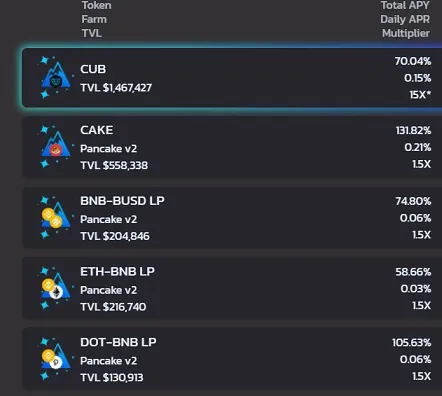

Over the last 3 days CUB has been making huge moves back up while the rest of the market trades relatively flat. Most attribute this rise in token price due to Kingdoms farming. Kingdoms allows users to farm two assets at once.

This is accomplished first by farming a foreign pool on BSC that offers a yield outside of the CUB ecosystem, on top of allocating even more CUB tokens on top to achieve the double reward. To sweeten the deal, these assets are auto-compounded back into the pool so users don't have to worry about doing it themselves every day.

Money gets saved because everyone's assets are auto-compounded at the same time. Meaning the cost to actually sell half of the assets and reenter the pool is split between everyone in the pool because it all happens at the same time algorithmically. Of course there is a separate fee tacked onto kingdoms, but at the same time the vast majority of this fee (rounded up to 100%) is used to buy and burn the token, further pushing up the price. The tiny fee is definitely worth it and pretty much benefits everyone.

So far it seems to be a hit.

CUB bottomed out around 50 cents last week; a stunningly brutal crash considering local highs around $4 two months ago. Still, farming the token over the last two months offset much of the losses sustained and provided the opportunity to just HODL and keep stacking more.

Now that CUB is up almost x2 in a couple days I've sustained massive "impermanent losses" (also known as dollar cost averaging to those who know better). Which is fine, considering that even when defined as "impermanent loss" I am in the process of actually regaining that loss. CUB can continue to climb and the massive amount of coins I've acquired during the crash will continue to be sold to the buyers, giving me back the BNB I started with. Sounds good to me.

However, Now that we see some bullishness in the market I'll need to start stacking my farm into the den again to avoid selling so many coins. I get the feeling many others are doing this as well, as much of the selling pressure seems to have evaporated.

It's hard to know where the resistance is, but my best guess would be back at our previously "unbreakable" $1.76 support line. My wasn't that a rude awakening.

Hopefully there won't be much resistance as we make our way back up to that level. It looks like many are stacking the den to avoid the dreaded "losses". Speaking of which the den was recently added to the auto-compounding kingdoms farm, which could be one of the reasons we continue to see the price rise. Adding utility to the den can only make the price go up, as coins that enter it are not for sale or subjected to IL.

I must admit, I was get a little worried about CUB, at least in the short term. That crash to 50 cents was absolutely soul crushing. Such is crypto. Now that we are back up to 90+ cents in a couple days I feel much better. That's just the volatility of crypto hard at work I suppose. Scaring the he hell out of everyone. This is one investment opportunity that requires some major fortitude. Holding continues to be the best strategy for 90% of "traders". Just avoid trading altogether and it often becomes a free win.

Conclusion

Exciting times. Again, it's hard to imagine this summer being a dud considering everything going on in the world. By all accounts, we may see some pretty incredible stuff very soon. And if not there's always Q4 to look forward to. The mega-bubble only comes once every four years. The wave materializing on the horizon is shaping up to be quite the monster. Surfs up!

Posted Using LeoFinance Beta

Return from Cub on a tear; tear for the bear. to edicted's Web3 Blog