CUB has been on a wild ride.

From a peak of $13 to a bottom of 2 cents. Yikes! If I say the project isn't down and out, is that just delusion? I mean you'd think if something crashed 99.85% I'd give up on it! But also running the numbers like that is extremely misleading.

A much better metric for high-yield defi networks is market cap (which still isn't a great metric). CUB traded in between a very predictable band for over a year. The low market cap was $2M and the high market cap was $5M. Both of those numbers are very low for a total market cap, and in no way reflect how much actual money can be extracted from the market, but this is neither here nor there.

When Polycub launched I was very worried that it would suck up liquidity from LEO and CUB and then dump that value into the aether, becoming lost as value bled out of all the ecosystems. Arguably that is exactly what happened. We gave free money to a bunch of LPs that provided zero value to the network, and that value simply wondered off when yields went lower. Whoopsie.

Hm yeah it's been pretty rough for the LEO ecosystem.

We could really use a win after so many slaps to the face, but it is what it is. Funny cause this isn't like 2018 where everyone was terrified and pissed and ragequitting. Everyone is just in a holding pattern thinking, "Yeah, I've been here before I know the drill." The LEO ecosystem has some of the most steadfast diamond hands I've ever seen. Pretty impressive considering everything that has gone down recently.

Can't throw the baby out with the bathwater.

In any case, big pivots are being made to how CUB is doing things. When this started some weeks ago I was pretty annoyed. I had a huge stack of value in the CUB/BUSD and CUB/BNB pools, and every few days I would log in to see my yield further and further diluted by the new pools being issued.

Seems like every time I log in, the pools that I'm farming have magically lost yield multiplier while other ones have gained it. No voting. No warning. Nothing. Just Khal going in there and beep boop beep: number different.

I don't have to explain why that's annoying or how it shows how the entire ecosystem is fully centralized and dependent on the whims of a single person. But at the same time I also haven't learned anything new. This is what I signed up for. Strong centralized leadership has a lot of benefits even if things don't always head in the direction. Decentralization is fully on the backburner for LEO, and honestly that's fine until we have the regulators up our asses. Then we gotta scatter quickly. There is a plan for this, but again... it's a low priority given the current circumstances.

It's a bit ironic...

If CUB had launched and the pools looked exactly like they do now... I'd be like nice this looks good. But because I had a bunch of money sitting in the pools that are now being diluted I'm all pissed. I guess I'm getting lazy. I just need to rebalance my positions.

In fact when CUB first launched I was all like, "Where the hell is the LEO/CUB LP?" "Where are the Hive LPs and pegged tokens?" And I was told we shouldn't do that because it would dilute the other pools and make the bridge less effective. I mean sure makes sense but I wasn't particularly sold on that answer.

Now we have 5 new pools that are paired to Hive or HBD and I'm not even farming them. Perhaps I'm a bit burned out on this little game. I guess that what happens when you're up $140k in three days on the Polycub launch and you get greedy and lose most of it for like no reason even though you predicted this entire situation way in advance. Live and learn. Stick to the plan, Stan. Theoretically I could have dumped it all out into HBD and lived off that money for the rest of my life just on interest alone. Oops.

No use dwelling on the past though.

Now is now. Stay present. So what is going on with CUB right now?

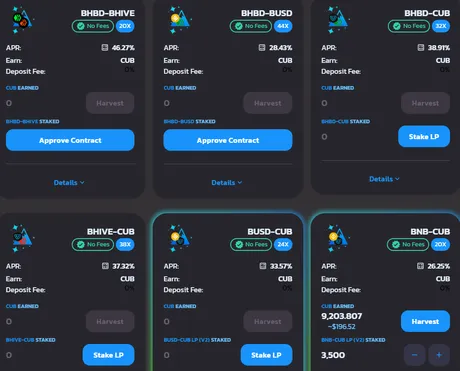

- bHBD/bHIVE (x20)

- bHBD/bUSD (x44)

- bHBD/CUB (x32)

- bHIVE/CUB (x30)

Four new pools, which basically all are now being allocated more yield than the original BNB and BUSD pools. The newest pool being HIVE/HBD which is pretty awesome and something I've been looking to see on the main chain as an upgrade to the internal market. Don't be fooled by that x20... it was like x10 a week ago. Khal just keeps going in there and moving the yields up every day it seems. And then there's the massive x44 allocation to the bUSD/bHBD stable pairing which is like wtf.

Why is this happening?

There's a good reason.

My first argument against doing something like this is that it fucks up entry/exit liquidity. It's much better to have liquidity paired to BNB and BUSD because those LPs have massive liquidity (especially on BSC). However, that's not that big of a problem, because Hive liquidity is large enough for 99.9% of users. Anyone can dump coins on Binance or Huobi for 0% slip and 0.1% trading fees. Not a big deal.

Ignoring that 'problem', the real issue comes into play when using smart-contracts like 1INCH or PARASWAP that allow us to buy or sell CUB to/from multiple pools at the same time. Wrapped tokens like bHIVE and bHBD have no other connections to BSC, and thus can't be used by these contracts to buy and sell from the LPs at the same time. It spreads our liquidity out in a way that is extremely inconvenient, and Khal should consider creating a custom contract that allows CUB to be bought or sold from all available LPs.

Whale problems?

Of course if one is only moving around a couple hundred dollars here or there this is all completely irrelevant. Might as well just use a single pool and avoid paying the 50 cent BNB cost of adding another transaction to the contract. For small amounts, the 50 cent flat fee is more than the money saved from lowing slippage, thus the big buy contracts are not financially viable unless we are trying to buy/sell big amounts. Makes sense.

Again, why are these changes being made?

Basically the new strategy revolves around arbitrage and creating a deep liquidity connection between CUB and HIVE. The reason why Khal is going in there by hand and manipulating yields without permission? Because the new strategy is working surprisingly well. Why wouldn't he do it?

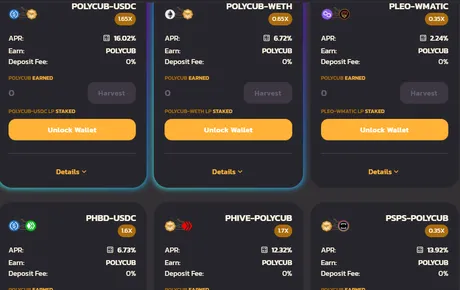

Just to reiterate: no one said CUB was decentralized (yet). If you thought it was I'm not sure where that information was derived. I've never seen anyone make this claim. In fact every single token on HiveEngine can be printed to infinity up the displayed cap by the founder. None of this stuff is decentralized, but it can and will make a transition later. POLYCUB already has a voting mechanism in play to allocate yields. How are those pools doing?

Unsurprisingly polycub APR is already less than 20% across the board. (What is surprising is how long it took.) That's what happens when DEFI projects refuse to print out money to incentivize the LPs, but then again I already went over all this when the token price was 80 cents and I dumped everything and talked major shit about the entire situation. Don't need to repeat what I said. I was very clear at the time. I didn't think it was sustainable. Seeing a 6.7% yield on pcub/ETH... why would anyone put money into that LP? They're basically guaranteed to lose money unless polycub and ETH move in tandem, which is exactly what we don't want (we want a 100x). So... yeah...

But also I actually did stick to the plan on the rebuy of polycub, so I still have money locked into xpolycub. Bought at $700k market cap. So yeah, down 30% even after buying the massive dip I was predicting, but that's crypto for ya. I'm still interested in the collateralized loans coming down the pike. It's a very interesting solution that I'll talk about some other time.

Speaking of market caps... the combined market cap of LEO, CUB, AND POLYCUB is less than $2M. God damn! Talk about being down bad! But again we've all been here before. What's more reasonable to expect? Crashing to zero or making a legendary recovery during the next bull run?

Sure, some projects do crash to zero. Do they have a diehard community, or just a bunch of tools looking for an x1000 who bail the second they don't get what they want? Rhetorical question is rhetorical. I mean shit it even looks like LUNA might make a comeback... which would be the most epic underdog story ever told.

Weren't you talking about arbitrage and CUB?

Quite right.

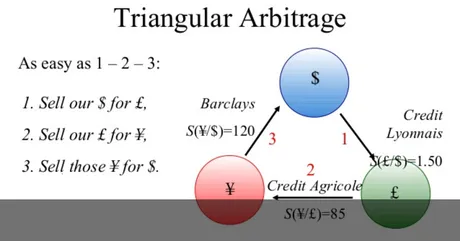

So the reason for this pivot? Why are we creating derivative Hive tokens and allocating massive yields to the liquidity pools? It's all about that 0.25% wrap/unwrap fee. Doesn't sound like a lot, but hot damn that fee is adding up, and arbitrage opportunities guarantee that even if CUB has zero liquidity and absolutely no one is buying or selling it... the arbitrage volume is still going to happen because it's free money for the bots. This is a pretty weird concept when you think about it.

So imagine Hive pumps x2.

But it hasn't pumped x2 on CUB yet, so arb bots need to get in there and collect their free money. That means cheap Hive in the Hive/CUB and HIVE/HBD LPs is just sitting there... waiting to be extracted and dumped on the centralized exchanges for a profit. As long as that profit is more than 0.25% (extremely likely), the unwrapping fee doesn't matter and the bots will keep buying Hive and dumping it in a loop until it gets within that 0.25% range.

The fees generated from this process go directly toward buying and burning CUB from the ecosystem forever. It's basically just free money for the network. This is why Khal is so aggressively leaning into the strategy. Seems to be working pretty well.

Not only that... what happens when Hive crashes? What happens when CUB crashes or when CUB goes up? Upbit pumps HBD? It doesn't matter. Any change in price across any of the wrapped assets is going to trigger an arbitrage event that's going to siphon a 0.25% fee into buy and burns, and it's working so well that we are about to burn more CUB in a couple months than we have since inception. It's actually crazy how well it's working given the state of the markets. Imagine what happens when volatility picks up and this thing kicks into high gear.

And Cub price is just chillin at all time lows. Nobody gives a shit. Everyone is burnt out and doesn't want to deal with the bullshit anymore. $13 to 2 cents. Fuck that, amirite? Yeah well when it goes x10 I'm sure they'll all be lining up to buy again. Classic crypto. Happens every time.

But seriously though this is obviously not a shill. I'm clearly very annoyed with how a lot of developments have turned out and I have voiced my opinion as objectively as I know how to. It's a centralized project. It's lost a lot of money. What can I say: I'm a glutton for punishment.

CUB is my only BNB position left.

I think this is why I'm the most annoyed. My BNB/CUB position has been massively diluted, and this is the one reason I have to hold BNB and be exposed to the price action of one of the most consistently long-term performing assets.

But honestly, from a political perspective, should I even be holding BNB? LOL, probably not. I mean it's not the same as owning real crypto like Hive or BTC. It's basically just Stock 2.0. But at this point so is LEO/CUB/POLYCUB.

At the same time CZ and Binance have fucked us over pretty good.

That fuckhead tried to tell us the hostile takeover wasn't their fault because they were hacked by the Steemit Inc script that powered up customer funds and used them to unlock Sun's stack so he could in turn replace our top 20 witnesses with 20 sock puppets.

So basically Justin Sun tells CZ that the democratically elected witnesses of the blockchain are hackers, and asks CZ to run the script. Then CZ turns around and says the script itself was a hack but no charges are brought against Sun or STINC. Thus CZ was obviously lying or just involved in corrupt collusion (pick one). Then they take their sweet time powering down and tell us they don't want to get involved. Bitch, you're involved. Can't play the neutral card when you're the one that created the problem. Oh right and then the first powerdown goes 100% right into Sun's pocket. Aggravating to no end. I had almost forgotten all about it too. Wen documentary?

So yeah all things being said, I still hold a BNB position even after all that bullshit. Maybe I should just dump it all for Hive or Bitcoin. I'm certainly comfortable doing that at this point. Still I always liked having exposure to BNB because even after all that I feel like CZ is running circles around all these other jokers. Beggars can't be choosers. But am I still a beggar?

lol what was I talking about?

Right... my BNB/CUB position. What do you think? I should probably just dump all the BNB for Hive and get into that Hive/CUB position eh? Fuck it! All in on Hive and Bitcoin! Yeehaw.

There's also something to be said by strengthening the connection of Hive and CUB. There's a lot more synergy there than with BNB or BUSD or BSC. If more people hold HBD, Hive number goes up. If more people hold Hive, Hive number goes up. If more people provide liquidity to these pools, more fees are generated and CUB burned. If Hive has a strong connection to a single EVM chain, then it has an indirect connection to all EVM chains. Could be more synergy here than many realize... especially now when CUB is 2 cents a token and everyone just assumes it is down and out. I guess we'll find out. Money talks and bullshit walks.

Conclusion

Khal is still out there grinding away development. Luckily he is one of the few developers in crypto that actually knows how to DCA and manage money within the most volatile and choppy economic market the world has ever seen. While everyone else is wallowing in misery, those who had balanced positions can afford to buy the dip and profit from both sides of the volatility spectrum. Hopefully more crypto peeps have learned their lesson for next time, but I doubt it. People never learn. Especially on the average.

I would say crypto as a whole is defending support across the board pretty well right now. The economy does not look good, and there are no guarantees, but I think we can hold this level. We just might have to do it more times than we wanted to, thinking we were out of the woods and then the house of cards collapses again. 2023 gonna be a weird year, guaranteed.

CUB's transition to these new pools is quite a shock, especially considering the aggressive changes in yield across the board. Still, in my opinion, a strong connection to Hive will have much better results than a strong connection to BNB, especially considering the dynamics of arbitrage combined with quarter percent wrapping fees.

Not not financial advice and all that. Rather, here's some financial advice: buy more actual decentralized tokens like BTC and Hive if you can afford it (doubtful). I certainly can't. DCA DCA DCA. Do as I say not as I do.

Posted Using LeoFinance Beta

Return from Cub's New Arbitrage Strategy to edicted's Web3 Blog