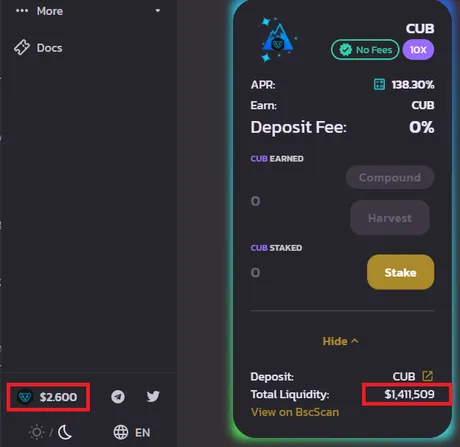

1,411,509 / $2.600 = 542,888 CUB

49% of all CUB is in the Den.

Yep, hodlers gonna hold.

Market cap is still stuck in this $2.8M-$3M band, but price is largely bottomed out due to extremely reduced yield. It will take 5 weeks for the number of coins in the pool to double now.

Even after massive reductions in yield and CUB token price, APR on the main farm is still above 500%. That's pretty legendary. That's a huge honeypot for users outside the network to ape in if we can show that the price of CUB has bottomed.

More than HALF of the DENS have a higher APR than the CUB DEN. This is insanely bullish, and lures many other farmers on the BSC network to our farm if we can keep the pace. Judging by the speed at which LEO moves that should be no problem.

If this $2.50 level is the bottom I would find that extremely bullish, as it's only a matter of time before the market cap starts going up and we experience of snowball affect in terms of APR.

When APR stays high we are luring outside money into farming the network. A 500% APR means anyone farming the main pool needs to buy some CUB. So many users being in the Den makes all the other APRs higher, again drawing outside money into the platform.

Even if the price crashes more, it's going to be pretty easy to defend the $2 level. Like comically so. Like I said I'm getting major Uniswap vibes and $2 was the low there as well. Then it shot up to $30 months later. #winning

The ERC20 >> LEO << BEP20 bridge will be up soon.

Just getting the audits out there and building the bridge is a small step in the right direction as far as reputation goes. Looking forward to the leasing dapp as well. These things take time; just need to ride the market a bit longer until developments pick up. This is a time-in-the-market game. No need to speculate further than that.

Conclusion

Hive/LEO community strong. CUB APRs are high due to so many diamond hands and supply is about to run out.

Posted Using LeoFinance Beta

Return from Cub Hits Huge Milestone to edicted's Web3 Blog