Regulators all around the world as still scrambling to put a lid on crypto.

- Even after losing the Ripple case (secondary sales are no securities) the SEC has declared they will take the case to appeals court.

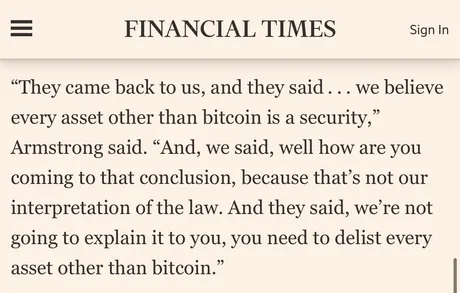

- It's come to light that the SEC told Coinbase they should delist everything except Bitcoin before sending them a Wells Notice

- The Nigerian SEC has accused Binance of illegal operations within the country.

Today this is the bombshell news that finds itself front and center.

There are quite a few implications to be drawn here, the first of which is that Brian Armstrong was clearly feigning surprise when Coinbase got issued a Wells Notice from the SEC with the intention of being sued by the regulator. Seriously how are you going to act surprised if they tell you beforehand that they think everything but Bitcoin is a security... and then when you ask a followup questions they just tell you to shut up and do as they say. lol. Okay then.

- Ignore

- Laugh

- Fight

- Lose

But on another real level it's quite clear that the "Fight" stage of this crypto battle is ramping up into high gear. The gloves are coming off, and real punches are being thrown. Of course punches like this can only land on centralized agents, which are exactly the agents that crypto doesn't want around, so it's somewhat ironic and funny when looked at in the long run. The SEC is doing us a pretty big favor by forcing decentralization across the board.

Crypto banks were never meant to exist, which is why "be your own bank" has always been a thing. On the same side of that yin-yang coin is the fact that crypto is for everyone; it doesn't discriminate. So we must accept that crypto is also a tool for banks and even governments as well. Whether that tool is utilized correctly is up to the people to decide. It's no secret that citizens are willing to trade freedom/privacy for security/convenience (or even the illusion of them).

Why are the SEC maximalists?

Why only Bitcoin? On a personal level I think the answer is quite clear. Looking at these things globally and using intuition presents the answer instantly. It is not possible for the SEC to vet every single crypto asset, nor is that in their best interests.

Normally in cases like this the SEC would come up with a plan and some kind of clear-cut regulatory framework for crypto, but they can't do that either. Crypto is simply too complex and downright smarter than anything the SEC could throw at it. As soon as the SEC laid down the rules: hundreds of tokens would find a way to loophole around it like swiss cheese. The SEC understands this, which is why they've chosen the regulation by enforcement path for so long.

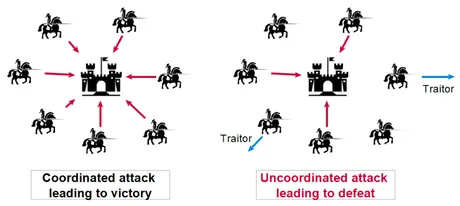

So why Bitcoin? Because the SEC (and the government) need crypto to be as centralized as possible to control it. So while all the maximalists are cheering that hash rate is going up while price is still low... this does not point to higher security like they espouse, but rather a centralization of hash power and the threat of 51% attack.

However even the 51% attack is a red herring

Bitcoin will never be under threat against such an attack, even if regulators actually do end up capturing it. The real threat is centralizing mining so badly that most (if not all) of the blocks that Bitcoin mints are whitelisted by the regulators. Don't be surprised if one day it's deemed illegal to post a block to the chain without using the appropriate blacklist to sanction the baddies.

With all this in mind it makes perfect sense why the SEC would say something like "only Bitcoin". Bitcoin is already a difficult enough beast to handle. Allowing anything else into the mix makes the situation completely unmanageable.

But again all these points are moot in the face of eliminating the banks in the first place. If people are accepting crypto for goods and services directly the banks become completely circumvented and meaningless. Perhaps even the vendors become mini-exchanges in this regard, with the ability to allow people to exchange value right there directly in store (kind of like a cashback program now that I think about it).

But will the regulators try to make that illegal as well? I mean probably, but again it doesn't matter. At a certain point the law no longer makes sense and people just ignore it because of how absolutely ridiculous it is. Look no farther than prohibition of alcohol in the United States history books to see what happens when you try to impose such Draconian bans. You can't police the people if the people are the police. Perhaps that's why they need robot/AI police going forward, which is a whole other can of worms.

In other news

Nigeria has accused Binance of illegal activity in the country, which of course is true. Nigerian citizens are not allowed to really engage with crypto at all. You can literally get picked up off the street and carted off to interrogation if the cops simply suspect you might be using crypto or refuse to unlock your phone. There are many tales of this happening directly on the Hive blockchain if you care to look them up.

The fact that Nigerians are still able to use Binance's P2P trading system is kind of hilarious and obviously also against the law. However being to actually enforce such a law seems to be quite difficult. Such is the nature of decentralization and the Internet.

The SEC said the post reiterated a June 9 warning that referred to a company called Binance Nigeria Ltd.

That's funny because...

Binance told CoinDesk at the time that the company was not affiliated with it.

Looks like we've got a classic case of the he said she said finger pointing game. CZ loves these games, and seems to always win them. As an American citizen I still use Binance non-KYC. It's called Mandala and it uses the Binance cloud tech and all their liquidity pools. Mandala hard IP-blocks any country with crybaby regulators, which gives Binance two ways to deny any wrongdoing: one with the IP-ban and the other with the fact that technically Mandala is a completely different incorporated entity and they should take it up with them. Hilarious.

You lost. Get over it.

The fact that the SEC is hinting at taking the Ripple case to appeals court is such a slap in the face on so many levels. First of all they disrespected the judges on that case multiple times, and this call for appeal is further disrespect; saying the judge on the case literally "got it wrong". Wow. These people have no shame.

At the end of the day this is simply what happens when you try to apply hundred year old laws to crypto. Everything breaks. Good thing the entire point of crypto is to regulate itself. Certainly there will be growing pains along the way, and the centralized regulators moving in to try and control everything is just a part of the normal process of decentralization.

Conclusion

The frantic nature in which regulators are poised against crypto points to one thing: mainstream adoption. None of this would be happening if more and more people weren't jumping into crypto. It is the regulators job to pave the way for such events so that it has a minimal amount of disruption to the status quo. Will they actually succeed in accomplishing this goal? I highly doubt it, but it would be foolhardy to assume that they wouldn't even try. However, the "We're not going to explain it to you; just do what we say," angle can only work for so long.

Return from Crackdown Smackdown to edicted's Web3 Blog