Valentine's Day in Two Days

Coincidentally the CPI report comes out that day as well. We all know the market has been frantically trying to speculate on the CPI as it relates to 'inflation'. Why? So it can try to speculate on what actions the FED will take to fight 'inflation'. Why? Because the rule is that you don't fight the FED, and we want them to end their war against 'inflation' and pivot these fund rate hikes.

Bad news is good news.

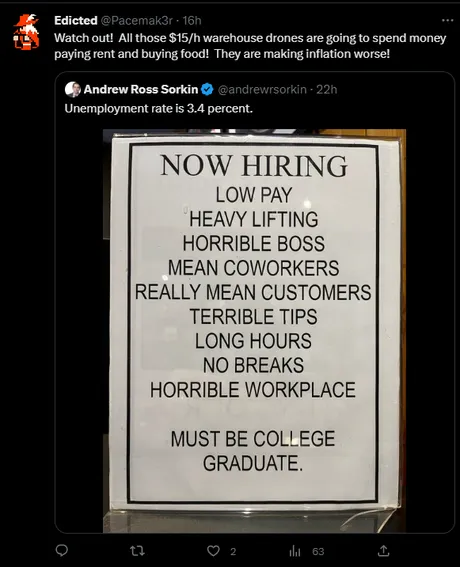

Because the market has this obscene hyperfocus of not being allowed to fight the FED, this toxicity creates incredibly weird and irrational outcomes. The classic example is that the market wants to see a higher unemployment rate because the FED wants to see a higher unemployment rate. What's up with that? The answer was actually framed quite well on a Tweet I saw yesterday.

The FED is trying to spoon-feed us this concept that low unemployment is bad... because if citizens are employed then they are making money... and if they are making money then they are spending the money... and if they are spending the money this is akin to demand-pull inflation that will cause prices to rise more.

Economists love to build these towers of assumptions and act as though they are completely infallible. As the meme aptly points out, the jobs that people are working are absolute shit compared to what the job market was like decades ago. How can low wages lead to this mythical inflation they are talking about? People barely have enough money to get by as it is.

The logic is absurd.

But nobody seems to care. DONT FIGHT THE FED. BAD NEWS GOOD! I can only assume that the FED knows exactly what they are doing and simply is shining us on as their cronies continue to insider trade this market. We may get front row seats to one of these events tomorrow, as we often see suspect behavior in the markets the day before these "important" reports are announced to the public. A pump tomorrow assumes a CPI with low 'inflation', while a dump implies the opposite.

Looking at the crypto market, Bitcoin has gone up a tiny bit since yesterday, but the volume is still piss poor abysmal. I have to assume for multiple reasons that a dip to $20k has a pretty significant likelihood. With volume this low it could catalyze at any moment.

If we want to bring Goddess Moon into this conversation, as I sometimes like to do, the new moon comes on Feb 19-20. If we get a clean pattern there a small pump will come in around that time with a definitive dump after. Of course even the crystals girls haven't been talking much about the moon cycles lately. Perhaps their Goddess has abandoned them for now.

As far as Hive is concerned there are at least three or four metrics that point to 35 cents being a massive line of support going forward. Both the MA(100) and MA(50) are there and are currently in the middle of a golden cross. The golden cross between MA(25) and MA(100) also happened here. Drawing a straight line across 35 cents also shows that this was a key price during the vast majority of the FTX contagion fiasco. I'm basically all in on Hive if we get back to this level. Feeling pretty confident here.

And then there are moments like this that make me want to take all the dry powder I've saved up and just YOLO into the market right here at this 44 cent price point. We can see that just hours ago Hive mini-pumped above the MA(200), which is exactly the kind of action that we'd want to be seeing right now, especially considering we just got that golden cross yesterday.

Of course I know in the back of my mind that this is probably just the psychic-vampire market whispering to ape in without thinking about it so I can provide exit liquidity down to 35 cents. Not today, Satan! I'm continuing to maintain a balanced position between both liquid Hive and HBD so that I have options in both directions. That's a first, amirite?

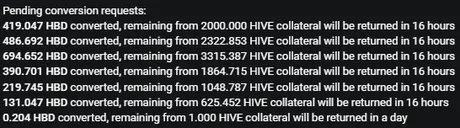

Oh yeah... my liquid Hive...

I'm not sure how much I made from my conversions 4 days ago, but I definitely made something. I know I started out with around 5000 Hive, and was promptly returned 5862 Hive this morning. Like I said before, I think I'm up around 700 Hive. Not too shabby considering the circumstances. I'll take it!

So with these two positions (5800 hive; 2000 HBD) I will proceed to wait and see what happens. Hive spikes up... I'll sell a little bit. Hive crashes down: I buy. Easy peasy balanced position for the win. This is a rare occurrence for me. Mark the date.

Conclusion

Tomorrow be on the lookout for that insider trading I was talking about. If the market goes up "randomly" and then a day later a favorable CPI report comes out... let's be honest it probably wasn't a coincidence. These people get caught insider trading time and time again and they don't even get punished these days. It's wild.

The FEDs strategy for combating "inflation" makes zero sense in the context in which they present it, but makes perfect sense in the context of insider trading and popping bubbled markets. Volatility is a trader's best friend, and if you can overleverage a bull market for 15 years and then pop it on demand making money in both directions, that's just a double victory lap.

I think the CPI has a pretty good chance of continuing the trend and confirming that the worst phase of higher prices is behind us. After all, the metrics they are using are archaic, ridiculous, and trailing indicators. Low unemployment should not even be considered. The CPI is the result of supply shock and temporary cost-push inflation. Worldwide geo-political response to COVID and Ukraine are the main reason for all this volatility, but everyone demands that the FED fixes it by crippling the debt-market. How is that logical? I guess we are about to see how it's all going to play out once and for all in 2023.

Posted Using LeoFinance Beta

Return from CPI Valentines to edicted's Web3 Blog