Cubdates

https://peakd.com/hive-167922/@leofinance/leofinance-weekly-dev-update

IDOs - initial DEX offerings - give new tokens a launchpad to generate funds. It's up to the project to decide how those funds are used.

In most IDOs for the DeFi space, the generated funds are utilized to seed an initial liquidity pool.

I assumed as much in my original assessment six days ago.

First IDO

We're anticipating Polygon CUB to have a limited "raise" (burn) of $1m-$2m USD worth of CUB. More details will be released as the launch of Polygon CUB's IDO gets closer.

As for our external team's launching IDO #2 and IDO #3, they've chosen the "IFO" model developed by other BSC platforms which we have adopted for CUB IDOs:

- The external team receives 100% of the BUSD raised in the IDO.

- Users receive a proportional share of IDO allocation based on deposited CUB-BUSD LP tokens

We're anticipating IDO #2 to raise somewhere in the ballpark of $250k - $350k CUB-BUSD.

IDO #3 was just signed and they will be using the same IFO model. ... Current expectations are a raise between $2-$5 million USD via CUB IDO.

Just to remind everyone:

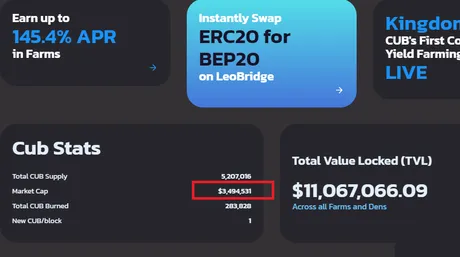

CUB MARKET CAP: $3.5M

These deals we are making are gigantic. None of this is priced in, nor can it be priced into the market. This is way too much fundamental development to even be priced in by anyone in this community. Prepare for extreme volatility.

By the looks of how they are set up now, users who enter the IDO early may be guaranteed to lose money. If the price of CUB is guaranteed to go up (and these numbers we are dealing with basically do guarantee that) then those who enter these pools early will likely get hit with impermanent losses as the price of CUB goes up. It may be financially viable to enter the LP near the end of funding to make sure the value of your tokens stays intact till then.

If there is no advantage to entering the pool early (farming more) then there is no reason to enter that pool until the price goes up from supply shock. If I had to guess a burns like this should at least double the price of CUB quite quickly.

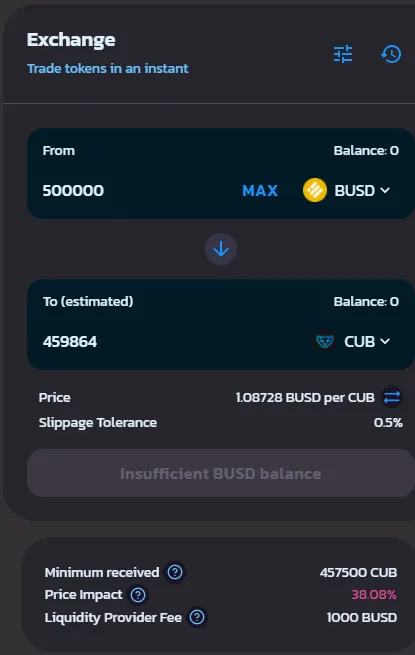

Half a million BUSD being pumped into CUB increases the price by 76% (38% slippage x2). It takes near a half million BUSD to pump the other pool as well. However, in addition to shear magnitude of these burns, we also have to consider the fear of dreaded impermanent losses.

We also have to consider time between IDOs. Every IDO is going to have a stacking effect in terms of FOMO and getting out of the LPs into the CUB kingdom. Cub Kingdom dominance is still at 59%. 59% of all CUB in circulation is in the den (kingdom). This is a mind-shattering statistic and a testament to this permabull community that continues to HODL no matter what.

Zero increased LP competition

While LPs will suffer serious impermanent losses should the price of CUB moon, none of that buying pressure is going to be competing for yield. Exiting the LPs may not be a smart play, especially if users are doing it reactively after the price has already shot up (buying the spike, as it were).

Not only will competition not be increased in the LPs, it will be automatically decreased and LP yields will skyrocket. Why? Because millions of BUSD are being dumped into the LP in order to EXTRACT liquid CUB and put it into the new IDO LP. This is why leaving the LPs could be a serious mistake. Yield in the LPs is going to moon pretty hard if this goes down even remotely like it's being described.

For example...

Say CUB goes 10x in a short timespan. If you are in the CUB/BUSD LP or the CUB/BNB LP your stack will only go up by around x3. However, the CUB you're now farming could skyrocket quite a bit. Imagine 50% of all the liquidity was extracted from the two main LPs and dumped into the IDO. That means CUB yields will double, and because CUB USD price already went 10x, you'd be farming 20x more USD in that situation than you are now. All of a sudden impermanent loss doesn't sting... really at all.

Because a new temporary LP is being created for these burns, it automatically lures competition from all the other pools to jump ship and participate in the IDO, increasing yield across all farms. CUB will be profiting heavily on these token launches, and these token launches will be profiting heavily on the infrastructure being created here. It's a symbiotic relationship: win/win.

Wen/Wen?

Who cares? The longer we have to farm CUB and stack the Kingdom the better. We are being assaulted by these promises guaranteeing millions of dollars of CUB will be burned. Seems to good to be true but also seems extremely legit. Whether it takes two days or two months to happen doesn't really matter. In fact the more time I have to stack, the better. These burns are going to be quite the sight to behold.

Conclusion

We have plans to burn the entire CUB market cap and everyone is just kind of in disbelief that such a thing could actually happen. CUB's market cap is $3.5M. We very well could burn that much over the course of these 3 IDOs... and that doesn't even count future IDOs. Surely if these three have success more will come down the pipe. Even if they fail more IDOs will launch. Again, this is all win/win. You're going to miss those days where CUB was under $1. You were so lucky to get in early.

Posted Using LeoFinance Beta

Return from Cubdates Summary August 6th, 2021 to edicted's Web3 Blog