Good to be back.

My seven days of holiday are over. Looks like crypto is right where I left it.

Monero Delisted from Binance

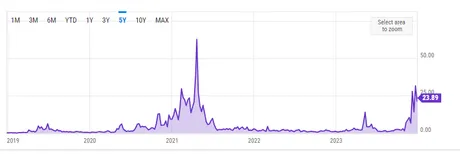

XMR is down around 7% seemingly in response to being delisted from Binance. Honestly it's impressive that Monero is anti-fragile enough to withstand being delisted from the biggest exchange while sustaining less than a 10% dip. At this point the XMR community is used to it. If these incessant delistings tell us anything it's that XMR as a privacy solution actually works; otherwise there wouldn't be such a massive push to remove them from the banking sector.

On a certain level it's a bit ironic.

Surely this delisting is a result of Binance's capture by American regulators and the recent $4 BILLION DOLLAR fine along with CZ's resignation. Feels like a dream honestly. However, what makes it interesting is the fact that XMR and other privacy solutions will almost certainly get adopted by financial institutions sooner or later. How could it not?

How many billions of dollars does the banking sector get fined every year for exploiting their own customers? If privacy coins can help them to avoid these inconvenient fees then of course they will employ them. Will privacy coins get their 15 minutes of fame within the upcoming bull cycle? Somehow I doubt it will come so soon. I'm thinking perhaps the cycle after this one (2029?).

The ultimate problem is that the narrative of the current bull market is the ETF and larger institutional adoption. Expecting that privacy solutions could get utilized within the same cycle is a bit foolhardy, which is why it's much more likely to take a couple of years before the banks realize what they can actually do with this newfound infrastructure.

Liquidity is the key

Much like Hive needs a permissionless connection to Bitcoin, Bitcoin needs a permissionless connection to Monero. This is accomplished by atomic-swaps, a technology that has already been around a long time but struggles to provide the necessary matchmaking required to link buyers and sellers en masse. AKA volume/liquidity. Luckily the tech in question is needed now more than ever and development is accelerating to match the demand.

The ability to move in and out between XMR and BTC at will without an intermediary will make Bitcoin private by proxy, which is more than enough for the vast majority of use-cases. It will also incentivize many Bitcoiners to keep a stack of XMR liquid without even transferring it back due to this increased privacy and lower operation fees.

Speaking of Bitcoin's transaction fees...

They are absolutely abysmal right now. We've hit another wave of Ordinals nonsense with NFTs and BRC-20 tokens being stored on the chain. At this point I tend to side with the maximalists on this one. Bitcoin was not designed for this and spam is an attack on the network. However, who's to blame?

- The BTC core devs for authorizing Taproot signatures?

- The Ordinals devs for implementing shitcoins on chain?

- The greed of the users interacting with these contracts?

I tend to blame the infinite greed of the market participants. There is no reason to secure these kinds of assets directly on the Bitcoin network unless that security is warranted. However this is a self-defeating argument because no new project ever needs that level of security. I would only give this strategy a free pass if the token was incubated on a different chain and it was only determined after the fact that the native chain it was developed on had been outgrown.

At the same time this sentiment matters very little.

The way Bitcoin works is the way it works, and the only way to distinguish between spam and not-spam are the fees users are willing to pay. If users are willing to pay $30 on BRC-20 token transfers then that's what it will be used for. The problem is that these hype-cycles come in waves and are based on pure speculation and greed-based scarcity behavior.

The Taproot "upgrade" has proven itself to be much more of a liability than an asset. In my opinion that functionality should simply be rolled back and functions like Ordinals should be annihilated from the platform by force, but that's just like, my opinion, man.

Say one thing: do another

It's no secret that the bankers are liars and thieves. Watch what they do and ignore what they say. No one's a bigger hypocrite than the one in charge.

Many assumed that ETF fees would be something like 1% or even 2% per year. There were even spreadsheets and math laid out that showed how much money you'd lose over the next 30 years under this assumption. Now we see how comical these predictions were.

This is a classic case of loss-leading. Galaxy is signaling their intent to allow users to buy into the ETF at a 0% APR for six months. This tactic already sounds like I'm watching a car commercial. Why would they be willing to do this? Because, much like WEB2, it's of the utmost importance to get the most users and corner the market than it is to actually make money at the beginning of the race.

More EFT commercials revealed.

VanEck's ETF commercial has been leaked to the world along with the others. I find it interesting that each applicant seems to be generating hype by showing us what they have planned. Personally I think this one is pretty sub-par but it does add more fuel to the fire either way.

SBF news

Apparently Sam Bankman's second trial has been canceled. This was the one that included $100M donations to politicians. Unsurprisingly many are upset about this and calling it out as blatant corruption and the unwillingness for government to return these ill-gotten gains. Maybe this is true, but I won't be looking into it further as I don't really care either way.

Doomsday Bunkers

Also circulating the crypto Twitter and conspiracy theorist circles is the fact that 12 billionaires have decided to start building doomsday bunkers, including Mark Zuckerberg. Apparently SBF also had a plan for this before being arrested. Do they know something we don't, or is it simply prudent given the current environment of geopolitics mixed with tech like AI and potential food shortages? Who knows?

Conclusion

As we inch closer and closer to the Jan 10th deadline I can't help but think there's no way we'll get approval from the SEC so soon. At the same time our gut feelings on these issues tend to be accurately incorrect a scary percentage of the time. Institutions are going to be dipping their toes in either way. It's only a matter of time at this point.

Regulators are trying their damnedest to get a chokehold on this market, but crypto is a slippery opponent. We can code faster than they can put up red tape. Should be interesting to see how that plays out over the next cycle.

Return from Current Events: Back in the Saddle to edicted's Web3 Blog