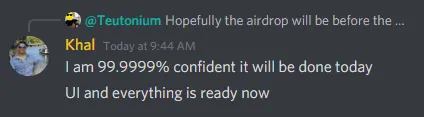

The day of 30,000% APR has come and gone. Still no airdrop. Soon™

So I can't help but feel like this airdrop delay is greatly changing how CUB tokens are being distributed. We were supposed to get the drop yesterday when the total CUB supply was 200k. Half of that includes the 100k (or so I'm told) airdrop.

Now the total supply is 300k just a 24 hour delay later, so we can see how critical these opening moments are for the network. Luckily I had a little money to throw in before the airdrop.

Luckily CUB inflation is static and does not increase exponentially like Hive and LEO. Meaning that inflation on CUB does not create more inflation (non-compounding). 3 CUB are created every BSC block. That lasts for a week. Then 2 per block, and a week after that 1 per block.

https://testnet.bscscan.com/chart/blocks

Well would you look at that?

28,800 blocks per day is a number I'm quite familiar with. This is the number of blocks Hive creates in a day if none of them are missed.

BSC: 3 seconds per block.

So CUB actually has the exact same inflation schedule as the game I want to create (Magic Words). I also wanted to go with 1 coin per block. I guess my conversations with Khal in DMs are showing through :D. To be fair jacking up the inflation for the first two weeks is a really good idea. I may have to consider that. So much hype.

The important things to note are this:

- How many total CUB will there be?

- How big is the supply?

- How high can the price go?

For this first week we're creating 86,000 CUB per day. We can simply think of this first week being 3 weeks all at once. Then the second week will count as two weeks. In the long term, none of this matters very much, as most inflation will be created 28.8k coins per day.

So once two weeks have passed we'll get to the core inflation.

- 28,800 CUB per day.

- 201,600 CUB per week.

- 10,512,000 CUB per year.

So we see that the inflation we're creating now really doesn't matter that much. Sure, it's a good way to get a big head start, but after a year, there will be 10M tokens max, which is obviously a lot more than the few 100k we are seeing now.

We also have to consider all the burn mechanics that are going into CUB. The entire point of CUB is to create a push/pull of high inflation combined with deflationary mechanics to have a more stable system.

So far we are only taking the 4% deposit fees on the farms and using that to buy and burn CUB (80% to CUB, 20% to bLEO). It's safe to say we can expect other types of burns and DeFi dapplications that lock up stake and push up the price.

What kind of DeFi dapps?

The obvious one is something I've talked about a dozen times already. The LEO network obviously needs a stable coin. This is accomplished by modifying the collateralized debt position (CDP) smart-contracts of MakerDAO.

In theory we would be able to lock CUB in a contract and pull stable coins out of it. The stability of these coins would be regulated by two sliding scale variables that change due to governance votes:

- Collateral required percentage to mint stable coins.

- Minimum collateral percentage required to avoid bad-debt auction.

Considering how busy Khal is and how many projects he's working on I wouldn't expect something like this to launch for possibly years, but you never know, he seems to move at lightning speed compared to other dev teams.

What is CUB for?

Basically any DeFi dapplication that LEO creates would likely be connected to CUB first. CUB is officially our DeFi token. LEO itself is becoming a governance/airdrop/blogging token. That may change (governance) when the next project launches (second layer consensus nodes)... not sure.

Needless to say the utility of CUB is going to be massive in a couple years if everything goes according to plan. Any DeFi dapplication LEO makes will be connected to it almost guaranteed. It's not just a pointless farm with zero endgame as many may be worried about. Already the mechanics in place blow a lot of the other farms out of the water: which is why we are getting so much general attention from the BSC/PancakeSwap network at large.

So how high can the price go?

I mean we see that there will only be 10M tokens max in a year so that's really not a lot even with this massive inflation on the table. Also that inflation does not take into account all the possible burns that will happen within that time.

Timing is key.

A year down the road if CUB had a $10M market cap 1 token might only be worth $1. That's my lower bound worst case scenario. However, considering we are in the middle of a mega-bull cycle and Q2 is just about to start, I think things are going to be pretty crazy at the end of the year across every single network, including CUB and LEO and Hive and everything else.

Welcome BSC.

The attention CUB is getting on PancakeSwap is exactly the kind of attention wLEO needed to get on UniSwap but didn't. Brilliant play by creating 22 different farms that all farm CUB. Top notch really. This lures a lot of new people, not only to CUB, but also gets them looking at LEO and Hive itself.

The kind of exposure we are generating right now is pretty legendary: across the entire network. This exposure is only primed to increase as time goes on during one of the most important windows during the 4-year cycle.

Conclusion

What good is the CUB token? You can farm it for more CUB! Very speculative. However, we all know how quickly speculation can turn into actual fundamentals around here. CUB is LEOfinance's official DeFi token. Anyone who believes in the LEO ecosystem and thinks that DeFi is going places shouldn't ignore what's going on here.

The hype in LEO Discord General is off the charts. Many many users are looking to "buy the dip" on this airdrop. However, look at who the airdrop is going to: the most hardcore LEO holders over the last 2 years. Don't expect that big of a dump is all I'm saying. I've personally held more than 1% locked as LEO power for two years, therefore I expect 1% or more of the airdrop at this point. Guess how much of this airdrop I'm selling? @null

Posted Using LeoFinance Beta

Return from CUB Tokenomics and Future to edicted's Web3 Blog