First off:

I didn't realize it only takes 5 days to undelegate coins on HiveEngine. Figured it was the normal 1 week schedule like Hive. Guess not. I've started a powerdown so I can provide liquidity to the wLEO pool. At these prices even 10,000 coins is "only" $1100 so I shouldn't have to come up with much Ethereum to make it happen. Need more practice with my Trezor anyway, seeing as it's already cost me $2500 being lazy with the Uniswap airdrop.

Sister coin PAL has also gone x10 over the last month. I almost wish I bought some at 0.003. 1 Hive for 330 coins of a project that has 7M coins in circulation? Truth be told I never considered it because I haven't been hearing any talk of adding utility to the product. That's been changing recently.

@aggroed is talking about doing predictive markets and various other projects connected to PAL. Again, I was thinking about buying some just to show my support, but I'm already $2000 (5000 Hive) in the hole on that front (only worth 1000 Hive at best at the moment). I feel like I've done my part just by holding on and hoping for the best. We'll see what happens.

I'd actually really like to make a Fantasy Bitcoin League connected to LEO, but honestly connecting it to every other HiveEngine coin would probably be a trivial process. It's possible that someone like me could make something that increases the value of EVERY HiveEngine coin because it's connected to all of them. After all, they're all following the same rules with the same protocol. Interoperability is trivial for tokens of this nature. We'll see.

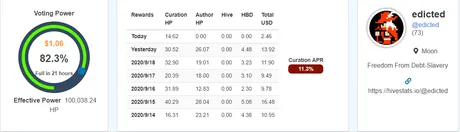

Behold the power of Hive inflation. In the wake of everyone saying our tokenomics don't work, I'd like to point out why they do work. Curation is the original gangster DeFi yield-farming technique. How many other projects can boast 11%+ APR per year?

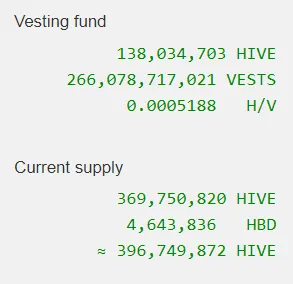

I'd like us all to stop and think about how crazy that is. 11.3% APR per year. Hive has 8% inflation per year. How in the world could my curation be upwards of 11%? Only 65% of our inflation is alloc to the reward pool. Only half of that (32.5%) is allocated to curation. So, I ask again, how is it possible that 2.6% (32.5% x 0.08) APR turns into 11.3% APR via curation?

That's the power of stake.

Once again, I am compelled to remind everyone that 370M Hive coins are generating inflation and only 138M coins are powered up. That's a ratio of 2.7 to 1. When we add the 15% inflation allocated to stakeholders back into the curation percentage modified by Hive inflation and multiplied by this golden ratio...

(15 + 32.5) * 0.08 * 2.7 = 10.25% APR

We can see that getting an APR of 11% on Hive is not only possible, but probable. All you have to do is play the zero-sum curation game better than 50% of the other curators out there. Spoiler alert: people using bots win. Anyone who throws out votes hours after something has been posted is allowing the curator bots to leech rewards. I personally do this all the time... it's fine for now.

I'm on record as being definitively against curation and how it works, but the system we have now is a lot better than most people think it is. What's more, the solutions being proposed for our "problems" are not really solutions at all and come at a higher overhead cost than is even worth to implement them.

What really needs to change is everyone's attitude as it relates to price. This network has the ultimate history of huge spikes followed by MONTHS/YEARS of downward price action. Guess what? Hive was 10 cents in April. Now it's 17 cents. That's a 70% gain. Shut up about how the system doesn't work. If you can't deal with razor thin liquidity that tends to rocket our price upwards followed by epic dumps... maybe this isn't the place for you. I'll tell you what though... it is a trader's dream. Too bad I'm so bad at trading, amirite? I'll get lucky one of these days, said the temporarily embarrassed millionaire.

Taxes

I've been talking about taxes a lot and it got me thinking about something a little weird. It speaks to how tax law no longer makes any sense because of crypto and this fact is only going to get worse.

The concept is simple

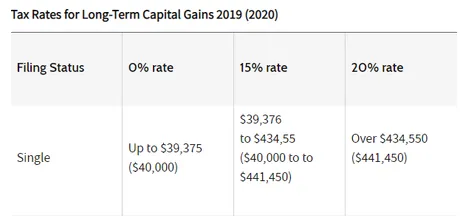

Why would inflation be treated as income? To clarify, if I choose Bitcoin for my investment, I can hold it for a year and pay all long-term capital gains tax (0%-15%-20%).

Because Bitcoin inflation is low (hard capped) and I'm not a miner, I don't have to pay any kind of income tax with Bitcoin. This is true for all deflationary (MKR) and pseudo-deflationary (BTC) assets.

Enter a high inflation token like Hive, and all of a sudden the rules are different? It makes zero sense. I put money into Hive just like I would with Bitcoin. I hold the Hive for a year, just because the Hive network allows stake holders to control inflation, now that's all taxed as income? Pretty backwards honestly. Especially considering that the inflation generated theoretically puts selling pressure on the token price, driving down the value of the initial investment that counts as capital gains.

You know what would be really weird?

What if someone created some crazy cult with a quarantined cryptocurrency that wasn't connected to the outside world? As in, you could only use the currency within the confines of the cult's economy and internal structure. How could this possibly be taxed in any way if the dollar value is totally unknown?

Now imagine the government creating a law that allows taxes to be paid with said weird cult coin... okay... so the cult starts paying taxes with their coin. How does the government then turn those tax-coins into actual money? There is no market for them to sell it on. No one from the cult is going to allow that money to come back into the ecosystem. How wild would that be?

The government could try to tax them 90% and it still wouldn't matter. I guarantee super weird situations are going to pop up like this over the next few decades. Crypto evolves x1000 times faster than government. They will not be able to keep up.

I saw a Tweet today posing the question as to what Bitcoin has to offer except for its first move advantage. I think the answer is pretty simple:

security & stability.

Nodes are cheap because blocks are small, and the entire world competes for 10 entire minutes to post a single block. The likelihood that someone can come along and profitably attack the network is extremely low. Anyone who comes close to doing it realizes they'll get paid exponentially more if they simply play by the rules. That's the magic of proof-of-work. Good actors are incentivized more than bad ones. This is the opposite of the legacy economy.

Notice how no other cryptocurrency in the entire world is trying to be more secure than Bitcoin. That's 100% impossible. Ever wonder why no forks have popped up that require 20 or 30 minutes to mine a block? This would increase security? Yeah?

Well, it would only increase the security of the token in question. A random token with 30 minute blocks still has less hash-power per block than Bitcoin, which means Bitcoin will ALWAYS have the highest hash power per block no matter what. I think this is a really big deal that most people just don't consider. This fact is so blatantly apparent that no dev in their right mind would even attempt to challenge Bitcoin superiority in this context.

Notice the "scalability" argument reigns supreme. Every network that comes out these days is all about speed and instant gratification at the cost of security. All the alts justify themselves by hyping up the scalability argument while downplaying the security they lose by centralizing the product. This leads to a situation where everyone is asking "What does Bitcoin have to offer?" because the altcoins are basically lying 24/7 about their speed/security ratio.

In addition, the unit-bias mindfuck of Bitcoin being "too expensive" because 1 arbitrary unit costs $11k really messes with people's heads. Spoiler alert: $1 is 9000 Sats. If Bitcoin keeps doubling in value every year 1 Sat will reach dollar parity in 13 years.

#dreambig!

Return from Crypto Musings to edicted's Web3 Blog