I got so massively sidetracked in my last post that I never even got to the point. This seems to happen a lot to me. Oh well, let's try this again!

Thinking about money in terms of water is a good metaphorical tool in order to understand currency better, and the economy itself. What are the properties of water?

- It is liquid (most of the time).

- It can flow and adapt its shape to whatever it needs to be.

- It can freeze (which is very bad in the context of economy)

- It can be separated and is near-infinitely divisible.

- It can get trapped/captured in a lake or backwash.

- It can rain.

- It can evaporate.

- It can make waves or create ripples.

- It is identical (fungible) to the water that lies adjacent.

- Types of water on a macro level:

- Ocean

- Lake

- River

- Cloud

I will now attempt to create a relevant analogy with this information.

Central banks and fiat currency are the oceans.

The ocean is vast and nearly-infinite, just like the depth of the theoretical money supply is infinite. Technically, a central bank could print to infinity, but they don't do this on purpose because that would destroy their entire value proposition. In this context, the salt-water is non-drinkable water, and therefore it is non-useable currency. It's just an idea; money is just a concept that conveys value from one person to another; the oldest abstract technology by far.

It is possible that someone might try to go to the ocean and bottle the salt-water and sell it as drinking water. We call this counterfeiting, and it is extremely dangerous for any central bank. This is why the Secret Service's number one priority is to protect, not the president, but USD itself. Not only does selling salt-water as drinking water pose a danger to the central bank, but also anyone who drinks the salt-water is also at risk. No one wants to be caught holding the bag on Monopoly Money.

So how does salt water become portable potable water?

The water evaporates from the ocean and forms clouds. Then it rains. This rain has been desalinated by the sun and becomes drinkable. Unfortunately, we live in a society where it is against the law for citizens to collect rain water. We call this having water rights, which is exactly why Michael Burry, the guy from the Big Short that predicted the housing crisis in 2008, is buying up water rights in the mountains (he thinks there will be a literal H2O water crisis).

Moving on...

We plebs are not legally allowed to collect the rain water.

Rather this rain water flows into the lakes.

The lakes are the retail banks.

Once a central bank gives out loans to a commercial retail bank the theoretical salt-water from the ocean is turned into real drinkable water in a lake. Now, all that is left to do is to get this potable water into the hands of citizens that need it. We do this using the river connected to the lake.

However, the retail bank can't just let anyone come bottle up that water for free. No no no, they have to control it and make sure only the "good guys" have access to water. It would be chaos if the river was just open and free and anyone had access to it (sound familiar?), so they build a dam.

The dam allows the retail bank to control all the liquidity that passes through. They can set the flow of the water to whatever they so desire. They could set the flow high and give people with bad credit a loan, or they could tighten their policy and set the flow to a trickle. It's all up to the entity that controls the dam as to what the policy should be.

Ideally the owners of the lake would like to fill up the lake with more water. The water that leaves the lake is an investment (a loan to be paid back with interest). Unfortunately for the lakes, this is a zero-sum game. More water is owed back to the lake than water in existence. It is possible that some of the banks give out great loans and make a bunch of money, but it is not possible for all of them to make money. Unless...

Collateral

The world of legacy finance has been dealing in NFTs long before crypto came around. An NFT in legacy finance is called collateral (a non-water asset). It's the thing you own that the bank can take from you should you fail to pay back the loan you owe them. If you take out a loan to buy a house: the house is collateral. Same goes for a car or any other large purchase.

What about credit cards?

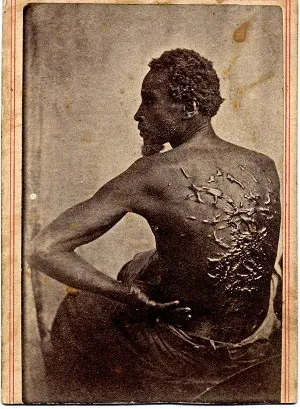

Ah, well that's where things get interesting. The collateral behind credit cards is simply a promise that you'll pay it back. In effect, your credit-score, reputation, and very identity are the things that become collateral. People are collateral within this system, in more ways than one.

Fun fact: usury is forbidden.

Usury - all usury - is banned by Christian doctrine, as it is by Muslim doctrine. In the late Middle Ages the problem of financing the royal exchequer and setting up capitalist institutions in the face of the Christian ban on usury was resolved by allowing Jews to act as bankers.

It's easy to see how an entire culture of people became demonized as money-grubbing debt-slaving slum-lords. But I digress.

The reason why usury is forbidden by multiple religious doctrines is because it leads to debt-slavery. We've known about this stuff for thousands of years, because again, money is the oldest and most critical technology in human history.

Where was I?

Right right... so the retail bank (lake) issues a loan (dam) to the fish they deem to be worthy based on the fish's collateral (NFT). (Oh snap should we make fish-based NFTS? No time!) Once the fish (person... whatever it's not the greatest analogy) has the money they can either use it to buy the approved NFT (house/car) or just spend it where ever (credit card / personal loan).

The interesting thing here is that once the money gets spent on something, it "simply" enters the river and starts moving around between all the different fish. This is the traditional economy we all know and love. The farmer sells his wheat to the baker. The baker makes bread and sells that to the blacksmith. The blacksmith sells a sword to pirate. The pirate kidnaps a rich person with the sword and gets a nice ransom. You know: a fully functioning economy.

For every buyer, there is a seller, and vice-versa.

So when someone takes out a loan to buy a house and then instantly spends the money on that house... the money isn't gone. Somebody owned that house, and now they have the money flowing in the river and can in turn spend it where ever they want just like the people with the credit cards and the personal loans. The point here is that our entire economy 100% DEPENDS ON THE NFTs (collateral). This is something that @taskmaster4450 has been talking about quite a bit lately. If we have strong NFTs, we have a strong economy.

The problem in this economy is that the NFTs are losing value.

A car loses 10% of it's value every year. Computers/phones lose at least that much every year as well. COVID and work-from-home measures are lowering property values in the city as people move to cheaper locations.

At the core of this "problem" lies technology. Technology is making everything cheaper and streamlining logistics. This makes the NFTs worth less because it's easier to mint them. When the NFTs are worth less, people do not have any financial incentive to pay back their loan. Why would you pay back $500k on a house if your house is worth $400k? You wouldn't. Probably smarter to just to call it a wash and declare bankruptcy in certain situations.

People are worth less.

In order to fully understand the economy (impossible but it's fun to try) one must look at people as NFTs. People are collateral. People are things. People are expendable. People are a tool that should be thrown away when they've outlived their usefulness. This is the nature of capitalism, so it's best to think in this way if we want to understand the economy itself. Growth and profit are all that matter. Fish don't matter; let them die; what should we care? They're fish.

The ultimate problem with the economy is that the slaves (literally everyone) are losing value. Automation is taking over. Robots will soon be cheaper than McDonalds workers. The reason why the only jobs left are the shit jobs is because the shit jobs don't pay enough to be automated out of existence (yet). If the shit jobs paid more they would ironically disappear. How's that for a mindfuck?

Technology is making this all happen. Technology is making the legacy economy completely irrelevant. Should we all become Luddites and destroy all the machines before Skynet kills us all? No, humanity must move forwards, not backwards. This is why cryptocurrency is literally the only thing that can save us going forward. Technology was the problem, and now technology is the solution. Funny how that works.

Getting back on topic.

So every retail bank is creating a river of debt, and all these rivers flow together to create our clusterfuck economy. Eventually the river will trickle out to the ocean, meaning the loan to to the retail bank will be paid back, and in turn the retail bank will pay back their loan to the central bank.

Hilariously enough nobody actually wants to be paid back... not in full anyway. What these rent-seekers are really after are high interest rates over long periods of time. If everyone paid back their debt there'd be no more money left and all the rivers would run dry and the entire economy would meltdown immediately. That would be bad for everyone. Perhaps even lethal for many. How many fish do you know of that hibernate in the mud? There are actually a few that do.

In any case, we are trying to keep the fish alive for the most part, unless the fish is collateral and they didn't pay back the loan. In that case we gut them without remorse. Fuck um! "This is a business." "It's nothing personal." However, should too many fish die that's going to cut into profit margins, so that needs to be considered as well. This is why the FED constantly prints money. They want water to be in that river. You can't turn a profit on an empire of dirt. The fish need to be harvested in a sustainable fashion.

Ah, what do we have here?

Looks like a corporation is holding fiat on their balance sheet. The liquidity is getting trapped and not escaping. Interesting. Is that good or bad for the economy? Probably depends on the context.

Something I haven't mentioned yet is business loans. If you want to start a business, you're probably going to need a loan at some point or another. The reason why small companies allow themselves to be bought out by big companies isn't because they are worried about competition. The small company needs money. A lot of money. More money than a bank would feel comfortable giving because a bank doesn't have personal stake invested in that particular industry.

Needless to say, small-business loans make up a huge part of the liquid supply of money. What happens when small-businesses default on their loans and go out of business? What happens when the NFT collateral of the business drops because of competition or customers not having enough money to pay them? What happens when the middle-class disappears anytime throughout society's history? Same shit: different day. The economy will do very poorly when these things are happening, and they are all happening right now.

A Frozen economy is good for no one.

So we might ask, if a frozen stagnant economy is good for no one, then why do we ever let the economy become stagnant in the first place. The answer is simple: the economy, like the Internet (and the "metaverse"), is much much much much bigger than any single entity. Even the central bank itself that made all of this possible becomes small potatoes when looking at the economy as a whole. The economy is all the banks, all the people, all the corporations/businesses, and the government wrapped into one. It's gigantic, and this gigantic entity is totally unpredictable and subject to Chaos Theory.

Central banks are tiny.

All the central bank did was rain down money on retail banks and set interest rates. That's literally all they did. As powerful as these institutions are, they really have very little sway over the economy itself aside from their tiny little toolkit they can use to try and manipulate these waters. Again, they can try to incentivize healthy action, but they often fail at manipulating it in the way they are going for.

All a central bank can do is rain water into the lakes. All the retail banks can do is control the flow of water into the rivers. All the fish can do is try to hang on to the most valuable NFTs and leverage them to get the water they need to live. We can count on the corporations/small-businesses to act in their own self interest: paying employees the bare minimum while absorbing the most value possible. In fact, we can trust all these entities to act in their own self-interest. That's just capitalism hard at work.

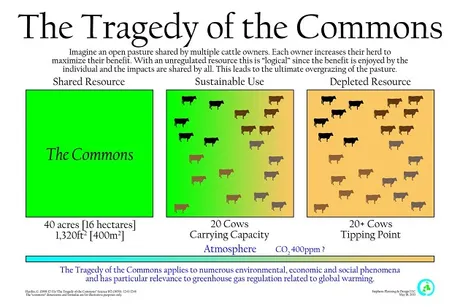

Therefore, if one entity does something that's bad for everyone, but good for themselves, we can count on them to keep doing it unless someone stops them. Greed is infinite even though resources are not. This is called the Tragedy of the Commons. It's hard to create a scaled up non-authoritative system that incentivizes everyone to act in society's best interest. Hell, it's hard to make a totalitarian empire with the same goal. Force has diminishing returns and punishment is not an effective deterrent. It becomes an exciting game of cat and mouse where the mouse usually gets away; gambling at its finest. Then, once you get to the top, the punishment is less harsh than the reward from the crime, giving those with the most power zero incentive to follow the laws that they usually had a hand in creating in the first place.

Unintended consequences: leading a horse to water.

So the Federal Reserve might lower interest rates to incentivize retail banks to take out favorable loans. In theory that favorable interest rate should trickle down to us plebs. However, the FED can't actually force consumer banks to issue loans or choose how good those rates are.

In addition, the retail bank might actually do what they are told and take out the loan, but that doesn't mean us plebs are actually going to take the deal.

You want me to risk building a business in this economic climate? LOL! No. How about not.

You want me to buy a house when the housing market could collapse again just like it did in 2008? Hm, no.

You want me to buy a car when I'm flat broke and the one I have is running just fine?

There's a pattern here.

When regular people just stop spending money (because they don't have it or they are already in too much debt or whatever else) the economy falters. That's why in America there is an entire culture that revolves around decadent spending and living beyond our means, shackled by debt. That's the best possible outcome for this crackhead economy, at least in the short term.

The bill comes due.

At some point or another, loans are bound to default. This is especially true if NFT collateral continues to devalue. Don't worry, when this happens the FED will bail out the big banks and the airlines and everyone else 'too big to fail', but instead of actually fixing their failed business model they'll just continue giving the CEOs and people in charge their full bonus checks. Again, you can bail out a business, but you can't stop them from laying off their employees and siphoning that money directly into the Big Wig's pockets. Capitalism! Isn't it grand?

the FED will bail out the big banks

Oh, my bad, did I claim that the FED will bail out big banks during the next financial collapse? Actually, no, they won't. Because last time that happened everyone was pissed so they made bank bail outs illegal. But don't worry, the next time the banks fail, you are the one who's going to bail them out. Ever heard of a bail-in? YIKES!

Unintended consequences part 2

So lets say one section of the river needs more water. That water can only come from one place: the lake. So if you pump more water into the lake, and in turn pump more water into the river, you'll eventually get the desired outcome... or will you?

Because even if you raise the water level in that one area, guess what? You fucked up and now another area is flooding. OOPS! This is Chaos Theory hard at work. People think we can focus-fire fix one part of the economy without affecting other parts. Anyone who's built a complex computer program knows otherwise. Changing one thing can create a cascading clusterfuck of needing to rewrite a dozen other pieces of code. The same is true with the programming of the economy, which is why we are still using the shit-ass SWIFT system from the 1970's. That and the people in control want everything to stay the same so they can navigate and manipulate the system in the ways they see fit.

Conclusion

I can't believe I still haven't gotten to the point yet.

I swear this is all supposed to be about how crypto solves the problem.

But it takes 10,000 words just to describe the problem!

Fascinating.

The economy is quite complicated.

Central banks are the oceans.

Retail banks are the lakes.

Rivers are created from the lakes.

The rivers from the lakes sustain the fish.

The fish are herded into the corporations and small businesses.

And the analogy breaks down at the seams.

Not everything can be simplified.

The major point to be made here is that thinking about figurative liquidity as literal liquidity can help us understand the economy and the function of money itself. Money is liquid. Money can take the shape of whatever object you put it in. Money can be divided and rationed and diverted and manipulated in many ways. And money can dry up.

All money is debt sustained by collateral.

In many cases YOU are the collateral.

Never forget this important fact.

People are NFTs.

And the value of all collateral is diminishing due to abundance technology.

Posted Using LeoFinance Beta

Return from Currency Tidal Wave Part 2: The Water Analogy. to edicted's Web3 Blog