The virus has returned!

The bull market is rampaging and our favorite scammer is in full force pumping his own illiquid coins with his overaggressive long positions. Steem is now up 77% over the last week, positioning itself at a rank of #217 on the market cap; just above Hive at #227. Tron itself has slowly ascended to a position of rank #11 on the MC, which is even more insane obviously. Currently nipping at the heels of Doge, it could easily flip the memecoin and find itself in the top 10, which would obviously be a very noteworthy accomplishment and get a lot of attention.

Of course we all know it's all bullshit.

And a lot of other people do as well, but clearly not enough. As far as I know, nothing has been built on Steem since we forked away from it. They can't even copy our hardforks. New users can't make an account there and start earning because all of the rewards go to the top 10 shitposters.

As far as Tron is concerned, I haven't really been paying attention to what they're building over there, but a lot of the work being done is rendered totally irrelevant when a single account has the ability to dump the network to zero on a whim. That's what we like to call extreme systemic risk in this business.

Is Steem stealing our thunder?

A lot of maximalists claim that altcoins (aka shitcoins) only serve to leech value away from BTC. Of course we understand that this is not true, and that a space like crypto has dozens if not hundreds of niches that Bitcoin could not possibly fill. It's even easier to get into this mode of thinking during the bear market when 90% of projects are caught with their pants down and crash to zero. Rugpulls and systemic failure become the standard. Everything looks like a scam because there's no time to properly research everything.

Given this knowledge it's hard to make the claim that Steem is syphoning any value from us whatsoever. Although it is possible they are borrowing some temporarily until we can definitively prove ourselves superior to market participants. The other day I met a guy who learned about both Hive and Steem at the same time, and he had to pick one pretty much randomly due to not knowing any better. This is likely a more common occurrence than we would like to admit. Perhaps Hive still has a lot of growing to do in order to definitively distinguish it from the 'competition'.

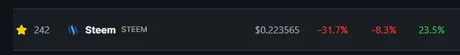

Alright well while I was writing this Steem just crashed in price by 31.7% within the hour. No idea what's going on over there.

In any case I think it's pretty obvious we need to continue distinguishing ourselves from the sister chain. How do we do this? Eh mostly it's just a matter of patience and time. Centralized onboarding helps quite a bit (email/password and metamask logins). Also having a stable coin that actually works is quite nice.

While I'm on this note go vote for the VSC proposal by @vaultec. It's a smart contract proposal (Vaultec Smart Contracts) for Hive that will further build out the infrastructure of this network.

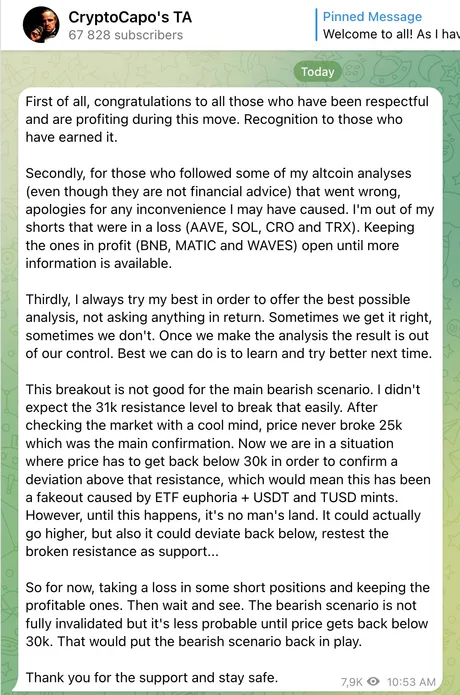

Capo

The days of roasting the infamous CryptoCapo have come to an end.

We had a good run.

Biggest bull trap I've ever seen, but they won't trap me

The words will live in infamy to the end of time.

Bears have finally correctly flipped bullish. The bull market started a year ago and only now has market sentiment caught up. Human psychology is weird like that. In a year everyone will forget that 2023 was a bear market, because it wasn't.

More current events

Blackrock ticker

In other news yesterday the Blackrock ETF ticker $IBTC was removed from the site and caused a minor panic. Then it was put back on the site along with Fidelity as well. Conspiracy minded people such as myself can't help but wonder if it was actually Blackrock that was responsible for the Cointelegraph fakenews, and now that this has happened it looks even more like slight manipulations and testing the market. Of course it's also possible we're reading too much into it and all of this stuff is just a coincidence.

However when we look at Larry Fink's interview after the fakenews occurred the statements he made were pretty clear. He officially can't talk about the status of the ETF, but the confidence exude and the "flight to quality" narrative paint a pretty clear picture.

It's obvious that Fink knows his EFT will be approved, and now that Grayscale has won their lawsuit in court he also knows that it is legally impossible for the SEC to decline the ETF based on "market manipulation". What better time to manipulate the market than right now? You've got to admit the timing is pretty crazy.

BTC speculation

It's possible the timeline on this flag is actually playing out much faster than I expected. These are 4h candles and they show a possibility that the flag has already completed and we are at the precipice of another 20% god-candle up to $40k resistance. The 1D candles haven't been invalidated yet, but will be is spot price ascends to something like $25.5k. The last pump made it to $25.1k and almost barely invalidated the 1D flag. Alas, it is still in play.

At this point I'm convinced that it's simply a matter of time for when the market pumps. Many traders see the low liquidity and are loading up on shorts due to this "sign of weakness". This is exactly what bulls want. Rather than being a sign of weakness this is actually a signal for one of the biggest supply shocks I have ever seen.

Volume on August 30th when Grayscale won their court case was x4 times higher than it is during this rally, and the price only moved up 5%. The price spiking on low volume isn't a sign of weakness, but rather of crippling supply shock. There's no Bitcoin to be purchased even at a 20% higher price point. The market must move up 20% again to incentivize more selling and get that increased volume that it so desperately craves.

While the pump could come immediately I'm still leaning toward the daily candles which would require at least 3 more days to play out. 4h candles will be invalidated today or tomorrow if and when price returns to the $24k average. I'm somewhat expecting a pump on November 1st or October 28th. I guess we'll find out!

Conclusion

Justin Sun is a scammer and this rally is just getting started.

Return from Current Events: Steem Overtakes Hive in Market Cap Once More to edicted's Web3 Blog