Repo Market (Repurchase not Repossess)

I don't know about you, but when I heard the word "repo" I always think of "repossession". As in your car was repossessed, or perhaps even your organs!

After all "Repurchase" doesn't have an 'o' in it.

Neither does "agreement". Go figure.

The repo market enables market participants to provide collateralized loans to one another, and financial institutions predominantly use repos to manage short-term fluctuations in cash holdings, rather than general balance sheet funding.

This is something @taskmaster4450 has discussed many times, but I never quite had a grasp on it before. I'm beginning to understand this market with a little bit more clarity now though. We all use the Repo market without even realizing it.

For example, remember back in the day when you'd make a deposit on Coinbase and you'd have to wait an agonizing 5 business days before the money was ready to trade? By that time perhaps the dip you wanted to buy doesn't even exist anymore. Such is crypto.

Coinbase fixed this problem and removed the delay by extending users a temporary line of credit to their users. I can deposit $500 right now and have access to $500 right now. I can even buy crypto with it. What I can't do is withdraw it from the platform until the bank clears my transaction (1-5 business days).

Should the bank transaction not be cleared Coinbase will repossess my collateral, be it $500 cash or Bitcoin. If the crypto they collect is worth less than $500 they'll probably even send me a bill or garnish some money from my account if it exists.

Now I have no idea how this temporary line of credit is extended on Coinbase's backend. I have no idea if they borrow money from a bank to make it happen. Probably not, right? Why would they? They can just front the money themselves. It doesn't really matter how it is accomplished logistically because the frontend result is the exact same outcome as the repo market. An invisible temporary line of credit is extended to remove the delay from the lumbering banking sector.

But what if there was no delay?

What if transactions within the banking sector cleared instantly? Then this whole concept of a Repo market would become completely antiquated and would have no reason to exist. Not only can crypto accomplish this feat, but the new FedNow project can as well. I'm hearing reports that FedNow will be launched in the summer which should make payments near-instant, again potentially eliminating the need for overnight lending in certain areas.

Given this development do we really still think that CBDC is something we have to worry about right now? CBDC would completely undermine FedNow. Why would anyone allow CBDC to happen? The bankers don't want it. What is the point of retail banking if the government can just print money as they see fit? It makes no sense... the ability to print money is retained and protected by retail banking. They aren't going to roll over and die while the government tries to push CBDC.

Although the CBDC narrative is ramping up pretty fast and we should continue paying attention to it. But being alarmist about it is totally pointless. Just wait and see what happens. It's not something that can be prepared for anyway. This is a reactive situation, not preemptive/proactive one.

This video is pretty informative about the current bailout situation with the banks and the backstops that are being put in place. I'm listening to it as I write this and I'll give the rundown below.

You can put perfume on a pig but it still smells like a pig.

In other words, the government can pretend it's not a bailout but it is.

At 4:30

Security collateral is not marked-to-market.

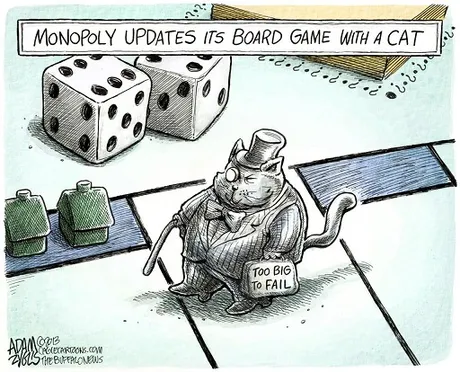

This is a revelation that I had no idea was going on. Banks can borrow money from the backstop using securities whose value has tanked. Imagine the bank bought Tesla stock at $8000 a share and the price tanks to $1000 a share. Let's say they bought a million shares currently worth a billion dollars. They can put those securities up as collateral and borrow from the backstop as if it is still worth the $8B they originally bought it for! Mindblowing! Holy shit. Yeah... that's going to end well. lol

At 6:00

Silicon Valley Bank did not have an insolvency problem; they had a liquidity problem.

SVB bought a bunch of securities largely with money given to them from startup companies. Apparently they offered a higher rate of return than other banks which is why these startups were so motivated to deposit there in the first place. SVB bought these securities that paid a higher interest rate than what they promised the depositors. Classic banking 101 stuff.

However, the securities they purchased (mortgage-backed securities and bonds I believe) were "sensitive to interest rates" so when the FED jacked up the fund rate SVB did not pivot correctly. The value of their securities went down and they were forced to sell at a loss to cover the bank run.

This isn't particularly revolutionary news as I kind of explained this in previous posts... but I'm just summarizing the above video and it's good to have a robust outlook.

They had a liquidity problem that could have been fixed. It wasn't broke.

At 7:50 to end

President Biden's bailout could have been avoided if we had done any one of these three things:

- Management of SVB should have hedged against their risk. It's banking 101, SVB bankers were incompetent.

- Regulators didn't catch it. The regulators were also incompetent. The private sector even reported on this risk in advance.

- The bank should have been bought out by another entity. This is the normal response to this situation. But FDIC doesn't like bank mergers. Even though a merge was ideal: politics got in the way. FDIC stalled the situation and panic ensued.

Interesting take.

So was this all just a mistake and complete incompetence, or did everyone just want an excuse to put this backstop into play where securities can be collateralized at the price of purchase? It's quite unclear, but we definitely should keep that in mind going forward. A situation like this almost certainly will not end well. This backstop is a farce and potentially a way for banks to once again borrow more money than they'll ever be able to pay back.

It's also important to note what a "security" is within this context. The example I gave was Tesla stock, but I think something like this really applies more to the bond market and safer derivatives, as those are usually the kind of 'low-risk' assets that banks are normally willing to take on. Even lower risk now that they can borrow against their own busted trades without a penalty, amirite? lol. What a wild situation. I won't even pretend to fully understand this development and the Butterfly-Effect that will emerge from it. Nobody does.

Conclusion

Overnight lending is something we use all the time without even knowing it. It happens in the background. Have you ever transferred money from Venmo to your bank account and instantly gotten access to the funds? That's not because the transaction happened fast; it's because Venmo extended you a line of credit based on the collateral within your account or the account of the person that sent you money. Venmo doesn't get the money until the bank transfer actually clears. It's important to keep this in mind going forward.

FedNow and crypto could completely eliminate the need for the repo market given enough infrastructure and fast transactions that settle near-instantly. Just look at Hive. Used to be transactions would settle in around a minute and now it's more like 4.5 seconds max. Pretty impressive if you ask me. How will these developments affect the legacy economy as we continue to build? I have no idea. Nobody does, but we'll eventually find out as it becomes implemented within the field of finance.

The FEDs bailout via a liquidity backstop is super interesting and definitely something we need to be paying attention to. I'd love to call it an 'innovative solution' to the problem of short-term liquidity as it pertains to securities that have lost their value... but we all know this is just more bailout fuckery as the decline of an empire continues.

The FED created this situation by raising rates within a clearly DEFLATIONARY environment. The numbers show that there is a dollar shortage worldwide. The FED made it worse by increasing rates. Nobody cares. The price of goods and services went up and everyone wrongfully called that "inflation".

You reap what you sow. Now the FED has to bend over backwards and provide a backstop to the banks they fucked over. This will not end well for them, but they may be able to kick the can down the road one more time until the next recession like they always do. Until then guess who gets to pay for their mistakes?

Posted Using LeoFinance Beta

Return from Crypto To Crush Overnight Lending Market + FED Backstop Bailout to edicted's Web3 Blog