CUB is up another leg.

Yet another whale has jumped into the den (CUB Kingdom). I'm legitimately afraid to compound my farm at this point. No more selling CUB for me, at least for a week or two.

### Let the cannibalization begin!

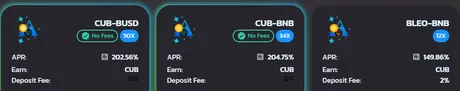

As predicted, increasing yield on the den is heavily incentivizing CUB bulls to exit the LP pools a bit and stack the CUB kingdom. Not so long ago (days) the CUB/BNB yield was sitting at something like 150-160%, now back up to over 200%. This morning CUB/BUSD also got a bump from around 180% to over 200%. Our liquidity is being drained and added to the den.

### Let the cannibalization begin!

As predicted, increasing yield on the den is heavily incentivizing CUB bulls to exit the LP pools a bit and stack the CUB kingdom. Not so long ago (days) the CUB/BNB yield was sitting at something like 150-160%, now back up to over 200%. This morning CUB/BUSD also got a bump from around 180% to over 200%. Our liquidity is being drained and added to the den.

The "Everybody Wins" scenario

Normally this might be cause for concern. Do we really want to lower our liquidity and unsustainably pump the token in such a risky way? However, because CUB is gaining substantial value, we can see that the actual USD value remaining in the LP pools isn't actually being drained at all.

We've still got $2M worth of liquidity (more than entire LEO market cap) even after cannibalizing the LP, so we haven't actually lost anything. I expect this trend to continue. This change of inflation is basically a win for everyone.

This pump looks like a sustainable one because we were so oversold at 50 cents and built up a nice support wall there. It's time to forge a lower bottom, hopefully somewhere along the lines of $1-$2 (which is a lot considering market cap, as LEO market cap itself currently stands at $1.8M, and CUB is already almost double that even at these low levels).

"So I should exit the LP and all in the kingdom?"

Not necessarily. Again, this is a win for everyone. Sure, those left in the LP are subject to "impermanent losses", but also, yield has increased 40% to reflect that risk. Everyone still in the LPs is farming even more than they were before.

My main strategy is to bring in as much outside money as I can (relatively very little only 3k CUB) and simply stop selling my farm. I farm a lot of CUB every day, and if I stop selling half, that's already a big enough risk to diversity back into the Cub Kingdom.

Balance

Again, the best strategy is a balanced strategy. Those who went all in on the den from $3 to 50 cents got absolutely wrecked; very demoralizing. Meanwhile those who were in the LPs were very quite protected from such a brutal drop.

I had a friend buy into CUB with Bitcoin a while back and he was disappointed that he "lost money". He was down to $11k from $15k. However, when I asked him about how much BTC was worth at the time he replied $60k. Therefore, if he had kept the $15k in Bitcoin he would have lost almost twice as much. That's the magic of hyperinflationary assets combined with safer stable-coin pairs with absurdly high yield.

We can expect that if the price of CUB continues to go up, the yields in the LPs will continue to rise to reflect the impermanent loss risk by going up in yield. It's good to have money everywhere in order to maintain maneuverability within these markets. I have stake in all four of the main pools, and that's working out quite nicely.

- CUB/BUSD

- CUB/BNB

- bLEO/BNB

- CUB Kingdom

By having a little in each, I can rebalance them as needed depending on how the market shifts. When one pool is doing "too well" I sell off a little to an underperformer.

It's also important to note the bLEO/BNB pool

This is a very special pool that pays out significantly more yield than you can get anywhere on the LEO ecosystem, and that yield isn't even paid out in LEO, it's paid in CUB, making it truly interesting. The CUB ecosystem pays homage to the "main chain" so to speak.

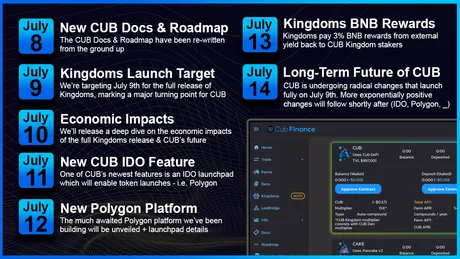

Buy the rumor, sells the news: THWARTED

@khaleelkazi does a great job with announcements. With so many fundamentals coming down the pipe within a week, it's impossible for speculators to frontrun the market. This strategy has some very important ramifications.

When traders buy the rumor and sell the news, they are creating a negative feedback loop that siphons value from the bulls. We don't want the more diehard supporters of CUB to get shredded in the market, so by announcing these launches late we give zero time for price to get pumped before the actual fundamental event. Now pumps should be in sync with fundamentals, which will reward community holders rather than the pump/dump speculators.

As another reminder today is a new moon, which has been marking peaks in the market. Considering where we find ourselves with such abysmal volume, things are not looking great on the surface of Bitcoin.

However, on-chain metrics and worldwide fundamentals are still at record breaking highs. If we see a reversal here I believe that CUB will double bubble. At the very least I'm expecting to see CUB near $1 at previous resistance. Hell, the den yield hasn't even been increased yet and it's already spiked 40%. If the market at large crashes, I still expect CUB to outperform. Modifying the den yield is that big of a deal.

But wait there's more!

What was the title of this article again? Oh, right...

The IDO will only allow CUB to be traded for "Token X". Since no funds are actually being raised in this IDO, 100% of the CUB traded for "Token X" during the IDO will be burned permanently from the supply.

PROOF-OF-BURN MUHAHAHA

Ah yes, taking one out of the old deflationary economics book. The key to crypto going forward are massive hyperinflationary yields colliding with massive hyper-deflationary tokenomics. CUB thus far has the hyperinflationary yields down, but what of deflation?

Well, you can't get more deflationary than burning tokens forever. This IDO project is bound to be interesting, and we'll be getting more and more information on all this stuff over the next few days. Exciting times.

If this IDO majig has any kind of popularity whatsoever, not only will CUB token price skyrocket, but also the yields of every farm will increase. That's because yield increases when token price goes up, and it also increases when competition goes down. If coins are being destroyed competition will go way down, permanently.

The Bill Gates scenario twarted

In the old legacy economy all these ideas and technologies would have been patented and quarantined by various corporations. Cease and desist orders everywhere. With crypto, everything is open source. Hive/LEO/CUB are a great example of this. There are lots of good ideas floating out there, and the people that actually make those ideas a reality are basically forced to share the rewards with every single stakeholder. That is some powerful synergy, and it's only going to get crazier.

For example, say I have a really good idea but I'm too lazy or too poor to make it happen. I write the idea out in a blog post and get some paltry rewards for it, or I talk about the ideas in private DMs on discord. Blah blah blah. Talk is cheap.

However, when I see a network implement the exact concepts I've been talking about, I now have the opportunity to put my money where my mouth is and support my own idealology. That's what crypto is all about: supporting the governance structures that we think have merit. Truly an amazing time to be alive during a period were we can provably own a piece of open-source tech and that value can never be counterfeit even though the code is available to all. I guess that's DLT for ya.

The bLEO/BNB effect.

This is going to be the only pool left with extremely high yield that doesn't have a pairing to CUB itself. This is a very important pool with a lot of unique attributes. For starters, it's required for the bridge to Ethereum, which will become much more important when Ethereum gas costs decline and the need for bridge liquidity is more important than ever.

On the economic side of things, this pool is 100% dependent on CUB token price, whereas the other two (CUB/BNB CUB/BUSD) are much more dependent on competition to farm vs fear of impermanent losses. If CUB goes x2, there is no guarantee that yield on CUB/BUSD would go up (because the buyer may park all their assets in that pool, driving the yield down via competition).

However, with the bLEO/BNB pool, it becomes a game of reactions. If CUB goes x10, the bLEO/BNB yield will go x10 right along with it. That would be a new yield of 1500% up from 150%. Hell, just a couple of days ago this yield was less than 100% due to low token price. Already up 50% in a matter of days.

So imagine for a moment that CUB did do something crazy like x10. Now bLEO/BNB yield is 1500%. The reaction to this is going to be pumping this farm with liquidity to compete for that insane yield, which of course will drive the yield down but it will still be high.

The question we have to ask ourselves is: if CUB moons does that mean LEO automatically moon as well? The answer is almost certainly. There are very few LEO tokens to go around. Most of them are already powered up or in the LP pools already. The only way to get more is to buy via the LP pools. However, buying pressure would create more impermanent losses, creating another snowball effect that could moon LEO just like CUB is primed for the same right now.

It's also worth noting that bLEO/BNB still has the 2% deposit fee (will change when modified to kingdom), so if we see a storm of entry, that deposit fee will again pump the price of cub via buy and burns, snowballing all these fundamentals even further. So many deflationary economics are synergizing with the hyperinflation things are getting very out of control.

Conclusion

After a "long" wait and many "wen"s, the dominoes are dropping. CUB is proving that development matters, and it's going to leave a lot of these other pump/dump scams in the dust, as predicted.

Implementing proof-of-burn tokenomics in addition to injecting the den with yield is a guaranteed way to boost up this sad token price. 40% gain is just the beginning. Set up a balanced position and watch the money roll in. Khal's doing all the work: you just gotta throw your money in the ring and keep annoyingly asking "wen". We got this, fam.

Posted Using LeoFinance Beta

Return from CUB to implement proof-of-burn tokens to edicted's Web3 Blog