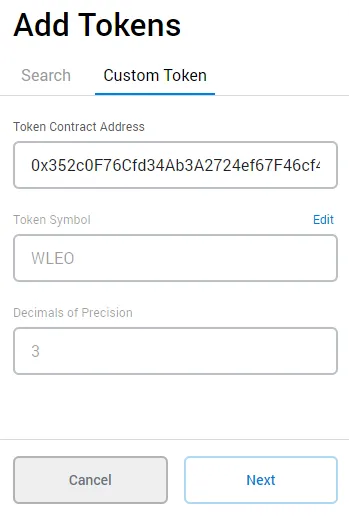

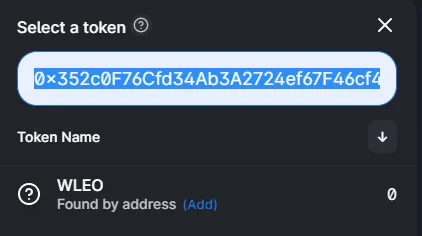

Contract address:

0x352c0F76Cfd34Ab3A2724ef67F46cf4D3f61192B

This address is very important. You can use it to do various "hackish" things on the Ethereum network. This particular address belongs to wLEO, and you can use it for all things wLEO related.

For example, you can add this contract to your Metamask wallet to keep track of your tokens:

Assets >> Add Token >> Custom Token >> Token Contract Address >> 0x352c0F76Cfd34Ab3A2724ef67F46cf4D3f61192B

I was actually super impressed that MetaMask already knew this token was called wLEO and auto-filled the name and a precision of 3. That was not the case when I added Uniswap token to the list. I had to tell it the name was UNI by hand.

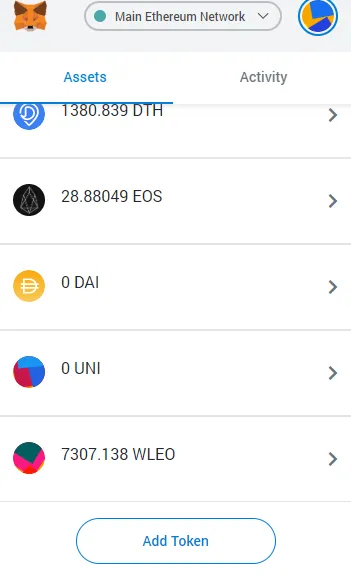

Now wLEO appears on my MetaMask token list.

Now trade wLEO on Uniswap:

https://app.uniswap.org/#/swap This is the site for swaping tokens on Uniswap. You can simply add the token contract to the end of this link.

https://app.uniswap.org/#/swap/0x352c0F76Cfd34Ab3A2724ef67F46cf4D3f61192B

Uniswap will auto-redirect to the correct syntax:

https://app.uniswap.org/#/swap?outputCurrency=0x352c0F76Cfd34Ab3A2724ef67F46cf4D3f61192B

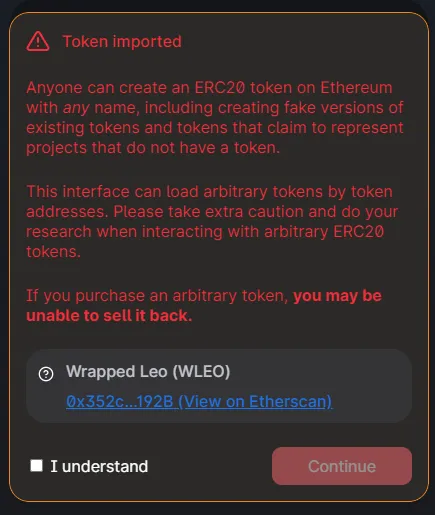

Why the scary warning?

Because wLEO creation is totally centralized. Theoretically wLEO could be created out of thin air to drain all the ETH out of the pool and destroy the entire ecosystem. You must trust the founder of LEO (@khaleelkazi) to not exit-scam and to not get hacked until we have a more decentralized solution.

I was able to purchase 7307 coins for 3 ETH. At today's prices this comes out to 14 cents a coin after fees have been taken into account. Pretty good considering I would have gotten railed on HiveEngine if I tried to buy that much.

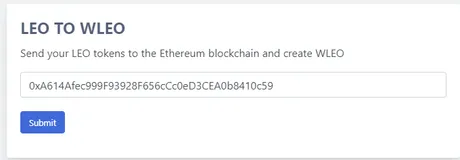

Contact switch #1: trade LEO for wLEO

Visit https://wleo.io/ and enter your Ethereum address. I recommend MetaMask because it's amazing and everything uses it (including UNI). You can connect MetaMask to your hardware wallet if you want more security.

Because I only have 500 liquid LEO at the moment it doesn't make much sense to trade it for wLEO (the fee could be as high as 50 LEO which is 10% of what I have... not worth... waiting for powerdown.

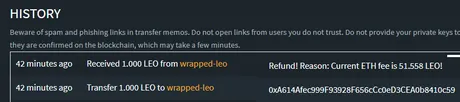

However, what I did do was send 1 LEO to the swap bot.

This resulted in an error:

While this appears to be an error on paper it does exactly what I want it to do. Now @khaleelkazi and the wrapper bot know exactly which account to credit while I yield farm the pool. Even though I didn't actually trade any LEO for wLEO the bot should figure out that 0xA614Afec999F93928F656cCc0eD3CEA0b8410c59 is connected to @edicted, and I can get paid twice as often and with zero fees on the Hive blockchain instead of ETH.

If this is indeed the case as I assume it to be, it might be an opportune time for a black-hat hacker to swoop in and start claiming yields by faking these transactions and pointing other user's yields into their own wallet. I'll discus with @khaleelkazi how this is to be avoided...

Now I need to add liquidity to the pool.

You might have a hard time finding the wLEO token in the list of Uniswap pools. Again, this is to avoid noobs from entering scams like the chumps they are. Once again, we use our hackish solution of simply tagging on the contract address to the end of the URL. https://app.uniswap.org/#/add/ETH/0x352c0F76Cfd34Ab3A2724ef67F46cf4D3f61192B

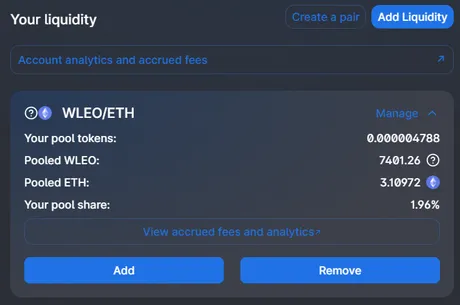

And I've done it!

It says I'm now providing 2% of all liquidity in the market... pretty good. This is especially true considering the founding team threw down $50,000 into the pool. I threw down around $2000, so that means the pool is already up to around $100,000, which was the ultimate target to get started... and we've already hit it within the first couple hours of launch.

When it comes to yield farming the bounty, my total contribution is closer to 4% of the total pool. If no one else added liquidity at this point I would receive 4% of the 300k coin bounty... that's 12,000 coins for free in the next three months... lol. I'll take it... nobody else do this :D

Gonna have to come up with another $1000 or more worth of ETH once my next powerdown completes in 5 days. Should be another 8750 coins I add to the pool. Good shit.

Other contact switches

The first gas cost is getting wLEO. Whether you do that via buying it on Uniswap or wrapping it with the bot, you're going to incur gas fees. From there you have to "Approve wLEO" to be traded and stored in contract form on Uniswap, this cost me another $1.50. Then I actually had to provide liquidity to the market which cost me a lot more ($4.95) because it's a bigger contract. Buying the wLEO off the market was also around the same cost ($5.10).

So all in all I spent over $10 doing all this stuff. Luckily the amount of money I'm throwing around is large $2000, so $10 isn't that big of a deal compared to how much I'll get from yield farming (hopefully). It all depends on the price of ETH and wLEO after 3 months. Personally I expect both of these to outperform BTC, which is why I pulled this $2k from my BTC reserves.

Checking my work.

It took a little messing around but I was able to "import" the data on my pool share. Again, because anyone can make an ERC-20 token, navigating Uniswap is a lot harder with a completely unknown project like wLEO because it doesn't show up on any of the official lists yet. The contract address is key.

0x352c0F76Cfd34Ab3A2724ef67F46cf4D3f61192B

Looks like I still own ~2% of the pool (4% of the bounty).

Cool beans.

https://uniswap.info/pair/0x85c4f11c4b3887425762e9d7e63774f087411dcf

Napkin math confirmed

Indeed, we have hit our target of $100k liquidity.

Go LEO!

Conclusion

Seeing this up and running makes me a lot more bullish on the LEO network. wHIVE had little to gain by being listed on Uniswap. However, LEO's liquidity was always hammered dogshit. Now anyone can trade thousands of dollars in either direction without having to worry about slippage. Liquidity for LEO via Uniswap is x1000 more important than it was for Hive. Good stuff.

I'll continue farming the pool for at least the 3 months of the bounty period. Hell, if we have enough daily volume I'll just leave it in there to continue farming just like the dev team is doing. That's the goal anyway.

Updates to come.

Feel free to ask any questions below.

Return from Contact Switch Overhead: wLEO crash course. to edicted's Web3 Blog