My prediction over the last month is that Bitcoin would dip to support at $20k and then spike to $25k before crashing. I also predicted that these moves would continue to move with the weird 2-week moon cycles that we are seeing.

My $5k range ($20k-$25k) ended up being correct, but support was $19k and the local top was $24k. Now we are back at $22k. The new moon is coming on the 28th, and the FED meeting is coming on the 27th. We have a few more days left of potentially bullish action but... we also have to expect people are going to insider trade the FED meeting as well as has often been the case with these things.

None of that matters long-term.

Crypto is actually spring loaded and ready to spike up aggressively at any moment. My guess is that we only have one more dip to go before we've hit rock bottom and can only go up from there. The FED thinks they can get away with raising interest rates again... and they certainly can, but they can't get away with raising rates twice in a row. I expect the CPI data and the combination of other factors is going to lead them down the wrong path of raising rates again soon.

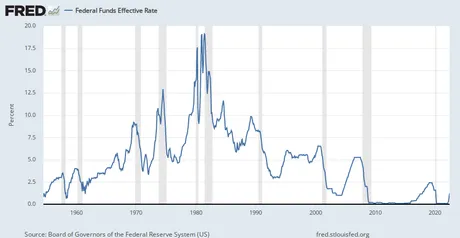

When this happens, the economy is not going to be able to handle it. The FED is going to raise rates again and the economy is going to start imploding from the pressure. To be fair the FED is out of options. The economy (central banking) is a pyramid scheme that's been operational for a hundred years now. We can see from the interest rates chart that they have zero buffer left to create any kind of "soft-landing".

Wow, the 1980's though

Right around the time I was born the economy was peaking. Everyone was making money (most of all the banks). The birth of the personal computer and the internet fueled the scam known as central banking. Central banks sucked a lot of the technological gains away from that era. It will not happen again. Money is the new technology.

But also we can see that it used to be sustainable to have like a 10% interest rate. Now when things get bad it just goes straight to zero. There's simply no buffer left. There's nothing the FED can do really at this point. Everything is pretty jacked up. Which leads me to my next point:

Risk-on; Risk-off

Crypto is seen as a "risk-on" "investment". Crypto is neither risk-on, nor an investment. This is where we see problems come in. This is when perception can temporarily become reality. Sooner or later reality kicks in though... like a ton of bricks.

Crypto is the solution to almost all the world's problems at this point (at least the biggest ones). It is a silver bullet. Putting our value into the solution to the problem is not a risk-on investment. It's the only reasonable thing to do. Crypto is a way of life. Those of us who have been around for a couple of years know this very well.

Imagine calling cars a "risk-on" asset "horse hedge", or calling the Internet a "place where people do email". Like, people do not understand new technology, but we do. We know better.

We know crypto is not an investment (unless the investment is freedom from tyranny and debt slavery). An emergent cooperative economy is not an investment. It's not high risk. It is the future.

The problem comes when people get greedy and overextend themselves. Rather than put in $1000 and become a millionaire in ten years, users put their entire net worth in thinking they are going to be a millionaire in a couple months. Yeah, that's ridiculous and stupid. Crypto will ALWAYS net a positive return after 5 years. We need to think on longer timelines and be patient.

Market slightly dips on Tesla's BTC dump declaration.

Funny how emotional the market is. Tesla sells a billion dollars worth of Bitcoin and everyone flips out? That's BULLISH. That money was a liability. Telsa sold at an average price of $28k. Now we have the opportunity to buy at $20k and everyone is mad about it? You can only be mad about it if you were grossly overextended and are trying to extract value from the community. Stop being greedy. It's not hard (it is).

Doubling curve trendline will be at $50k EOY.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Imagine what happens if Bitcoin spikes back up to the doubling curve by the end of the year. People are going to call that "an epic bull run". Bro, that's not a bull run, that's par for the course. That's the same boring trendline we've been on this entire time. We just had to get past a legacy recession first.

Crypto moves faster.

By the time the current recession we are in is bottoming out, crypto will be spiking up. The "correlation" between crypto and the stock market has never been higher than it is right now. Both are bleeding at the same time. However, we can already see the history of the correlation, and it can change on a dime. The fact that the correlation is very strong right now only signals to me that we are going to get a snapback flip at any moment. Such is the nature of crypto volatility. Just when it looks predictable it becomes completely unpredictable.

Conclusion

Even though crypto is very volatile, it is much more robust than these legacy systems built on a house of cards. The second the FED is forced to reverse course because everything is crumbling around them... well that's when we get an automatic spring loaded bull market. By the time that mainstream media admits that we are inside a brutal recession, crypto will already be spiking up and negatively correlated to stocks (or perhaps even zero correlation).

Bitcoin is massively oversold. It's not a risk-on asset. It is the future. The world is waking up to this fact quite quickly. All we need now is fiscal policy to loosen so that this spring-loaded market can bounce to the moon. Will we have to suffer another dip to $18k (or maybe even $15k?) The chance is high. Who cares? We're playing the long-game here.

Don't fight the FED. Wait for the economy to implode before going all in.

Posted Using LeoFinance Beta

Return from Crypto is heading toward a spring-loaded bull market. to edicted's Web3 Blog