Crypto: The fly in the ointment.

There are so many libertarians, anarchists, and conspiracy theorists in crypto that I think we don't really know how to process all these victories in court. Even I'm a bit shocked that the SEC's appeal to overturn the Ripple case was just straight up shot down recently. We all understand that the court system is corrupt (at least to a certain extent) and just kind of assumed that we'd lose a lot of these uphill battles, and yet the SEC just seems to be folding like a precarious house of cards.

And now they're going against Elon Musk... again.

Apparently there is a new probe into Musk's takeover of the Twitter platform and the underlying stock that used to exist for this formerly public company. I can't say I'm surprised, but at the same time it's crazy to watch the SEC flail around like this taking swings and picking fights with entities that easily have the resources to annihilate them in court.

The SEC has always been one of those three letter agencies that everyone kind of low key hates, but lately it seems like they are heavily leaning into their own ridiculousness. They are losing a ton of credibility and respect while still acting like they're on top of the world. Their lawyers are constantly disrespecting the judges who preside over their cases and they blatantly project this aura of being above the law in all circumstances. It very much feels like this hubris is catching back up to them in a big way.

Coinbase

Coinbase filed a motion to dismiss the case against them and a few days ago the SEC filed a 40-page counter motion against the dismissal. Talk about overkill. I don't know if this is business as usual within the legal system but even if it was that would be even more sad. Imagine a judge sitting there reading 40-pages of legalese on the taxpayers time just to make a decision as to whether or not a case should be thrown out... and that doesn't even include the motion-to-dismiss itself. So ridiculous. When will AI do all this work for us? I'm over it.

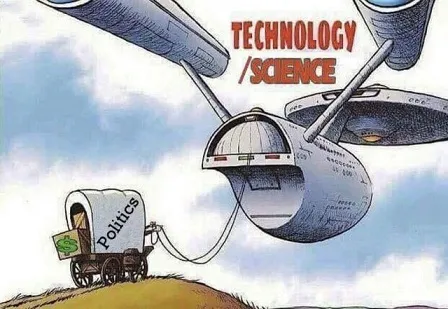

Point being that the SEC knows if the judge does dismiss the case they once again look completely incompetent. Of course they are not incompetent, just corrupt. It is basically their job to delay crypto adoption in any way they can because it runs contrary to the entire system of established power. The only way to do that is to slap down the centralized tendrils of the ecosystem like exchanges and dev teams. Not only that: they must refuse to provide regulatory clarity and continue lording over the space via subjective after-the-fact enforcement.

However we can see this strategy has severe diminishing returns. The SEC is running out of cards to play and the hypocrisy of their "we're just protecting investors" mantra is coming full circle. They are very much stuck between a rock and a hard place at this point. Banks and governments would like the lid to stay down while the pioneer billionaires would rather blow it wide open. In the end the SEC will either step aside or get completely steamrolled by Blackrock.

Actually maybe not Blackrock at all!

It's true, much of the focus is on Blackrock. Many forget that Fidelity has an application as well. But the actual development that most have glossed over for the last month was the Grayscale court victory. It is apparently a bigger deal than it seemed at the time.

When I first reported on this in late August the vibes were a lot different than they are now. At first everyone flat out assumed that the ruling implied that the SEC was being forced at gunpoint to approve an EFT and the market got really excited. Giving us a little Bart Simpson action around that time.

But then the hype instantly faded when everyone realized that actually this "victory" was just another opportunity for the SEC to say "no" at a later date and in a different way. Grayscale did not win a lawsuit for the spot ETF conversion, but rather they had just won the appeal against the SECs reasoning for denying it. I mean how hard can it be for the SEC to just come up with a valid reasons for denying it a second time?

The third option for Gensler and the SEC would be to spin a new rationale for denying the application. This new approach will push Grayscale to sue again. The previous argument—that the market size for a spot Bitcoin ETF was insufficient to prevent manipulation—can no longer be used.

I repeat

The previous argument—that the market size for a spot Bitcoin ETF was insufficient to prevent manipulation—can no longer be used.

One trick pony

Okay well that's been the reason they've used to legit deny every single one of the applications, so maybe it actually will be pretty difficult to find another "valid" reason.

7 min in

The SEC has never ever delayed ETFs in the way that they delayed it because of this apparent "government shutdown", and the response to the delay was giving guidance to the filers...

7:30

They have not denied the GBTC EFT because they are not in control of the GBTC application. If you remember back a few weeks ago: the courts handed a slap-down to the SEC made for securities-law history.

They basically said, "We have NO IDEA how you managed to come to this conclusion and deny this ETF based on the products that you've already approved."

This is a smackdown to a level we've never seen before in securities laws.

Now while this BritishHodl guy can be a pretty cringe maximalist type character he is pretty well educated on a lot of these matters. Can we take this assessment at face value? I believe we can.

Not cringe at all!

“To avoid arbitrariness and caprice, administrative adjudication must be consistent and predictable, following the basic principle that similar cases should be treated similarly. NYSE Arca presented substantial evidence that Grayscale is similar, across the relevant regulatory factors, to bitcoin futures ETPs (exchange-traded products).

The Commission failed to adequately explain why it approved the listing of two Bitcoin futures ETPs but not Grayscale’s proposed Bitcoin ETP. In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful. We therefore grant Grayscale’s petition for review and vacate the Commission’s order.”

SO ORDERED.

Keywords:

- Arbitrary

- Capricious

- Similar

- Inconsistent

- Incoherent

- Failed

- Unlawful

Uh... wow okay

You might read this as a normal person and think, "Meh what's the big deal doesn't sound so bad," but if you're a lawyer you're reading this and your like, "Holy shit the judges absolutely railed them!" Honestly how often does a judge tell a 3-letter agency that unequivocally what they are doing is illegal and there's absolutely no possible excuse for it? Once in a blue moon. The SEC is up against the ropes on this one and they are signaling with their behavior that they will indeed approve an ETF (my guess is still January).

Conclusion

The tipping point within the legal system has been reached. Crypto now has the resources to defend itself legally against the system that it is attempting to replace. Of course there's a much higher chance that we just fuse together with the current system rather than replacing it outright, but still such a transition is a massive upset to many of the powers that be. There are just as powerful players on the other side of the fight now that intend to make it happen. It's only a matter of time.

Of course none of this is actually the ideal scenario, and it never will be. More legacy money moving into the space certainly can't help with decentralization, at least as it pertains to Bitcoin. Still, we must accept reality and continue to take baby steps forward. It's very much a double edged sword, and we would do well to avoid cutting ourselves.

Return from Crypto Court Landslides to edicted's Web3 Blog